I remember you responding to someones question about interest rates over a year ago and suggesting we would see a bifurcated market with one for Fed funds and another for mortgages. I have since seen many mentions in the last couple months of bifurcation and K-shaped economy. I think the catastrophe has already begun, we will reach further nodes that bifurcate until we hit chaos. Our choices land us in different places.

Ken

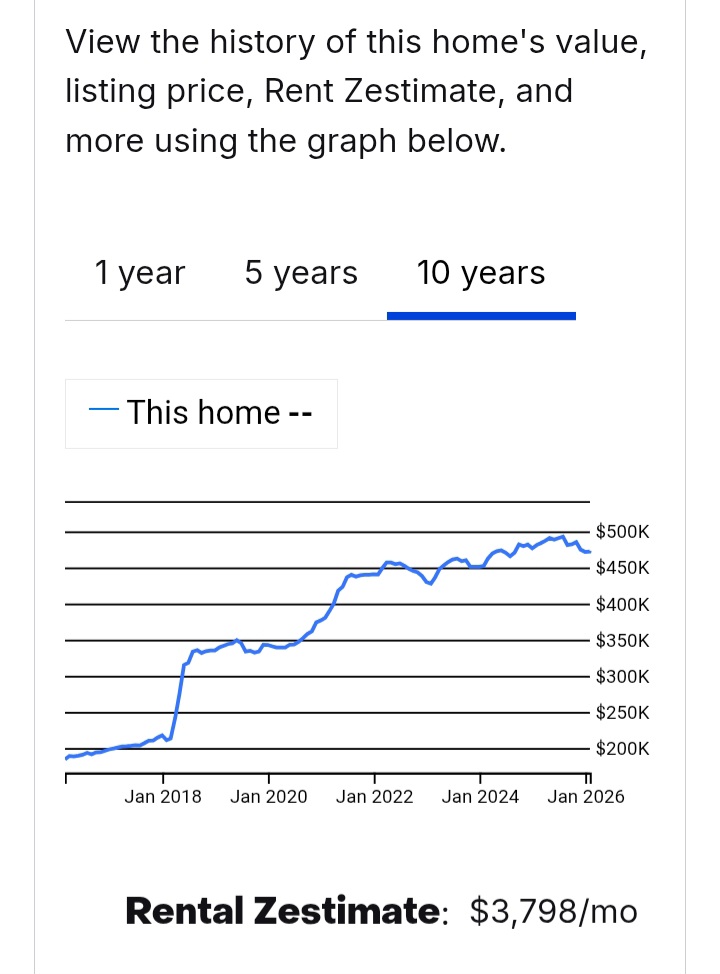

Here’s a good example of bifurcation

The bifurcation of society definitely manifests when we consider single family housing. I get a lot of emails from people asking me my thoughts as well as forwarded analysis claiming that residential real estate is entering a “great reset”.

It’s funny how terms are often thrown around whimsically. Investors have access to cash and practical financing, if needed. They buy SFRs, because they see them yielding a high enough return. To the average person on the street, the house price looks expensive. But to SFR investors, the rents make it worthwhile.

I can get a DSCR loan for a similar rate as I was paying for the past 10 years. I can actually get 6% money now. The only way for the average home buyer to figure out how to buy a home is to try to get a 3.5% loan.

The majority can no longer control their spending

The average person I come across, including the youngish Cassandras on YouTube, is a spendthrift and pisses her money away, because she can’t control her spending. This hypothetical person is a she, because women are much more emotional and subjective with spending decisions and life choices. Aspirational decisions result in a toxic doom loop of personal and spiritual bankruptcy.

As someone who has lived around long enough to see how people were much more financially prudent 40 to 50 years ago, I am absolutely shocked at how stupid people have become with money and how they piss it all away so frivolously. Yet, they sit and complain about how everything is just so expensive and they can’t save. They need to look in the mirror. They have no idea with how horrible they are with money.

The bifurcation becomes institutionalized

This is what bifurcation means. The bifurcation becomes institutionalized. It becomes ingrained in the minds of the plebs at a young age, before they have a chance to figure things out. What’s even worse is that so many of them don’t even have a father in the house anymore to provide stability and objectivity.

If the average person were financially prudent like you and I were, there wouldn’t be any bifurcation of society nor of the economy. There wouldn’t be entire industries that cater to the swindlers and marketers who legally extract the wealth from the people. The people bring it on themselves.

This is bifurcation, I digress….

Permanent repricing of assets

Rents are extremely high on single family houses. I’m not talking about apartment buildings, nor any other type of property. I’m not even talking about condominiums that rent out. I’m talking about single family houses detached or townhomes.

There is a lack of viable supply of these properties and there is an extremely high demand for them. I’m talking about SFR’s. In the example I provide above, Zillow estimate is fairly accurate. This means that in the past 11 years, the rent on this house that I’m about to turn over to a new tenant has increased almost $2,000 a month.

People strongly prefer to live in single family detached. To many of them, it’s a dream come true. It still is and it always will be. They can’t afford it, nor can they get the financing. But for those investors with the cash, they can continue buying these and will be able to make cash flow.

Home prices right now still offer a decent value on a national level. I’m not talking about Canada. I’m talking about the United States. Circumstances now are much different than during the GFC.

When I run the capitalization rates and the IRRs, there’s a value proposition. I don’t know of anyone else who makes these claims. This is especially true in the alternative media.

The k-shaped economy is here to stay

The dynamics of the single family house market is an example of a bifurcated market. I have access to cash, I have a bunch of these houses, and I rent them out for ever higher rents. They never go down. I don’t have much concern for the average tenants anymore. Their circumstances are primarily their doing, and if you listen to their mindsets, they are the people we rail against on this blog anyway. Their problems are their doing..

It doesn’t even matter if I rent out a house for a below market price to somebody, they don’t treat the property any better. And this isn’t communism anyway, I don’t provide subsidized housing; I’m running a business and taking a lot of risk.

Yes, a bifurcated k-shaped society can be very profitable to those who can control their spending and can sacrifice long enough to make the necessary choices and purchase decisions.

My advice is not to complain about it anymore, but rather, accept it and move forward. The economy has already been transforming and we are already in the New World Order. Get used to it.

True! Its all very parasitic!

That is a very good point about the young and issues with “control” of spending! Money and currency have lost any real value. Great job synagogue! Its like gambling in Vegas. Its chips, not real money. Nixon and the gold standard change really started this. Another point; many young people have no impulse control. This seems especially true with non adamic man.

You bring up something interesting. The industry of gambling and games of chance, which were once presupposed to be predatory in nature with a “negative-sum” outcome, has now become a viable way for tax jurisdictions and shareholders to profit.

A “negative-sum” industry is one in which the net economic gains from all the participants are actually below zero. In other words,, society as a whole is better off without this industry.

I think of gambling and how insidious and pernicious its hidden and not so hidden effects are. The industries built upon gambling and games of chance create a hidden societal rot that is extremely difficult to quantify.

I think of the untold bankruptcy and depression that games of chance bring. I think of the higher rates of crime and alcoholism, as well as drug use. I think of all the gambling addictions and the higher rates of divorce and family dysfunction. I think of the untold misery that gambling brings to society.

There are no advocates for the downtrodden and demoralized losers. The only advocates I see are those who support gambling and games of chance. They come from government and the industry itself. The tax coffers are stuffed with revenue from gambling losses and shareholders are richly rewarded from societal degradation, misery, and bankruptcy.

During my undergraduate Economics studies back in the 80s, the authors of my Public Finance textbook were adamant about not relying on casino revenue for taxes, for the very reasoning I just provided.

But with the lack of morality comes the predatory industries.