Follow me on this…

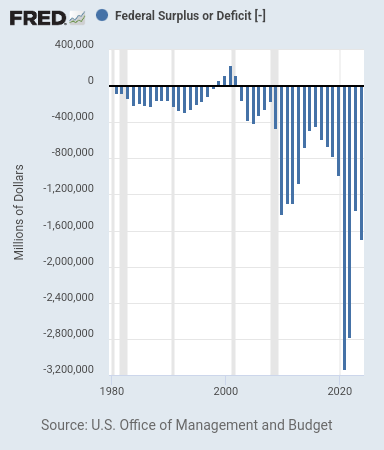

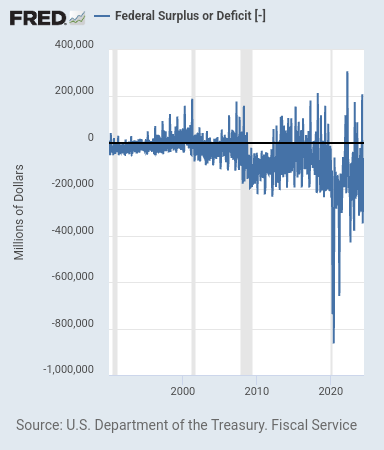

I suspect that when Harris gets “elected”, the Democrats will embark on the most ambitious wave of social deficit spending in history. I suspect that the fiscal deficits that will accrue under a Harris regime will dwarf anything under Biden. I know this, because I listen to what Harris has been saying during this campaign and that’s the only conclusion I can make; fiscal deficit spending will balloon with her at the helm.

To wit, the Harris regime or those who are promoting her will attempt to rewrite the Internal Revenue code to be more adversarial toward asset owners. This will be the Democrat’s attempt to raise tax revenue as well as to appear more friendly to their ostensible stakeholders, the poor and disenfranchised.

Regardless of any attempts to rewrite the IRC, asset prices will continue to escalate massively, rewarding asset owners. We need to keep in mind that the federal government will continue to try to reengineer society on many fronts, and this will include forcing people to drive EVs as well as heavily promoting race mixing, DEI and LGBTQ objectives, pornography desensitizing for children, green energy, etc.

I also submit to the reader that these regional and local wars will coalesce into an eventual global war, which will require the federal government to spend trillions more over the next several years. As opposed to the previous Republican regimes, the Democrats seem much more at ease with antagonizing the West’s seen enemies.

All these programmes require many trillions of dollars and with Harris as president, the Democrats will be emboldened to spend even more recklessly than during Biden.

The Democrats may camouflage many of their budget busting objectives with oxymoronic and patriotic sounding names, similar to the ironically named Inflation Reduction Act, but the results will destroy the ways of life for those without assets. Even with a series of punitive IRC modifications, asset owners will continue to hold up better than anyone else.

Even if the capital gains tax rates are increased and many of the tax benefits that have accrued to asset owners are rescinded, asset prices will continue to rise as the massive waves of budget deficits accrue in ever larger numbers. Thus, those who are promoting Harris are attempting to be proactive, lest asset and housing prices rise even more profoundly.

Data lower than expected, but not as bad as feared. Okay, but weaker than expected, with some downward revisions. A 50 bp cut is slightly less likely than before, but it looks 50/50 for this month’s Fed meeting.

Nonfarm Payrolls (Aug)

Act: 142K Cons: 164K Prev: 89K

Participation Rate (Aug)

Act: 62.7% Cons: Prev: 62.7%

Private Nonfarm Payrolls (Aug)

Act: 118K Cons: 139K Prev: 74K

U6 Unemployment Rate (Aug)

Act: 7.9% Cons: Prev: 7.8%

Unemployment Rate (Aug)

Act: 4.2% Cons: 4.2% Prev: 4.3%

Average Weekly Hours (Aug)

Act: 34.3 Cons: 34.3 Prev: 34.2

Government Payrolls (Aug)

Act: 24.0K Cons: Prev: 15.0K

Manufacturing Payrolls (Aug)

Act: -24K Cons: 0K Prev: 6K

Relatively speaking, the Household survey looks pretty good this month and actually the data in the Household survey shows a more optimistic picture than in the Establishment survey.

This report shows a gain of 168,000 employed and a drop of 48,000 unemployed. As a result, The unemployment rate drops from 4.3% to 4.2%. the labor participation rate remains unchanged at 62.7%.

https://www.bls.gov/news.release/empsit.a.htm

Based on the data contained in this Household survey, I suspect the Federal Reserve will drop 25 basis points this month.

