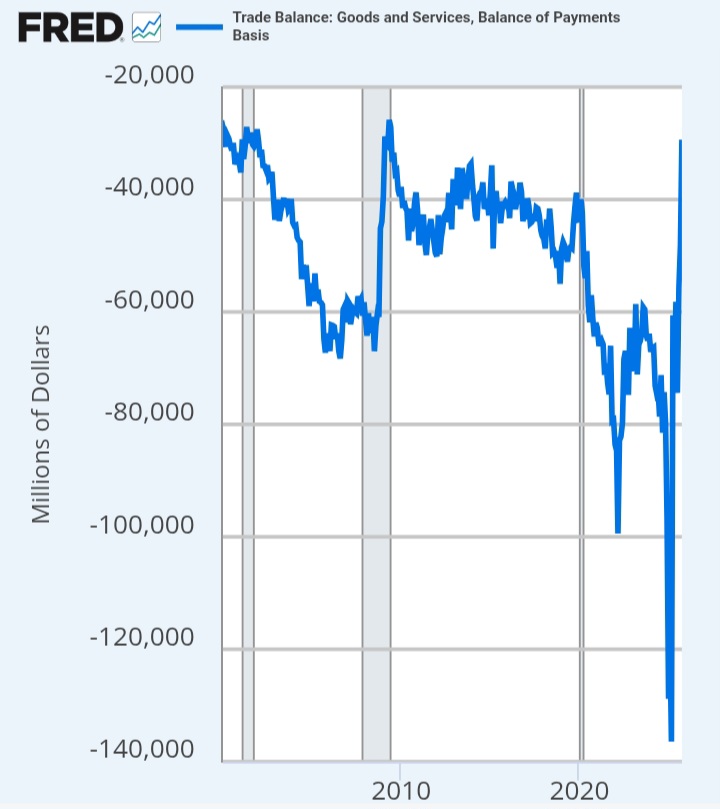

We can say what we want about the tariffs, but the numbers are becoming much more clear. This morning’s trade data was a smashing upside surprise.

The trade deficit continues to narrow, and if the trend continues, we will reach numbers that have not been seen in nearly 25 years. The data speak for themselves. Last month’s surprising narrowing is definitely not a one-off thing.

I personally never thought the United States economy would ever be able to achieve these types of numbers ever again in my lifetime.

GDP estimates are going to continue being ratcheted upwards. Labor costs are fading and productivity numbers continue to rise. Say what we will about current economic policy, but the trend reversals are absolutely spectacular.

Trade Balance (Oct)

Act: -29.40B Cons: -58.10B Prev: -48.10B

Exports (Oct)

Act: 302.00B Prev: 289.30B

Imports (Oct)

Act: 331.40B Prev: 342.10B

Unit Labor Costs (QoQ) (Q3)

Act: -1.9% Cons: 0.0% Prev: -2.9%

Nonfarm Productivity (QoQ) (Q3)

Act: 4.9% Cons: 4.9% Prev: 4.1%

This incredible narrowing of the trade deficit will ironically hurt the value of the dollar in the international markets as the phenomena underpinning the concepts of the Triffin paradox continue to unwind.

All of these things are fantastic, Oceania, separation from these other Japheth countries, etc. Venezuela invasion and so on, great.

That said, the smart cities, surveillance systems through AI, vaccine passports, robots that look like women, digitalization of identities through enforced biometrics are not stopping in the west. They are already in China since it was Silicon Valley who built that system. Those things are accelerating. My conclusion is this conflict, WWIII, will be the catalyst to bring these things in full force. In other words, the Synagogue of Satan banking cartel fams know regardless the outcome they ought to bring these things forward after the outcome and the noahide laws. The way things are going people will love it.

Anyhow, good stuff.

This is a snapshot of an email I now receive a couple times a day from a reader. If anyone remembers the Soviet Pravda newspaper, this looks pretty close to something I could have read in the 1970s Soviet Union. It’s now come to our shores and being consumed by the unwitting.

