Who’s really to blame? The answer is more complicated

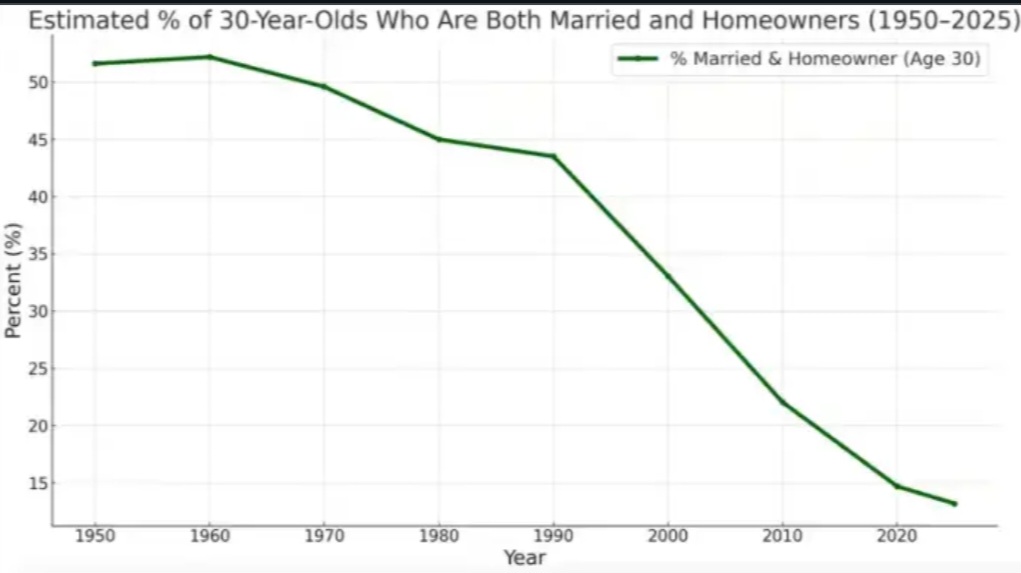

Came across this ……………….curious about your thoughts on this.

https://www.renegadetribune.com/the-death-of-the-american-dream-how-the-economy-was-ruined-for-a-whole-generation/Jeffrey

Yes. I came across that same chart. It is sobering and revealing.

Here’s my take on this. I’m a first year Gen Xer. I see both sides of this false binary that pits boomers against Gen Zrs, so to speak. I observe how society has changed drastically for the worse over the past 50 years, since I was a child. The differences between what a family means today versus what a family meant in the early 70s is vast.

Hardwired traditions must be broken

There are reasons why the media labors so vigorously about upending the patriarchal family unit. Traditions must be broken, especially hardwired traditions. There is a need to get the father out of home. The intact household where children honor their parents and especially their father seems to be a dying concept.

What the younger folk have been taught and shown just doesn’t work. Society is now much more weak and fractured. This was done on purpose with malice aforethought.

The chicken or the egg; The banking system mirrors society and society mirrors the banking system.

You and I can articulate all of the drastic changes to the banking and monetary system post World War II, and how the young folk are behind the 8-ball, but ultimately what undermines the younger generations are the personal choices they make.

Ultimately, the fault of all this rests with the man who stares at him in the mirror.

Of course, it is a lot tougher to buy a home, raise children, and afford the fineries that we took for granted in the 60s and 70s, but the media and society have been crafted to emphasize self-indulgence and aspirational lifestyle, and over-consumption, versus practicality and frugality.

Where’s Dad?

I look at the current crop of youngsters from secondary schooling and those coming out of college and up until 30 or so, and I can declare flat out that they don’t have what it takes like the older generations. Their heads are not screwed on straight.

There’s something wrong. Of course, it was bred into them and they’ll have no idea what I’m talking about. But I cannot emphasize to my readers how important the father is in a household, especially having a father who also had a father in his household. For they don’t have a longer time frame perspective to even know what is wrong.

