Note to reader:

Controlled opposition to the New World Order always seems to profit, regardless of circumstances. Even Alex Jones is somehow seeing the financial light of day. Donald Trump’s Truth Social Media outfit is an endless money pit and does not come close to deserving the stock price multiple it currently sports. Moreover, every firm run by Trump going back to the 1980s ended up in bankruptcy. I submit the stock price is being propped up in the markets like those of the “magnificent 7”. Trump has been doing a wonderful job as he corners the conservative opposition to globalism and woke politics.

Analysts like Joel Skousen, who claim to understand the “conspiracy”, only recite the kosher version. For those who think Donald Trump is the answer, I am concerned that what’s left of the nation will collapse if he gets back into office. If elected, he will once again sell his loyal followers down the river, like the incarcerated January 6th participants.

Trump Eyes $4 Billion Stock Windfall as His Legal Bills Pile Up

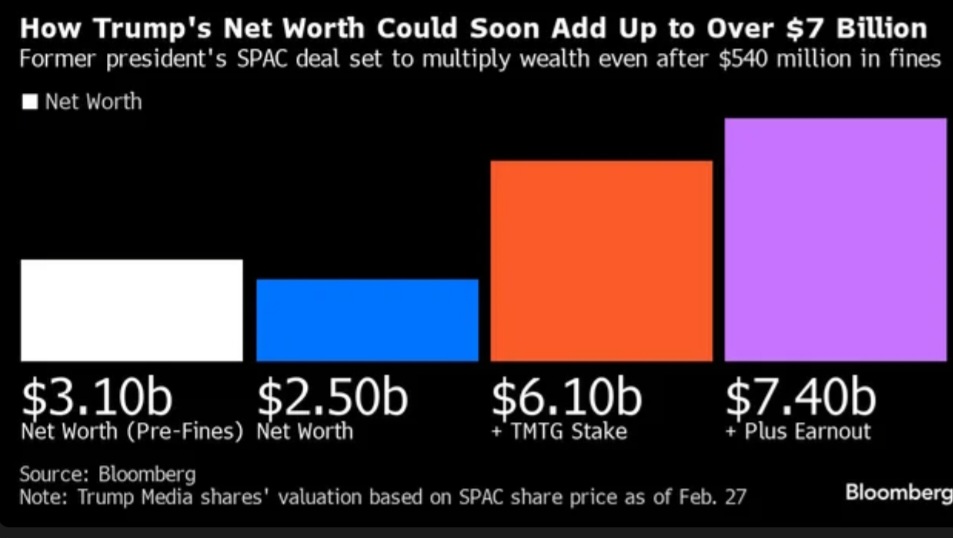

(Bloomberg) — On the financial front, the news has appeared dire for former president Donald Trump this year. Within a span of just a month, two judges in two separate cases ordered him to pay about $540 million in total — a sum so great that pundits have speculated it could erode his campaign finances.

What’s gotten far less attention, though, is this: A frenetic rally in a stock tied to Trump Media & Technology Group — which operates the Truth Social platform he posts on daily — has minted a nearly $4 billion windfall for him.

There are any number of caveats to this figure, including how it’s only a paper profit for now that he’ll have to wait months to monetize, and yet the stock’s surge is a potentially huge financial boost for a billionaire candidate suddenly short on cash.

The type of transaction — known as a de-SPAC or blank-check deal — that would hand Trump this new-found wealth is a complex one that briefly became popular on Wall Street during the stock mania unleashed by pandemic-era stimulus. In this particular deal, Truth Social’s owner would enter the stock market by merging with a publicly traded company called Digital World Acquisition Corp.

Shares of DWAC, as the company is known, have soared 161% this year in anticipation of the merger, which has been green-lit by the Securities and Exchange Commission and is now slated to go to a shareholder vote next month. If it’s approved, Trump will hold a greater than 58% stake. At DWAC’s current price — it closed Tuesday at $45.63 per share — that stake is worth $3.6 billion. Trump could get even more — close to an additional $1.3 billion worth, if the shares meet certain performance targets.