This sounds very similar to rense.com . Rense has lately posted articles taking the side of that leftist provocateur that was shot in Minneapolis.

Since that posting on rense, I think Jeff Rense has all but lost what little credibility he had. It seems he is turning left.

Rense is suffering from TDS. 🤣🤣🤣

Pretty decent numbers. Nothing that jumps out.

Unemployment Rate (Dec)

Act: 4.4% Cons: 4.5% Prev: 4.5%

Nonfarm Payrolls (Dec)

Act: 50K Cons: 66K Prev: 56K

Government Payrolls (Dec)

Act: 13.0K Cons: Prev: 6.0K

Manufacturing Payrolls (Dec)

Act: -8K Cons: -5K Prev: -2K

Participation Rate (Dec)

Act: 62.4% Cons: Prev: 62.5%

Private Nonfarm Payrolls (Dec)

Act: 37K Cons: 64K Prev: 50K

U6 Unemployment Rate (Dec)

Act: 8.4% Cons: Prev: 8.7%

Average Hourly Earnings (MoM) (Dec)

Act: 0.3% Cons: 0.3% Prev: 0.2%

Average Hourly Earnings (YoY) (Dec)

Act: 3.8% Cons: 3.6% Prev: 3.6%

Average Weekly Hours (Dec)

Act: 34.2 Cons: 34.3 Prev: 34.3

Building Permits (Sep)

Act: 1.415M Cons: 1.350M Prev: 1.330M

Building Permits (MoM) (Sep)

Act: -0.2% Prev: -2.3%

Housing Starts (Oct)

Act: 1.306M Cons: 1.330M Prev: 1.307M

Housing Starts (MoM) (Oct)

Act: -4.6% Prev: -8.5%

As expected, the Atlanta Fed GDP estimate skyrocketed in the wake of this morning’s data.

US Economy Set To Boom In Q4 As Trump’s Tariffs Push Trade Deficit To 16-Year Lows

-Benzinga

The U.S. economy may be on track to post an exceptionally strong expansion in the fourth quarter of 2025, helped in large part by a sharp narrowing in the trade deficit following tariffs implemented under President Donald Trump.

The Atlanta Fed’s GDPNow model lifted its estimate of fourth-quarter real GDP growth to a blockbuster 5.4% annualized, on Jan. 8, up from a prior estimate of 2.7% earlier in the week. Outside the post-pandemic rebound, it would mark the strongest quarterly growth rate since 1984.

The upward growth revision was triggered by better-than-expected October trade figures, with net exports now adding nearly 2.0 percentage points to GDP growth after previously subtracting from the forecast, according to Atlanta Fed calculations.

Trade data released Thursday by the U.S. Census Bureau and Bureau of Economic Analysis showed the goods and services trade deficit shrank to $29.35 billion in October 2025, a roughly 39% monthly drop and the lowest since mid-2009.

The outcome was well below the $58.1 billion consensus forecast. Exports rose by 2.6% to $302.0 billion, while imports fell 3.2% to $331.4 billion.

Almost all of the improvement came from goods trade. The goods deficit shrank by $19.2 billion to $59.1 billion, while the traditionally resilient services surplus edged slightly lower to $29.8 billion, reflecting softer government services exports.

The composition of exports reveals why economists are cautious about extrapolating October’s strength. Goods exports climbed $7.1 billion to $195.9 billion, led overwhelmingly by industrial supplies and materials, which surged $10.2 billion, and non-monetary gold, which jumped $6.8 billion.

By contrast, consumer goods and pharmaceutical exports declined.

On the import side, the contraction was both large and concentrated. Goods imports fell by $12.1 billion to $255.0 billion, with particularly sharp declines in pharmaceutical preparations ($14.3 billion) and consumer goods ($14.0 billion).

These declines more than offset the rise in capital goods inflows, including computers and telecommunications equipment.