The USDX is trading on its intermediate support. If this morning’s employment report comes in worse than expected, look for the dollar to fall below this level as the probability of a 50 basis point cut increases.

I also suspect the dollar is going to fall further to the downside as a result of a Harris regimes spending plans. What her backers have planned are going to completely upend what’s left of fiscal prudence.

Based on trends, I see a USDX in the mid-90s as extremely asset and gold price bullish, and this is where I think the dollar is moving. That’ll be terrible for the average wage earner, but a fading and weaker dollar will only help the asset owners at the expense of everyone else. This is because a stronger dollar has helped keep a lid on increases to the cost of living.

No shit Sherlock….

“Judaism is inherently gay,” Ben Platt explains as he marries his longtime boyfriend

The couple got a Vogue shoot commemorating the “very gay and very Jewish” nuptials.

https://www.lgbtqnation.com/2024/09/judaism-is-inherently-gay-ben-platt-explains-as-he-marries-his-longtime-boyfriend/

Debt to the Penny $35,343,824,738,015.02

The wealth consolidation must continue until the force majeure….

Landlords must exit minority areas ASAP or properties risk confiscation.

2027

After today’s terrible jolts data, tens and twos spread has narrowed to practically zero.

ADP numbers this morning are horrendous. 99,000 payrolls vs. 140,000 consensus.

The federal government and its fiscal deficit spending has been crowding out everything else. Gradually over time, the United States has been transitioning itself into a command economy in which the federal government will run everything.

The transition from its prior economic system into the desired product takes many years and a number of manufactured crises to achieve. Once Harris is elected, the objectives will accelerate and the amount of fiscal deficit spending will balloon and crowd out everything else.

This will result in a higher inflationary floor and in an economy in which the growing percentage of the population will be ever more hopelessly dependent on the government.

The debt markets are already behaving as if they are operating under a command economy; one in which the Federal Reserve controls the yield curve. Gradually, the debt markets will even transition to a command economy and in order to get a mortgage or other type of loan we will have to submit to the Communist doctrines, lest we be shut out.

This morning’s unit labor costs were revised down to 0.4% from 0.9%.

Is a 50 basis point cut in the cards? Let the asset markets rule!

In order for a young couple to buy a single family house in the states, entire families will have to come together and pool their monies for a down payment, just like communist China. Both the United States and China are now identical in function.

I observe how the United States has been sliding into the abyss after upwards of 75 to 80% of American adults receive the MRNA bio weapon injection, which shuts off the God gene.

Americans are so much wiser than Solomon. The whites and the schvartzes are mixing it up, according to their instructions given to them in the media and commercials. Wipe out the ingenuity and resistance of the Caucasians, while simultaneously breeding out a higher IQ level with the Caucasians fornicating with the blacks and Hispanics. The only positive spin I can make with a white person fornicating with an Asian is that the IQ level remains intact.

Today’s Christians are so much wiser than Solomon.

Further to Stone’s analysis

https://x.com/david_r_morgan/status/1831595788985606426

I guess the Talmud also discusses the collapse of the West as fulfillment of end time prophecy. It’s interesting how this Talmudic Jew refers to the West as Edom. Of course, the Jew is Edom and the Western Caucasians are the Northern Israelites.

What this rabbinical Jew discusses is a non sequitur as eschatological affairs do not flow through Edom as he is somehow concluding. They flow through Israel, the people.

Ironically, what this Jew says is a confirmation of what we have concluded a long time ago, the Northern and Western Europeans and their nations are the Northern Israelite remnants, because he is claiming that once the West is taken out, the end time can begin and the Messiah can come.

This Jew can say whatever he wants to back up his theories and refer to the satanic Talmud all he wants, but he only verifies our standing analysis. The Western nations were founded by the Lost Israelites.

The descendants of these rabbis and their brethren have been instrumental in destroying Israel, the people today who are called Israel. Unfortunately, this has been an ongoing process because the people from ancient times who are actually Israel do not know they are Israel.

Indeed, prophecy is being fulfilled and there is only a few more years left until the coming of the Messiah. Whether it’s through global war or through wormwood, the results will be the same. It will be 2,000 years since our messiah’s first Advent ended on the cross.

The true Israel’s Messiah will be Jesus. The messiah this Talmudic Jew is seeking will be the first man on the White horse. The first man on the White horse is that man of perdition and the Jew will follow him.

Excellent analysis! Very simply, the first one is the wrong one.