It seems improbable to many analysts that a stake in a money-losing social media company with little revenue and a fraction of its rivals’ user bases could potentially more than double Trump’s net worth. But as Trump began to steamroll his Republican rivals in January, setting up a likely rematch with President Joe Biden in November, retail investors frantically bid DWAC shares up. And when a group on Wall Street known as momentum traders joined the buying frenzy, the conditions for an epic rally were in place. In just six days, the stock jumped 200%.

“This is a meme stock, it’s not the type of thing where you bust out P/E ratios — you can throw that out the window,” said Matthew Tuttle, the chief executive and chief investment officer at Tuttle Capital Management. “DWAC has now become the de facto way to bet on or against Trump,” he added.

But if Trump’s rebound carries him back to the White House — and many polls currently make him the favorite to win — there could be value, in theory, at least, in owning a cut of the mouthpiece that will carry his message.

“The fundamental bull case is that he confines his tweets to the Truth Social platform, which means if you want to see them or interact with them, you need to sign up as well, making advertising all the more profitable,” Tuttle said.

Penalties and Fees

While Trump’s windfall would more than cover the penalties and legal fees he faces — he is appealing New York state’s $454 million civil fraud verdict — he would need to wait at least five months before cashing in shares, unless the company files to expedite that timing.

“He needs the money but he can’t sell too much at once without risking tanking the stock,” said Usha Rodrigues, a professor at the University of Georgia School of Law. “Once the lockup is expired, he could use the shares as collateral for loans in order to access cash without selling the shares.”

And it’s unlikely a bank would lend him a large sum of money against the locked-up shares, according to industry watchers like University of Florida finance professor Jay Ritter.

Representatives for DWAC, Trump Media and the Trump Organization didn’t immediately respond to requests for comment.

Even the so-called earnout would more than cover it. After the deal closes, if the stock trades above $17.50 for 20 of 30 days, Trump Media holders would be entitled to receive as many as an additional 40 million shares filings show — with the majority earmarked for Trump.

A more troubling question for Trump is whether shareholders will keep the faith for more than five months after the merger is complete. As recently as April, Trump assigned the company a $5 million to $25 million value in a financial disclosure filed with the Federal Election Commission, a fraction of its valuation in the SPAC deal terms as well as in the market.

The business has struggled, with Trump Media losing $49 million in the nine months through September while generating just $3.4 million in revenue, according to regulatory filings. As such, the company has warned that it may run out of cash without the merger, filings show.

Trump Media “hasn’t been able to turn the corner and it’s not clear how the company is going to succeed in monetizing its business,” said Ritter.

The deal’s anticipated completion is a feat in itself after more than two years of starts and stops. Skeptics questioned whether Trump Media’s merger could clear a litany of shareholder votes, as well as investigations from the Justice Department and the SEC.

After the completion and during the lockup, the share price – and Trump’s potential windfall – will hinge on how successful he is politically, industry watchers agree. Trump Media has been aiming to “rival the liberal media consortium” and fight against big tech companies like Meta Platforms Inc., Netflix Inc., and Elon Musk’s X.

Shareholders may even choose to hold onto their shares in the hope that because of Trump Media’s alignment with his campaign message, Trump would have a strong incentive not to add Truth Social to the long list of ventures he’s endorsed, then exited from.

“The majority of people who are buying and holding this thing are Trump supporters, “ Tuttle said. “I don’t think it’d be smart for him to entirely blow out of his position and leave them holding the bag.”

©2024 Bloomberg L.P.

We are still in a stimulative territory. As long as the equity markets are performing this way, stimulus continues for the asset owners…. Unit labor costs look good and came in lower than expected and the rear view of last month is .1% lighter. Nice numbers

Continuing Jobless Claims

Act: 1,906K Cons: 1,889K Prev: 1,898K

Initial Jobless Claims

Act: 217K Cons: 217K Prev: 217K

Jobless Claims 4-Week Avg.

Act: 212.25K Cons: Prev: 213.00K

Unit Labor Costs (QoQ) (Q4)

Act: 0.4% Cons: 0.7% Prev: 0.5%

Nonfarm Productivity (QoQ) (Q4)

Act: 3.2% Cons: 3.1% Prev: 3.2%

Trade Balance (Jan)

Act: -67.40B Cons: -63.40B Prev: -64.20B

I am looking for another SFR in the area I have been concentrating on for the past couple years. I am finalizing a cash out financing on an existing property to fund the next all cash purchase. My rate is 7.5% for a DSCR loan.

