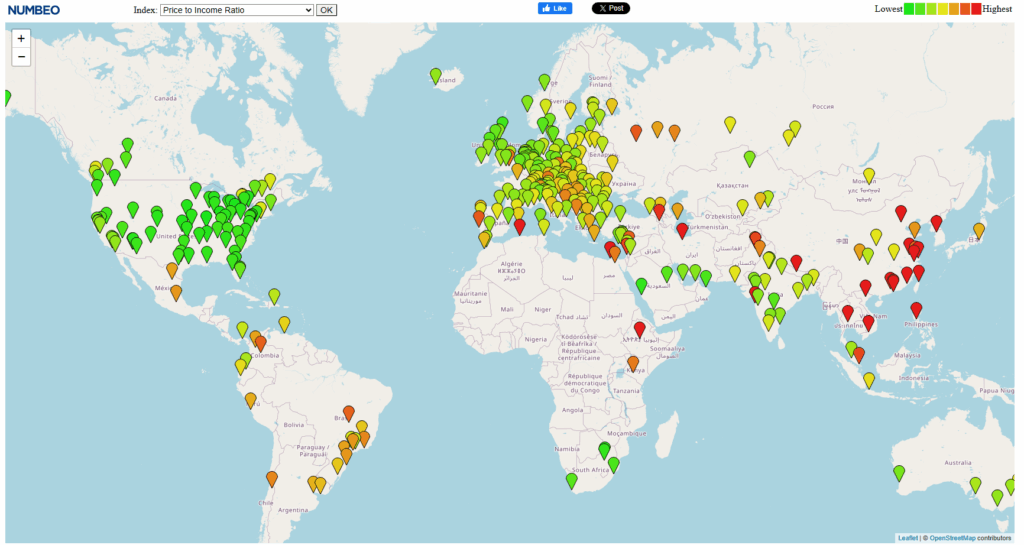

American housing is still cheap when compared to elsewhere

I know it seems hard to believe, but housing in the states is still relatively inexpensive when compared to other countries.

While there are some cities in the United States, like NYC and Honolulu, in which real estate is almost as costly to the local residents in their currency as that in some Latin American countries and cities, most cities and areas in the US still offer investors and homebuyers with some solid longer-term opportunities.

I have provided a sortable table below that includes the latest Western hemisphere’s housing data from Numbeo. We can see how inexpensive American housing is when compared to household income. I believe the data speaks for itself.

Let me end on this note. It has become so expensive to sell a home that existing homeowners are deciding not to sell. It now costs about $50,000 to sell a $500,000 when we consider all the costs involved, including any perfunctory fix-ups needed. So, traditional home sales data no longer truly apply like in the past. As house price to income multiples rise, closing costs climb and home sales decline.

Moreover, new home builders are building cheaper, smaller homes, so new home prices are becoming less expensive than existing homes.

I read an interesting article about Intel. It said throughout its history they would always hire within their own ranks for the leadership positions. Never letting anyone with a fresh point of view in. We see now where that got them. What an abysmal company.

I wonder if we should say “halleluyahweh” instead of hallelujah…..

How more obvious does it have to get?

Shares of Lithium Miner Pop as U.S. Proposes Equity Stake — Barrons.com

09/23/25 6:16 PM

The stock of miner Lithium Americas, which is developing a lithium deposit in Nevada to supply the critical mineral for batteries, nearly doubled in aftermarket trading Tuesday, on news that the U.S. government is in negotiations to take a stake in the mine.

The U.S. proposed an equity stake as a way to renegotiate a $2.3 billion Energy Department loan granted during the Biden administration. “This is a great critical minerals deal,” a Trump administration official told Barron’s while declining to provide the exact share of the company that the government is seeking. “It’s a small stake,” the official said, adding that negotiations are ongoing.

Reuters reported that the U.S. government was considering a stake in the project of as much as 10%.

Lithium Americas said in a statement that it remained “in active discussions with the DOE and our partner, GM.”

Shares of Lithium Americas rose 98.7% to $6.10 in after-hours trading. Before shooting up after the closing bell, the stock had risen around 3% for the year and 25% over the past 52 weeks.

The Canada-based company announced in December that it had entered into a joint venture with GM in which Lithium Americas owns 62% of the project known as Thacker Pass in Humboldt County, Nevada, while GM owns the rest. The mine is expected to be operational by 2028.

The U.S. has recently announced stakes in several other companies, including 10% in Intel, which it secured by converting a grant issued during the Biden administration into an equity stake. In July, it invested $400 million in rare earth miner MP Materials.

The news comes as the Trump administration aims to boost manufacturing in the U.S. through increased investment from both domestic and international companies.

The effort hit a speed bump earlier this month, when an electric vehicle battery factory being developed in Georgia by Hyundai and LG Energy Solution halted construction following an immigration raid. Hyundai said the raid will slow the plant’s opening by a few months.

Write to Anita Hamilton at anita.hamilton@barrons.com

This content was created by Barron’s, which is operated by Dow Jones & Co. Barron’s is published independently from Dow Jones Newswires and The Wall Street Journal.

(END) Dow Jones Newswires

09-23-25 1816ET

Copyright (c) 2025 Dow Jones & Company, Inc.

Inncaccurate chart or what am I missing? How does St Louis have such a high Gross Rental Yield but low Price/Rent? and price to income seems odd, there are many decent paying jobs in that City.

I can’t vouch for each number, but the data for St Louis seems consistent. If you have a low price to rent, it would imply that the gross rental yield is going to be high. This is because investors will be able to generate a high level of rental income from their relatively cheap properties. Thus, price to rent will be low.

St Louis does have a lot of decent paying jobs, especially in the suburbs. However, the St Louis area is not especially a desirable area anymore, so home prices are going to be relatively inexpensive versus incomes. This is why price to household income is extremely low in the St Louis area.

We have similar phenomena in Baltimore, for instance. There is a lot of decent paying jobs in the Baltimore area, but because there are so many cheap properties, the house price to income ratio is suppressed and rental yields are high.

What’s your outlook for Ag+Au?

Crapto looks like it might be topping here, but I’m not sure. There are chart similarities between now and 2021.

By the way, I would much rather own gold than crypto. If we are to own crypto, I’d always said it’s to be bitcoin.

What states do you recommend for buying properties and living as well? Thanks.

Whether Trump specifically knows this or not, war is coming. The Department of War is gearing up by accumulating natural resources, when possible. Look at the stock UAMY this morning.

I actually think President Trump will be a good president during war. If war is coming like we theorize in 2027, it’s better to have Trump in than any democrat.

Why would they change the name of they didn’t already know? Yes, I noticed China and Russia are preparing. Russia is testing the waters in the Baltics and with Poland; China is testing the waters in Western Pacific. I have been following this closely.

Realistically how long before we start burning bodies of Chinese in the grand Canyon after invasion?

People in other countries consider Russians as Jacob biological descendants whites. They definitely are not. Surely a deception.

I am noticing China is infiltrating every major ally in Asia the USA has, most notably South Korea. Here in Thailand, now, and I am seeing China ramping up influence everywhere. Although, USA is still prepared and admired for Thais. Thais consider Chinese as obnoxious, loud, and ill-mannered. Unlike the rest of the countries around Thailand which are communist states, Thailand has managed to align with the USA the most, even a significant amount of principles they have are similar to the USA compared to all the countries next to them. Though the WEF, OCDE are cranking up digitization banking, etc. same front in Latin America.

Just observations.

I’m having a hard time figuring out how INTC can solve its problems. A $5 bil investment by NVDA is not adding up to solve it.