Great analysis. The so called “Jews” of today are the ones descended from Edom. The Jews who came from Eastern Europe which comprise most Jews in the western world are not the ancient Israelites.

Atlanta Fed GDP Latest estimate: 2.1 percent — September 04, 2024

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2024 is 2.1 percent on September 4, up from 2.0 percent on September 3. After this morning’s releases from the US Census Bureau, an increase in the nowcast of third-quarter real gross private domestic investment growth from -0.6 percent to 0.0 percent was slightly offset by a decrease in the nowcast of third-quarter real personal consumption

For anyone interested, I have been holding RMTI for a week or two now and it broke out again today on some good news. It’s a Zack’s #1 and as the people get sicker from the bioweapon injection, especially with the growing rates of renal problems and failures, the stock should do very well. I’m a definite buy and holder and as the injected get sicker, we can profit.

I’ve noticed personality changes in long time friends who were injected. They can’t handle stress as well and no longer deal with contentious issues. I have one friend whose family now are taking vacations almost continually. She is no longer the same person and I’ve known her since the mid-90s.

You hit the nail on the head. I have noticed the same thing as you described with injected people.

I have noticed that those who got the Covid shots are much lazier physically. I also have noticed the covid vax injected people resist dealing with complex issues unlike these same people 4 years ago.

The injected people are also a lot more spacey and out of it compared to 4 years ago. It seems like they have began smoking marijuana 3 years ago.

I work for two bosses that are both injected multiple times. One is suffering many more and much stronger anxiety attacks to the point that he cannot sleep at night and cannot think over complex issues. It is much worse than 4 years ago.

I have to mentally hold his hand many times. He literally shakes due to nervousness. He is 71 years old and I am strongly encouraging him to retire as, fortunately, he has good savings under his belt and can afford it.

The other guy I work for, has gotten much lazier in the last 3 years. No anxiety issues but just has gotten much lazier and a lot less motivated. Instead of seeing the extra work as extra fees and billings, he just sees it as an aggravation. When I talk to him on the phone, he spaces out to the point where I wonder if he is still there. I have to explain things to him much more than in the past. He avoids and puts off complex projects much more than in the past.

I think the unvaccinated people now have a huge competitive advantage over the vaccinated folks and can really clean up.

It seems to me that the Covid vaccines exacerbate the bad behavioral qualities in the injected people. In addition, the injected people who had health issues in the past find those issues getting much worse and also getting health issues that they never had before such as new and rare cancers.

The injections are turning people into those from the movie, Invasion of the Body Snatchers. I am watching it in real time. The process is gradual, but now I have definitely noticed the difference.

Body Snatchers! Both versions are entertaining and depict people who appear human and are not. They Live is another movie on a similar theme. Those that are shot up may very well have accepted a change to their dna which would make them unclean, think days of Noah!

On the macabre topic of financially benefiting from bioweapon-created illnesses…. I was thinking that another would be companies that deal with anticoagulant medications (?) I was surprised though when I looked up the maker of popular blood thinner Eliquis, which charges approximately $2000/month for its med, that the stock isn’t doing better over the last five years. I am aware of the difference between amyloid clots and regular blood clots, but it appears most traditional doctors are treating all “clots” with regular blood thinners. With all the strokes, heart issues and clotting issues (induced by the bioweapon), as well as the rise in “sludge blood” blood thinners must be in pretty high demand. (According to Rense, all hospital patients, vaxed and unvaxed, have sludge blood now.) Your thoughts?

I specifically mentioned RMTI as it is a micro cap that is very specific to its niche. I observe how the bio-weapon injections have greatly enhanced the demand for renal care. RMTI is experiencing tremendous upside revenue momentum, with continual upward guidance. Moreover, yesterday’s announcement with NIPRO, which is a multi-billion dollar Japanese drug firm, greatly enhances this firm’s Revenue upside trajectory.

RMTI has great visibility, excellent momentum characteristics, and stands to benefit greatly as the bioweapon injection inspired renal and kidney failures have allowed this firm to really be able to push to the upside. I suspect that in a year or two this firm will be close to $10. This is a definite buy and hold and Zack’s says the same thing.

The blood thinners are produced by $100 billion plus firms, and these firms are in a different league.

Thanks for your thoughts. Before my last comment, I had looked at the 5 year chart of RMTI and noted it was much more expensive and went down approximately 90%, but that it looks quite inexpensive now and poised to continue moving up. Please keep us posted on your progress with that stock. Thanks again.

STSS. Trade action looks interesting. Something going on? Finally? Four consecutive daily green candles….