Investors are having a relatively easier time financing now vs. confirming mortgages. The spread is less than 100 bps. It used to be 300 bps.

What is gold pricing in? It’s outperforming the other commodities and PMs.

Is gold pricing in a growing concern the Fed will screw things up again like 2008? Is it pricing in the ongoing Federal government profligate ways (e.g. its latest 500 bil stopgap spending bill)?

Debt growth and the feeble antics of the Fed are really a one-two punch in the nards for the common man.

Meritless diversity hires

When you hear anyone is a diversity hire, rest assured they lack.professional or technical merit for the job.

https://rumble.com/v4fgag3-meritless-diversity-hires.html

Landlords, soak the reprobates. The cash flows will increase annually….

Gen Z and millennials are becoming ‘forever renters’ – here’s what this means for the real estate market

As economic woes continue to pummel the housing industry, one real estate developer is finding opportunities within a new market – the “forever renters.”

Post Brothers CEO and co-founder Michael Pestronk joined “Varney & Co.” Friday to discuss the real estate opportunity brewing in urban areas as some Americans are opting to rent instead of buying a home.

“The biggest issue, especially in large established metro areas, is a lack of product. There’s no such thing as a starter home in large [Metropolitan Statistical Areas] anymore. There’s no land available to build housing within commutable distances of jobs,” he explained.

Pestronk argued that “bigger” and “better” apartments are the ideal starter homes for those who live in big cities.

The real estate expert said that a portion of “forever renters” are of the “higher-end” demographic and have an eye for apartments with large scale rooms, sophisticated aesthetics and kid-friendly amenities.

“Most apartment buildings, especially over the last 10 years, have been built targeting a 27-year-old. And they have orange doodads as the design theme,” he told host Stuart Varney.

“We have a mid-Atlantic focused portfolio. Our average renter 10 years ago was 29. Today it’s 33. But we also have way more renters of the 35 to 45, making well over $150,000 than we used to have,” he said.

Michael Pestronk said that large apartments are great first homes for couples.

“We have a mid-Atlantic focused portfolio. Our average renter 10 years ago was 29. Today it’s 33. But we also have way more renters of the 35 to 45, making well over $150,000 than we used to have,” Pestronk said. New Africa – stock.adobe.com

Pestronk said the concept has not only attracted millennials but empty nesters as well.

The Post Brothers CEO said the rent could range from $4,000 to $8,000, arguing it’s “not inexpensive” but on the “favorable” end compared to the cost of owning a home.

“These buildings, especially the ones that we’re focused on, are in locations where there is no opportunity otherwise to build new housing because they’re completely infill, there’s no land available. And so they’re in the locations that are in the highest demand,” he expressed.

Pestronk said the concept has not only attracted millennials but empty nesters as well.

“The biggest part of this story is really that the millennial generation has come of an age and an income level, where in previous generations they would have been moving to the suburbs and buying houses, and they’re not,” he said.

For those who own PFE for its dividend, I’m observing that its dividend payout is currently higher than its net income.

Russian financial officials are secretly crying. Its inefficiencies and corruption preclude it maintaining its oil output at levels that are consistent with pre-Ukraine sanctions. Once the Western money and technology left, so did Russia’s oil output. Every barrel of oil output that OPEC+ “voluntarily” cuts only benefits USA, Inc.

___________

OPEC+ Extends Oil Cuts, With Russia Bolstering Its Effort

(Bloomberg) — OPEC+ extended its oil supply cutbacks to the middle of the year in a bid to avert a global surplus and shore up prices.

The curbs — which on paper total roughly 2 million barrels a day — will remain in place until the end of June, according to statements from members such as Saudi Arabia, which accounts for half of the pledged reduction. Russia promised to strengthen its role by focusing more on cuts to production than exports.

Traders and analysts had widely expected the extension, seeing it as necessary to offset a seasonal lull in world fuel consumption and soaring production from several of OPEC+’s rivals, most notably US shale drillers. An uncertain economic outlook in China is adding to the need for caution.