Society and the banking system

We can say that I’m putting the cart in front of the horse, so to speak, but society in general feeds off what they are exposed to. Thus, they are reacting to the ramifications and results of the banking and financial system in a toxic way. Younger folk are more egosyntonic with regards to what I would consider self-destructive behavior.

What’s worse is that this self-destructive behavior feeds and builds the banking and monetary systems. It is a self-generating loop. The more self-indulgent and hedonistic the population becomes, the stronger and mightier the banking system becomes. And we wonder why Moses lamented when the Israelites wanted to go back to Egypt.

If I were raising children today, my wife would stay home or I would move to an area in which we could afford more easily and the children would be homeschooled. I wouldn’t send them to a public school, or even a private school, to be indoctrinated in the fiction. The deception starts at a very young age.

Here’s the upshot about buying a home. It may cost a lot, but prices keep rising. In a few years, a young homeowner will probably have six figures in equity. These younger folk need to readjust their mindsets and stop sleeping around.

Their lives mirror that of the protagonists of their favorite romcom or action movies. This toxic self-feeding social-proof loop is reaffirmed through their social media addiction. Their houses are built on shifting sand. Their dreams, hopes, and aspirations were injected into their lives from the top down. They are probably living out some fantasy that was crafted from DARPA.

The residue of a childhood from long ago

I can afford to own a portfolio of rental properties, because I do so much of the work on my own. Where did I learn this skill set? I have to admit a lot of it has to do with watching my father work. He saved tons of money when I was younger by fixing our cars and doing the necessary work at home. He was always there and I learned so much from him. I never saw him drunk, yell at my mother, nor look at another woman. I always wondered what life would be like if I grew up in a divorced household. I shudder the thought.

Where did my father learn what he knew? He learned a lot from my grandfather, who behaved the same way. Both have long since passed on, with my dad passing in 2008. But his residue is as fresh today as it was when I was a child. Yes, I still miss both of them. If either were alive today, I would show nothing but deep gratitude. I took it all for granted, too.

I sound more like Alan Watt, who has since passed on, than someone like Catherine Austin Fitts. I don’t look at the banking system in a sterile environment. The reason why the banking system has gotten to this point is because of the population in general. The population now is effectively a nation of degenerates. We need to get used to this.

The asset owners profit off of this degeneracy. It is just vitally important that we don’t live like the degenerates.

The Federal Reserve pretends that all is fine, while the interest outlays of the United States federal government continue to skyrocket. Federal debt is being financed somehow and it seems that higher interest rates are plugging the gap….

Fed’s balance sheet drawdown enters new stage as reverse repos largely drained

NEW YORK (Reuters) -The Federal Reserve’s effort to shrink the size of its balance sheet is moving into a more uncertain phase as a key proxy of excess liquidity has been very nearly extinguished.

Over recent days cash flowing into the central bank’s overnight reverse repo facility has fallen very close to zero, capping what has been a long and slow grind down from a peak of $2.6 trillion on the final trading day of 2022.

The facility takes in cash primarily from money market funds, which use it to park liquid assets beyond what they need. Reverse repos have been falling since the Fed in 2022 began the process of shrinking its balance sheet by allowing a set amount of Treasury and mortgage bonds to expire each month and not be replaced, a process called quantitative tightening, or QT. That’s taken Fed holdings from a peak of $9 trillion in the summer of 2022 to the current level of $6.7 trillion.

The rate the Fed pays for these de facto loans is a key part of the central bank’s monetary policy toolkit and helps set a floor for the central bank’s interest rate target, currently in a range between 4.25% and 4.50%.

On Thursday, reverse repos stood at $32 billion, a level last seen in the spring of 2021. Some modest sum was always expected to remain in the facility, even as use shriveled as the QT process reduced liquidity in the financial system. That said, analysts do expect to see periodic usage surges, particularly around month and quarter ends when there are swings in market liquidity that can cause funding pressures.