I don’t know anything about the company except what it released, but I bought some earlier in a trade.

hmmm…Sharps Technology Enters Into a Five-Year Sales Agreement with Strategic U.S. Medical Products Company Creating +$5O Million in New Revenue for …

I guess they are getting ready for the next scandemic to try to inject us again….

It failed to break out in the late afternoon and I sold. I’m just holding RMTI for now.

Glad you sold STSS….Seemed that holding it was funding our demise…The payroll report looks awful for sure – it makes we wonder if they are setting us up for a big stock market tank going into October (usually a bad month for the stock market anyway) and just before the selection.

Ivermectin continues to amaze and a cancer surgeon sees effective cures when nothing else worked…

https://x.com/JanJekielek/status/1793455578812952790?s=09

I never see any of my research in the alt media. Not only is it accurate, but it easily explains the current state of affairs and trends. It offers accurate predictions and presents readers with viable and practical solutions. Unfortunately, it doesn’t line up in the manufactured side that’s portrayed with the alt media consensus. In other words, my research isn’t kosher. I know Henry Makow doesn’t follow me anymore.

I wonder why? Maybe I’m not bashing white people nor the founding fathers enough. Maybe I refer too much to the 66 books contained in the Bible. Perhaps I should spend more time externalizing the ruling hierarchy, which is effective in demoralizing the reader. Perhaps I personally know Judaism all too well. Oy vey….

I had three black gentlemen show up at my doorstep a couple days ago asking me about Jesus and whether he was a Jew. For about 45 minutes I let them have it. Of course, Jesus wasn’t a Jew. What does that exactly mean anyway? Jesus never said he was a Jew, only the Romans soldiers and Pontius Pilate said so.

When it comes to the Bible and father Yahweh, the lineage is determined by the seed, which makes this a patriarchal hierarchy.

However, according to the Laodicean Judeo-Christian, Talmudic rabbinical, and Babylonian traditions, lineage is determined through matriarchal lines. Of course, determining lineage through the mother is the communist and feminist doctrine, which is spawned from the devil himself. Based on their doctrine alone, it’s implied that the talmudic Jews follow the devil.

To wit, where did Jesus receive his Y chromosome? This set of genes came from father Yahweh himself. We will only assume that the x chromosome came from Mary, but we don’t even know that for sure.

Just on this basis alone, we know Jesus was not a Jew. The Old testament was not written for the “Jews”, it was written for my people, and it certainly did not pertain to the lineage of the three black gentlemen that stopped by my doorstep and were left speechless for 45 minutes while I quoted line and verse over and over again. I told them exactly what I told you over the years and for them to gird their loins and be prepared as they were totally deceived. They were Scofield Judeo-Christians to the core and were preaching the Communist doctrine that we’re all the same.

I pointed them to my wife hovering in the background who is more pale than I am, yet is Jewish, and told them that they probably presuppose that the Lost Israelites were not white. They were there to tell me that the Lost Israelites could have even been black. Observe the non sequitur.

The world has been completely deceived and this is especially true of the last days Christian “church”, which has been rendered a farce.

It appears the lie runs even deeper. Ancient Greek scholars have made the claim that the Bible was originally written in Greek, and later the Greek was translated into Hebrew. All the original jewish synagogues have Greek inscribed into the stone, not Hebrew. The jews claim that the Hebrew came first and it was later translated to Greek…. Perhaps there was more deception taking place than the claim that Jesus was a Jew, which most Christian churches claim today. The word “Jew” was later added to the Bible to reference those from the tribe of Judah, another intentional error. And we all know that most contemporary churched Christians are fine with the atrocities committed by Israel in Gaza, because of the misnomer of “Isrealites” given to that nation. Everything has been inverted.

You are absolutely correct with the change to the reference of Judah. It would be more accurate if we called Jesus a Judean, because he certainly wasn’t a Jew nor did he subscribe to any of their devilish doctrine.

Another point to consider. The book of Luke 1:5 states Elizabeth was of the daughters Aaron, the tribe of Levi. Luke 1:36 states Mary and Elizabeth are kin or cousins. Therefore Mary is likely of the tribe of Levi as a daughter of Aaron. Luke 3:23 speaks of Joseph’s lineage which of course is a step father at best and not His Father! Another way to think of this is to refer to someone as an American, even though they are of Irish decent.

Excellent points!

Jesus even mentions John the Baptist’s father as one of the Jew’s victims, as Zacharias who wouldn’t turn in his son, John, to Herod. Jesus even infers that the lineage of these Jews goes all the way back to Cain.