Ample supplies have anchored international oil prices near $80 a barrel this year, even as conflict in the Middle East disrupts regional shipping. While that offers some relief for consumers after years of rampant inflation, prices may be a little low for many in the Organization of Petroleum Exporting Countries and its partners.

Riyadh needs a crude above $90 a barrel as it spends billions on an economic transformation that spans futuristic cities and sports tournaments, according to Fitch Ratings. Its largest partner in the alliance, Russia, also seeks revenue to continue waging war on Ukraine.

These latest output curbs, which deepen reductions made last year, will be “returned gradually subject to market conditions” after the second quarter, the countries said on state-run media.

Russia — which has a unique exemption to split its curbs between production and exports of crude oil and refined products — will put greater emphasis on cuts to crude production during the coming quarter, Deputy Prime Minister Alexander Novak said.

That promise may offer some satisfaction to Riyadh. Saudi Energy Minister Prince Abdulaziz bin Salman expressed disappointment last year that Moscow hadn’t agreed cut production, which more directly impacts global market balances than changes to exports.

In April, Russia’s cut will comprise 350,000 barrels a day of output and 121,000 barrels a day from exports. In May, it will be 400,000 barrels a day of production and 71,000 of exports, while in June the curbs will come from production only.

Still, Russia and others in the group haven’t so far delivered fully on their commitments.

Moscow only recently fully implemented the production cutbacks it promised to make almost a year ago. In January, the nation reduced its exports of crude oil as agreed by roughly 300,000 barrels a day, but promised curbs to shipments of refined fuels were less clear.

Iraq and Kazakhstan collectively pumped several hundred thousand barrels a day above their quotas in January, but promised to improve compliance and even compensate for any initial overproduction.

The group’s decision to extend its curbs for the second quarter may have been widely expected, but OPEC+ will likely face a tougher choice at its next scheduled meeting on June 1, when ministers will set policy for the second half of the year.

Forecasts from the International Energy Agency in Paris suggest that, with growth in global oil demand slowing and new supply from the Americas soaring, OPEC+ will need to persevere with its cuts all year.

“You don’t want to bring barrels back in too early,” Saad Rahim, chief economist of commodity trading giant Trafigura Group, told Bloomberg television last week.

It’s unclear whether all members would be willing to subscribe to that policy. While Saudi Arabia has often urged the need for caution, its neighbor the United Arab Emirates has been keen to make use of recent investments in new production capacity.

Some forecasters believe that won’t be a problem, as strengthening demand will allow the group to relax its curbs and add more barrels later in the year.

There has been “an improvement in overall market fundamentals,” said Paul Horsnell, head of commodities research at Standard Chartered Bank Plc. “OPEC could increase output” without flooding world inventories.”

Finally! My bet on BCH is finally paying off. I came home from working today and find I have a two bagger in 24-48 hours. Just sold half. The half I have left are worth my cost basis from a couple months ago.

I have been telling people in my emails that I held BTC and BCH.

This money is bleeding into the asset markets and short term government paper. Once it’s drained, the banks will need a reason to maintain a certain level of reserves. Hello QE in its manifold forms.

https://www.terminaleconomics.com/wp-content/uploads/2024/03/RRP030124.jpg

$34,471,083,238,111.75

Debt to the penny…

https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-penny

Huge one day jump to finish the month. In Canada the deficit spending never gets talked about, there is always extra money being committed and spent on new initiatives for those who didn’t earn anything. The lawmakers here passed a new bill for “Pharmacare”. Free diabetes meds and birth control for everyone, I don’t know the details but I suspect Ozempic and its clones will be covered.

Big jumps in UST debt outstanding to end the month. The government seems determined to get the NWO and Great Reset objectives in place come hook or crook, so the spending must continue. The trillions it costs for the “immigrants” to establish themselves is driving the government into massive debt, while the people living here will be eating Soylent Green and living int their cars.

I remember this song from back in the 1970s as a young boy. What a time to be alive. I took it all for granted. I thought everyone was Christian.