TIME OF TESTING

Quantitative tightening is expected to go on for a while, with market participants projecting it can run until the start of next year. While reverse repos, which soaked up much of the aggressive stimulus provided by the Fed during the COVID-19 pandemic, are effectively drained out, Fed officials believe there remain large levels of liquidity left in the banking system that QT can bring down.

The effective end of reverse repo usage will test that notion, however. With Treasury borrowing issues settled after the passage of the Republican spending bill, QT will now begin to remove reserves from the banking system, which means liquidity will drain more quickly at this point.

Banking system reserves currently stand at around $3.3 trillion, about where they’ve been over the last couple of years. That should start to ebb but no one is sure how much they can fall before liquidity tightens too much. A dearth of liquidity would lead to volatility in short-term rates and it would compromise the Fed’s control of its interest rate target.

That’s how the last iteration of QT ended. In September of 2019, the Fed withdrew too much liquidity from the financial system, short-term rates went haywire and the central bank was forced to add temporary liquidity to markets to steady the financial system.

The Fed doesn’t think it will play out that way again. It has a new tool called the Standing Repo Facility, which allows eligible financial firms to hand bonds to the Fed in exchange for fast cash. That tool has seen some small usage at quarter ends when liquidity is tight, and the Fed is expecting to see more of that going forward.

At the Fed’s July policy meeting, the New York Fed official responsible for implementing monetary policy told members of the rate-setting Federal Open Market Committee “there would be times – such as quarter-ends, tax dates, and days associated with large settlements of Treasury securities – when reserves were likely to dip temporarily to even lower levels.” Minutes from that gathering noted “at those times, utilization of the SRF would likely support the smooth functioning of money markets and the implementation of monetary policy.”

The challenge for the Fed is that the SRF is untested thus far in a high demand situation, so there remains some risk it does not act as the shock absorber it is designed to be. The Fed has also provided guidance that if needed it will implement traditional repo operations to add liquidity.

It’s an uncertain situation with a lot of moving parts and that means many Fed watchers are not sure how it will all play out. In a speech earlier this summer Fed Governor Christopher Waller suggested reserves could have some way to go and might ultimately rest at $2.7 trillion.

But some in markets think conditions indicate QT needs to stop soon.

“Something changed” in markets, said Scott Skyrm, of money market trading firm Curvature Securities. “Massive bill issuance dumped a lot of new Treasury supply into the market, the (reverse repo) facility is close to zero, and bank reserves are declining,” while “the repo market is starting to experience more bouts of funding pressure.” Skyrm reckons the Fed needs to stop QT this fall to reflect tighter monetary market conditions.

Economic transformation continues. Trade data weaker and GDP estimates will fall.

Core PCE Price Index (YoY) (Jul)

Act: 2.9% Cons: 2.9% Prev: 2.8%

Core PCE Price Index (MoM) (Jul)

Act: 0.3% Cons: 0.3% Prev: 0.3%

Goods Trade Balance (Jul)

Act: -103.60B Cons: -90.20B Prev: -84.85B

PCE Price index (YoY) (Jul)

Act: 2.6% Cons: 2.6% Prev: 2.6%

PCE price index (MoM) (Jul)

Act: 0.2% Cons: 0.2% Prev: 0.3%

Personal Income (MoM) (Jul)

Act: 0.4% Cons: 0.4% Prev: 0.3%

Personal Spending (MoM) (Jul)

Act: 0.5% Cons: 0.5% Prev: 0.4%

Real Personal Consumption (MoM) (Jul)

Act: 0.3% Cons: Prev: 0.1%

Retail Inventories Ex Auto (Jul)

Act: 0.1% Cons: 0.1% Prev: -0.1%

Wholesale Inventories (MoM) (Jul)

Act: 0.2% Cons: 0.1% Prev: 0.1%

$FLNT is a good trade here. Accumulating here. Look for a nice pop.

Note to self, I liquidated my position on a small profit. I’m no longer in this stock.

I removed the clock on the front page, because the universal church needs to burn. Virtually all Christians have been deceived. It’s just like what the Bible says.