In inflation-adjusted terms, the move was even more striking. The real goods deficit shrank nearly 20% in October, as real imports fell faster than real exports.

The U.S. posted sharply larger surpluses with the United Kingdom and Switzerland, while deficits widened with Taiwan and Vietnam, reflecting shifts in supply chains and technology imports.

Notably, the deficit with Ireland fell by $15.1 billion in a single month due to a plunge in pharmaceutical imports.

Despite October’s dramatic improvement, year-to-date figures paint a more restrained picture. The overall goods and services deficit remains 7.7% higher than in 2024, as imports have risen faster than exports over the course of the year.

All eyes on Friday’s Supreme Court decision

The U.S. Supreme Court is scheduled to issue a decision Friday on the legality of tariffs imposed under emergency executive authority.

The ruling will determine whether the administration exceeded its statutory powers in levying broad import duties.

According to Polymarket, there is only a 23% chance the Court rules in favor of Trump’s tariffs.

Stone, check this article, politics is biology. Very interesting!

nxrstudios.substack.com/p/politics-is-biology

You bet your bippy it’s in the DNA. Only European Caucasians choose the form of government that suits them. It’s Godly, according to YHVH.

All other races are governed by other forces.

Hi Stone and readers. I highly recommend this book which outlines the bloodline of the true Israelites which the author links to the same Europeans who founded the United States. He lays out what many of us believe, that the world governments are run by the Synagogue of Satan and that all “events” are part and parcel of the war against the true Israelites. I only take issue with one area of the book but I’ll take that question to the author directly. A very important book for humanity. https://www.amazon.com/People-God-Destiny-America-Reunification/dp/B09NRG91XC/ref=cm_cr_arp_d_product_top?ie=UTF8

Thanks. I’ll look at it.

He is correct about the United States. Ephraim (Britain) led the way and the other Israelite tribes flooded America and built it. They made it the greatest nation in history, but the Edom Jews have worked to destroy it. it’s the last days JerUSAlem. Not that Sodom and Egypt Jerusalem city in the Middle East.

If there was a vacant land that the Israelite people could go to again and make another USA, they would do it. I would go in a heartbeat. We have to wait for YHVH to appear again for that to happen. The Earth is all spoken for at the moment.

The United States is definitely gearing up its economy for a global conflict. No doubt.

As internal unrest grows inside the US, the Japheth confederacy, led by Russia and China, will make an agreement to strike the European Caucasian nations and the land of unwalled villages (US and Canada).

Correct! Ezekiel 38!

Things are still real hot in Iran! The edomites will be dancing in the streets if so.

UNVERIFIED – UNCORROBORATED RUMORS: AYATOLLAH KHAMENEI KILLED IN IRAN

Talk about destabilization!

Let’s get Greenland!

It will happen eventually. Perhaps, there’s a deal made like something out of Vito Corleone’s playbook. Maybe Trump will place a severed horse’s head in Greenland’s prime minister’s bed. Trump will make a deal he can’t refuse. 🤣🤣🤣🐴🐴🐴

Right! Like Michael said, asked God for a bike, but I know God doesn’t work that way. So, I stole a bike and asked him for forgiveness.

Look out Greenland, or should we say, Trumpland

The Godfather (1972) – horse head scene

https://youtu.be/EkZpxF_ZGsQ?si=q0rBJss_FCLuYdCL

Classic! The art of inflicting pain!

Stone, have you seen this? Very interesting new weapon systems!

http://www.newsmax.com/newsfront/leavitt-use-warpower/2026/01/10/id/1241612/

This is the X repost from White House Press Secretary, Karoline Leavitt, referred to in this article. It makes perfect sense. The US military is now rolling this stuff out now.

https://x.com/nettermike/status/2009843044028428714

Mike Netter

@nettermike

🚨This account from a Venezuelan security guard loyal to Nicolás Maduro is absolutely chilling—and it explains a lot about why the tone across Latin America suddenly changed.