America – Simon and Garfunkel

https://youtu.be/7m5BbRf4GRU?si=XQWleTU8ROyMXTcx

The talmudic Jews turned Manasseh into a multicultural shithole of dumbed down dark skinned mongrels. The Israelite Caucasians hate themselves and have been conquered just like in the 720s BC. They have been replaced by the enemy in the very nation they founded.

All I can say is continue owning the assets and be the landlord to the synagogue of Satan Jew engineered cesspool.

Jacob’s trouble looms. There needs to be a great shaking in the land of Israel, and not in the misnamed Talmudic and satanically inspired sandbox in the Middle East.

Own the assets. All that fiscal deficit spending is also covering up the millions of “vaccine” related deaths.

What’s going on in the gold market today? I sold my trading position with a nice (taxfree) profit.

The Fed chatter is indicating that it may proceed with a wind down of QT and concentrate on buying Treasuries. It seems it may intend to operate by buying shorter term paper at the expense of longer term. This would allow the yield curve to steepen. It seems the US government intends to continue financing through the short-term paper conduits. The FED looks like it will shift into an effective QE mode by buying up short-term paper.

The reverse repo window continues to wind down with assets now down to about 400 billion. Once that is drained, there is nothing left to soak up the excess sovereign debt generation. Gold likes the message. Gold is also playing catch up to the other asset classes. It’s about time.

It’s good always selling off of strength. So, congratulations. You do what other successful traders do.

Gold traders on the aggregate seem to have been caught off guard as there was a net short position in the institutional class. You snooze, you lose. However, I keep in mind that most of the institutional shorting is what I would consider to be covered as it’s an offset to long holdings.

Great video, Love Your Race.

https://rumble.com/v4feas3-love-your-race.html

Of course, self loathing European Caucasians will scoff at this notion as being contrary to God’s devine planning, but all the Paul quoting can’t make it so. The Jew sits behind the scene and engineers it all. Hmm….

Price data still elevated, but coming in as expected. Personal income better than consensus, while real spending is weaker. Overall, okay data…

Continuing Jobless Claims

Act: 1,905K Cons: 1,874K Prev: 1,860K

Core PCE Price Index (MoM) (Jan)

Act: 0.4% Cons: 0.4% Prev: 0.1%

Core PCE Price Index (YoY) (Jan)

Act: 2.8% Cons: 2.8% Prev: 2.9%

Initial Jobless Claims

Act: 215K Cons: 209K Prev: 202K

Jobless Claims 4-Week Avg.

Act: 212.50K Cons: Prev: 215.50K

PCE Price index (YoY) (Jan)

Act: 2.4% Cons: 2.4% Prev: 2.6%

PCE price index (MoM) (Jan)

Act: 0.3% Cons: 0.3% Prev: 0.1%

Personal Income (MoM) (Jan)

Act: 1.0% Cons: 0.4% Prev: 0.3%

Personal Spending (MoM) (Jan)

Act: 0.2% Cons: 0.2% Prev: 0.7%

Real Personal Consumption (MoM) (Jan)

Act: -0.1% Cons: Prev: 0.6%

Though M2 money stock measures continue to flat line over the past year, they are obviously up substantially since the initiation of the COVID-19 stimulus packages.

I do know that M2 velocity continuing to increase close to the point where it resided pre-covid. Obviously, currencies around the world are being debased to the point that nobody wishes to hold on to them anymore and this is why we are observing continued elevated levels of price inflation.

https://www.terminaleconomics.com/wp-content/uploads/2024/02/M2velocity0224-Internet.jpg

https://www.terminaleconomics.com/wp-content/uploads/2024/02/M20224.jpg

How long would M2 have to flatline for people to regain confidence in currencies?

The loss of confidence has less to do with M2 growth and more to do with fiscal deficit spending and the resulting amount of sovereign debt that is being generated. I suspect that the longer elevated interest rates remain, which translates into concomitant higher bond yields, the quicker confidence will be lost.

If we wish to observe lost currency confidence in action, we should look no further than to the asset markets. We notice how asset prices keep moving higher and this is a result of Lost confidence in the global currency regime. Investors would rather hold assets than cash or even sovereign debt. If confidence was restored and solidified, asset prices would not be rising as they are currently.

Oh — but the Don said it so let’s cheer

https://x.com/gregreese/status/1762549471940882508?s=20