Economy continues to transform right before our eyes, while the incredulous alt media screams collapse. The dumb down Christians think the Bible talks about a collapse. I don’t see that at all. All I read is the booming economy for the wealthy right until the very end.

What a bunch of stupid people Christians have become. And they wonder why the world is the way it is….

Could that mean WWIII and the tribulation will come sooner?

It amazes me how even the smartest people (including those who attend church) are so deceived. So many supposedly intelligent people, including Christians, around me believed Covid 19 came from bats and also fell for the Covid 19 Kill shot. I just listened to a christian prophet who claims Emmanuel Macron is the anti christ. While Macron is not a nice person, I don’t think he fits the bill for the AC. So many Christians are mislead. Jesus Christ did warn us of those times and that time is now. The transformation is happening right in front of our eyes, yet, most people are looking in the opposite direction for the transformation.

I believe the AC is still in hiding and will show up after WWIII.

Who knows when the end times tribulations will happen. Right now it seems to be very slow motion. Meanwhile, make the most of each day as it comes. Make hay while the sun still shines.

I had agreed with your timeline of 2027 as all signs seemed to point towards then. Have you changed your view on the timeline?

I don’t know how others are feeling but it has become almost torturous for me to watch what is happening to our people.

Evil is meeting with very little resistance and it can be disheartening at times. Part of me wishes it would get started sooner rather than later.

I agree with you EB. It seems like the evil people are prospering at the expense of everyone else and the more evil and psychopathic they become the higher they rise to the top. They are the ones in charge. There is very little resistance to the evil.

I am hoping that the force majeur happens sooner and the Lord Jesus comes much sooner to break this spell.

End times will come alot like bankruptcy. A little at first…

I think you should put it back up, stand by your opinion. However I expected you to delete this website before that date, as you deleted the other one.

2027-2030 death and guillotines was your call? Maybe, it’s not that far off only a few more years, and the big event hoaxes are about 8-15 years apart. I’ve said replacement is the force majure and it’s happening now. A dumbed down multicultural sterile population, limited lifespans, mark of the beast QR codes, food rationing, digital currency, AI interaction, surveilance zones. Many variables coming into play. I don’t think we took it for granted back in the day, as we didn’t know at that time what the future would really be like.

I placed the clock back up again. It expires at the end of June in 2027.

I had to delete the old site, since I had personal issues with family members. They were handcuffing me while causing me untold grief.

I think those who have been following my writings going back 12 or 13 years know that I am now more direct and candid. I am now much more free to discuss the spiritual aspects and elements of this endtime economic system. I was never able to say these types of things in my old site. I can keep this site going for as long as possible.

Excellent. Keep up the great work. Your site has been a safe haven for me.

Second look GDP data looking pretty good. Unemployment data looks okay and consumer spending looking nice.

Core PCE Prices (Q2)

Act: 2.50% Cons: 2.50% Prev: 3.50%

PCE Prices (Q2)

Act: 2.0% Cons: 2.1% Prev: 3.7%

Corporate Profits (QoQ) (Q2)

Act: 2.0% Cons: Prev: -3.3%

GDP (QoQ) (Q2)

Act: 3.3% Cons: 3.0% Prev: -0.5%

GDP Price Index (QoQ) (Q2)

Act: 2.0% Cons: 2.0% Prev: 3.8%

GDP Sales (Q2)

Act: 6.8% Cons: 6.3% Prev: -3.1%

Real Consumer Spending (Q2)

Act: 1.6% Cons: 1.4% Prev: 0.5%

Initial Jobless Claims

Act: 229K Cons: 231K Prev: 234K

Continuing Jobless Claims

Act: 1,954K Cons: 1,970K Prev: 1,961K

Jobless Claims 4-Week Avg.