Matthew 23:35 That upon you may come all the righteous blood shed upon the earth, from the blood of righteous Abel unto the blood of Zacharias son of Barachias, whom ye slew between the temple and the altar.

As we can see in the gospel of Matthew, Jesus warned us about the Jews and what they are capable of doing. The present-day Jews have injected up to 6 billion people with a militarized bio weapon. These Jews will stop at nothing and yet, the Christian World rallies around the Jew. The synagogue of Satan is worshiped by the dummy Western judeo Christians in their organized churches.

Yes, and in Matt 21 He throw out the money changers, think bankers! These imposters have been doing their fathers will since the beginning!

Watched your linked video of the cancer doctor (Dr. Kathleen Ruddy) attributing cancer recovery to ivermectin in two individuals. You know the medical nazis are in charge when ivermectin treatment has caused doctors everywhere to lose their credentials. (I worked with one of them in my state. State board came after her for misinformation and pulled her license to practice.) The two doctors that Dr. Ruddy sites in the video for their groundbreaking research on ivermectin recently lost important medical credentials for “spreading misinformation.” https://www.unmc.edu/healthsecurity/transmission/2024/08/14/doctors-accused-of-spreading-misinformation-lose-certifications/

I don’t know if my previous comment this morning went through to your blog(or stuck in a moderation file (?) about this video by Dr. Ruddy you posted. Essentially I mentioned that the medical nazis have been busy taking away the credentials of doctors everywhere who have anything to do with ivermectin, including the two that Dr. Ruddy mentioned, who authored groundbreaking research on ivermectin. A doctor I worked with in my state had her licensed pulled for prescribing ivermectin. Ivermectin is obviously too effective for the SOS.

https://www.unmc.edu/healthsecurity/transmission/2024/08/14/doctors-accused-of-spreading-misinformation-lose-certifications/

You are correct, I didn’t see it. I posted it. I have to manually approve all links as I get tons of spam. Tons of porn spam.

I would like to pass this along, it is a neurosurgeon giving an explanation for quitting and leaving the medical complex. It could just as easily be an explanation by anyone who left their wage slavery. He is likely not Christian, but the essence of his message might be relevant to anyone who is stuck.

https://youtu.be/25LUF8GmbFU?feature=shared

The disappointing net export data this past week contributed to a -0.43% drop in GDP growth. Nevertheless, overall GDP growth looks great as PCE data shined and the people are spending above expectations. Although the people will be sleeping in vans and tents and getting sicker, there will be no recessions coming anytime soon…

Atlanta Fed GDP latest estimate: 2.5 percent — August 30, 2024

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2024 is 2.5 percent on August 30, up from 2.0 percent on August 26. After recent releases from the US Census Bureau and the US Bureau of Economic Analysis, the nowcasts of third-quarter real personal consumption expenditures growth and third-quarter real gross private domestic investment growth increased from 3.0 percent and -2.4 percent, respectively, to 3.8 percent and -0.1 percent, while the nowcast of the contribution of the change in real net exports to third-quarter real GDP growth decreased from 0.04 percentage points to -0.39 percentage points.

The next GDPNow update is Tuesday, September 3. Please see the “Release Dates” tab below for a list of upcoming releases.

DG shares crash in pre-market as the firm blames cost restrained customers. Eventually, there will only be two general retail players left; WMT and AMZN, with specialized retailers HD, LOW, and COST holding up.

The small and/or specialty retail businesses will go the way of the dodo bird in this new world order. I see Amazon taking over most of the retail business. Walgreens and CVS are losing out to Amazon. We will have to be dependent on the likes of Amazon or Walmart.

They will kowtow to government rules. If you don’t get your required vaccines then you can’t purchase on Amazon, Walmart, etc. There will be the same problem if you have a social blemish. Social credit is on the way here in the USA.

And don’t forget the Biden regime wants accelerated digital i.d. on both the state and federal level. This also will be required to purchase and receive government services. Think social security, etc. As someone once said, gird your loins!

And we wonder why US fiscal deficits continue to accrue in ever larger numbers and domestic housing prices and the cost of living keep spiraling higher.

To wit, the Democrats in control of foreign policy have given Ukraine $175 billion so far in military and domestic spending funds. Of course, you and I have been paying for this and those without the assets are getting punched in the face….

This proxy war will continue until the blood spills in the states later in the decade. It’s all part of the plan to antagonize Russia and China (Gog, Magog, and the rest of the Japheth remnants).