Security Guard: On the day of the operation, we didn’t hear anything coming. We were on guard, but suddenly all our radar systems shut down without any explanation. The next thing we saw were drones, a lot of drones, flying over our positions. We didn’t know how to react.

Interviewer: So what happened next? How was the main attack?

Security Guard: After those drones appeared, some helicopters arrived, but there were very few. I think barely eight helicopters. From those helicopters, soldiers came down, but a very small number. Maybe twenty men. But those men were technologically very advanced. They didn’t look like anything we’ve fought against before.

Interviewer: And then the battle began?

Security Guard: Yes, but it was a massacre. We were hundreds, but we had no chance. They were shooting with such precision and speed… it seemed like each soldier was firing 300 rounds per minute. We couldn’t do anything.

Interviewer: And your own weapons? Didn’t they help?

Security Guard: No help at all. Because it wasn’t just the weapons. At one point, they launched something—I don’t know how to describe it… it was like a very intense sound wave. Suddenly I felt like my head was exploding from the inside. We all started bleeding from the nose. Some were vomiting blood. We fell to the ground, unable to move.

Interviewer: And your comrades? Did they manage to resist?

Security Guard: No, not at all. Those twenty men, without a single casualty, killed hundreds of us. We had no way to compete with their technology, with their weapons. I swear, I’ve never seen anything like it. We couldn’t even stand up after that sonic weapon or whatever it was.

Interviewer: So do you think the rest of the region should think twice before confronting the Americans?

Security Guard: Without a doubt. I’m sending a warning to anyone who thinks they can fight the United States. They have no idea what they’re capable of. After what I saw, I never want to be on the other side of that again. They’re not to be messed with.

Interviewer: And now that Trump has said Mexico is on the list, do you think the situation will change in Latin America?

Security Guard: Definitely. Everyone is already talking about this. No one wants to go through what we went through. Now everyone thinks twice. What happened here is going to change a lot of things, not just in Venezuela but throughout the region.

11:21 PM · Jan 9, 2026

·

13.3M

Views

Read 5.8K replies

Reminds me of Revelation 13, And they worshipped the dragon which gave power unto the beast: and they worshipped the beast, saying, Who is like unto the beast? who is able to make war with him?

Palantir is all over this!

I have not seen that.

I can say this much, the US military under Trump is unbeatable. Only if nukes take out DC. The change has been absolutely stunning. The tight coordination. Democrat leadership should be shitting they aren’t next.

I don’t care what Zero Hedge and the Soviet sing-alongs in the alt-media say. The US armed forces will spend $1.5 trillion this year, thanks to QE.

I’m not a fan of Trump per se, but if this war is coming soon, the DoW will give us a fighting chance to survive it.

Stone, do you get the feeling that civil disorder/insurrection is about to get serious here in the states? Its really being pushed and Trump has talked about the insurrection act before.

Are you noticing price increases on durables at all?

Like what kind? Personally, it’s a mixed bag. SFR stuff like appliances and materials have stabilized in price. Prices keep going up, but I can get some excellent prices with stuff on sale. Electronics are similar.

Cars and furniture are another story. Many things have gone up, because of tariffs. No doubt. With cars, the manufacturers keep adding stuff and features. It’s annoying. I was thinking about getting another Outback, but the 26 models are hitting up to $50k. That’s insane for a Subaru. I would like to get a new F-150, but the base 8 cylinder is 50k.

Overall, it’s a lot better than a few years ago, but still running hotter than last decade, for sure.

Lots of affordable used F150’s out there. you could probably get a decent price for your used truck. Better sell now before the tranny goes out.

That’s interesting. Looking at this another way, we are doing much less business with China which is good for several reasons. Also, as you said this isn’t strong for the dollar because our currency isn’t flooding other markets. Now we are expanding debt by expanding all things A.I. including military spending. This just seems like a very crafty way to minimize the dollar to make way for the transition into the new digital system, while being very, America first.