Act: 228.50K Cons: Prev: 226.00K

Bill Ackman Demands Answers From Fed Governor Lisa Cook: Did She Commit ‘Mortgage Fraud Or Not’ — ‘A Question of Fact,’ Not Politics

Billionaire investor Bill Ackman is weighing in on the feud between President Donald Trump and Federal Reserve Governor Lisa Cook, calling on the latter to address allegations of mortgage fraud directly, while warning that the integrity of the American financial system remains at stake.

It’s ‘A Question of Fact,’ Not Politics

On Wednesday, in a post on X, Ackman referenced the “long history of Fed Governors” who stepped down over relatively minor “ethical or legal infractions,” in view of the “unimpeachable probity” required of people serving in such positions.

According to Ackman, the allegations against Cook similarly require a simple answer. He says, “It is either true or false that Governor Cook misrepresented her primary residence status on one or more mortgage applications,” while adding that the evidence put forth by William Pulte, the Director of the Federal Housing Finance Agency, “strongly suggests” that she has committed “mortgage fraud.”

See Also: Bond ETF Investors On Alert During Fed Shake-Up, Rising Yields

Ackman says, “It should be straightforward for Governor Cook to disprove the alleged fraud.” He questioned why legal action was even necessary, insisting that “it shouldn’t require a team of lawyers and litigation.”

The matter, he says, hinges on a direct query, “Did she or didn’t she sign an affidavit declaring that the subject properties were her primary residences? Yes or no.”

He also dismissed questions regarding Trump’s authority to remove Cook, saying that it’s “not that relevant in my view.” He says, what matters is whether a Federal Reserve Governor committed mortgage fraud or not. “It is not a political question. It is a question of fact.”

Ackman concluded by asking Cook to either “put forth the facts to clear her name” or resign from her position, in the interests of the integrity of the financial system. “The sooner this occurs, the better for her and our country.”

No ‘Factual or Legal Basis’

On Tuesday, Cook’s lawyer,Abbe Lowell, argued against her dismissal, saying that, “His [Trump’s] attempt to fire her, based solely on a referral letter, lacks any factual or legal basis. We will be filing a lawsuit challenging this illegal action.”

Trump’s decision to fire Cook marks an unprecedented move in the 111-year history of the Federal Reserve, whose Governors serve 14-year terms, which is primarily aimed at shielding policy decisions at the institution from political pressures.

Sen.Elizabeth Warren(D-Mass.) criticized Trump’s decision, calling it an “authoritarian power grab” that blatantly violated the Federal Reserve Act.

Warren accused Trump of using Cook as a “scapegoat” to distract Americans from his own failures in not being able to bring costs down.

2025 Benzinga.com

Janet Yellen and Jerome Powell caused the inflation in the first place. Yellen insisted on the Treasury financing the vast majority of all that new covid related debt in the short-term markets, rather than locking in long-term low yields. She’s just a Jew communist hack. At some point I have to believe their willfulness is intentional….

Janet Yellen Warns Of ‘Catastrophic’ Consequences As Trump Fires Fed’s Lisa Cook: ‘Higher inflation, Volatile Growth…Weakened Currencies’

Namrata Sen

Janet Yellen, the former chair of the Federal Reserve, has issued a stark warning about the potential fallout from PresidentDonald Trump’srecent attempt to dismiss Fed GovernorLisa Cook.

Yellen Warns Trump Move Threatens Fed Independence, Dollar

In a recent op-ed for the Financial Times, Yellen criticized Trump’s move to “fire” Cook, stating that it is not only illegal but also poses a significant threat to the independence and credibility of the Federal Reserve.

“Politicized central banks deliver higher inflation, volatile growth and weakened currencies. Such a road cannot be good for the U.S.,” stated Yellen.

She also cautioned that the U.S.’s economic stability and global leadership, both of which are underpinned by the Fed’s independence, could be at risk. “The consequences are likely to be catastrophic,” warned Janet Yellen.

By law,Federal Reserve governors serve 14-yearterms to prevent them from being dismissed by presidents who disagree with their views or seek their loyalty. The “for cause” removal is meant for documented misconduct, not “accusations,” stated Yellen.

This action sends a “chilling” message to all membersof the Federal Reserve boardandthe regional reserve bank presidentswho participatein the Federal Open MarketCommittee, stated Yellen.

The former Fed chair also pointed out that the move could potentially undermine the U.S. dollar’s status as the world’s reserve currency and erode global confidence in Treasury securities.

See Also: Bitcoin Holds Steady While Ethereum, Dogecoin, Solana Climb: Analyst Says Altcoins Could Rally 20%-30% If ETH Does This

Lawsuit, Backlash Mount Over Trump’s Bid To Oust Cook

Trump’s attempt to dismiss Cook has sparked widespread concern. Cook’s lawyer,Abbe Lowell, has announced that she will befiling a lawsuitto challenge the president’s action, arguing that it lacks any factual or legal basis.

This move has been supported by several prominent figures, including SenatorElizabeth Warren, who described Trump’s decision as an “authoritarian power grab.”

Meanwhile, billionaire investorBill Ackmanhas called on Cook toaddress the allegationsof mortgage fraud directly, warning that the integrity of the American financial system remains at stake. The outcome of this dispute could have far-reaching implications for the U.S. economy and its position in the global financial landscape.

According to Craig Shapiro, macro strategist at the Bear Traps Report, Trump’s dismissal of Lisa Cook could mark a major power shift at the central bank, paving the way for a Trump-appointed majority on the board and fueling concerns about the fate of regional Fed presidents

2025 Benzinga.com

Home Prices Are Quietly Cracking—The Last Time It Looked Like This Was 2010

A trend unseen since the aftermath of the financial crisis is unfolding, as U.S. home prices declined for a third consecutive month in June 2025, quietly signaling that cracks may be forming in the housing market.

According to the Federal Housing Finance Agency, the national Home Price Index declined 0.2% in June, following a 0.1% decrease in May and a 0.3% drop in April.

While individually minor, the streak marks the first three-month slide in home prices since December 2010—a period defined by weak recovery following the Great Recession.

The June reading missed expectations for flat growth, adding to growing concerns over market momentum. On an annual basis, home prices were up 2.6%—the slowest year-over-year rise since early 2012.

All nine U.S. census divisions reported year-over-year increases, although the pace varied significantly. The Middle Atlantic division—covering New York, New Jersey and Pennsylvania—led with a 6.7% increase. The Pacific division, which includes California and Washington, saw the weakest performance at just 0.9%.

Why Are Home Prices Slipping?

Affordability is the key pressure point. Home prices may be softening, but mortgage rates remain historically elevated, pushing many buyers to the sidelines. Inventory levels have also begun to rise, leading to increased seller competition.

“Home price appreciation in the U.S. has flatlined as affordability remains near record lows, inventory levels continue to build, and sellers outnumber buyers,” said Charlie Bilello, chief market strategist at Creative Planning, in a post on social media X.

Bilello added that the pricing power sellers held during the 2020-2022 boom is fading.

“The first half of the 2020s, with annualized home price appreciation of 4.6% above inflation, is unlikely to be repeated in the back half,” he said, noting there’s “no rational justification for prices to continue to outpace inflation by such a wide margin.”

“Only 24% of all US home sales in 2024 went to first-time home buyers, the lowest share in history,” he added.

Market Reactions

The Real Estate Select Sector SPDR Fund dropped 0.3% Tuesday, adding to a 0.5% loss the day before.

Among the worst performers, Crown Castle Inc. (NYSE:CCI), American Tower Corp. (NYSE:AMT) and SBA Communications Corp. each slipped by about 2.5%.

The only major gainer was Digital Realty Trust Inc. (NYSE:DLR), which rose 1.8%—a sign that demand for data infrastructure remains resilient even as the broader property sector weakens.

https://www.benzinga.com/analyst-stock-ratings/analyst-color/25/08/47336515/us-house-home-price-index-data-outlook-real-estate-property-market

2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.