This is from an email I received from Seeking Alpha this morning..

Debt Relief

It’s one of the speediest and largest sovereign debt restructurings in recent times. As Ukraine launches the next counter-offensive against Russia, the country has worked out a new deal that will result in relief for its more than $20B in international bonds. “This is an important step on Ukraine’s path to restoring long-term economic stability and will enable our swifter re-entry to international markets once the security situation improves,” according to Finance Minister Serhiy Marchenko.

Backdrop: The last time Ukraine restructured its sovereign debt was in 2015, which came shortly after Russia’s annexation of Crimea. Following a full-scale invasion in early 2022, bondholders granted a two-year suspension on payments, but it has not been enough as the attacks continue on cities and infrastructure. Expenses have not only ballooned for financing Ukrainian defense, triggering broader discussions in recent months about a potential haircut and other support mechanisms.

This time around, bondholders agreed to accept nominal losses of 37% on their holdings, relinquishing $8.7B of claims. The agreement also lowers interest rates and postpones due dates for bonds, which Ukraine forecasts will save its economy $11.4B over the next three years. Elsewhere, the IMF is scheduled to meet Ukrainian officials next week to decide on loan disbursements tied to its budget outlook, while GDP warrants with other debt holders are likely to be renegotiated.

Outlook: Ukraine has raised a total of $90B to fund its war effort since 2022, but is looking for more financial help as it faces a budget deficit of $43B in 2024 and $35B in 2025. The U.S. has been one of the nation’s biggest contributors over the past two years, allocating $175B in support for the country. Of the total amount approved by Congress, $117.4B has gone towards military, security and weapons assistance, with the remaining $57.4B earmarked for budgetary funding, economic assistance, and humanitarian aid.

Atlanta Fed GDP latest estimate: 2.0 percent — August 26, 2024

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2024 is 2.0 percent on August 26, unchanged from August 16 after rounding. After recent releases from the US Census Bureau and the National Association of Realtors, the nowcast of the contribution of the change in real net exports to third-quarter real GDP growth decreased from -0.28 percentage points to -0.30 percentage points.

The next GDPNow update is Friday, August 30. Please see the “Release Dates” tab below for a list of upcoming releases.

The goods trade deficit came in about $4 billion higher than expectations. The revised first quarter GDP came in 0.2% higher at 3.0% versus the 2.8% first read.

Given the huge miss on the trade number, I suspect that the Atlanta fed GDP will be revised down 0.1 or 0.2% with tomorrow’s revised estimate.

Debt to the Penny latest number

$35,289,492,003,154.99

Up over $64 billion in one day….

Zero Hedge, the quintessential pro-Soviet propaganda rag, this morning is putting out another Cassandra call on Warren buffett’s stock sales and the article is emphasizing the Buffett indicator, which is just the stock market capitalization as a ratio of the nation’s GDP.

Buffett has raised a lot of cash from his sales in Apple, but his sales prices in aggregate are about $50 below from where the stock is currently trading. Talk about pulling the trigger too soon….

When we talk about the stock market capitalization as a ratio of the country’s GDP and its historical context, we are almost comparing apples to oranges now. The largest publicly traded corporations now comprise so much of a larger percentage of the economy than in the past. Moreover these large corporations are now spread to the four corners of the globe and generate so much more Revenue with respect to the economy than in the past.

We know where the Harris regime will be directing spending. Gird your loins and prepare accordingly.

Zero Hedge just put out another Cassandra article this morning regarding commercial real estate (CRE). It’s warning us that we’re only in the second inning of a catastrophe.

Here’s the deal with these garbage articles. Since the Federal Reserve instituted QE in 2009, it’s been able to not only make up for the loss of organic demand in treasuries and mortgages, but it’s been able to effectively guarantee every debt market out there.

Look what the Federal Reserve has instituted in the wake of the large interest rate Spike. It has stated in no ambiguous terms that it will guarantee any unrealized Capital losses on bond portfolios in the banks. The banks no longer need to worry about marking to market and taking losses. Their cost basis will now override. This is also true of MBSs and CRE debt securities. The Federal Reserve has made it clear that it stands to support these debt markets and the banks and dealers that hold them.

QE has many facets to it and the Federal Reserve stands ready to support all the markets. It can, because the Federal government can generate any amount of debt it wishes to generate.

So if an office tower in Baltimore sells for $4 million, who cares? The Federal Reserve will support all the markets and this is the way it now is in a command economy.

Most of those on The Trump Train will hate those of us Remnant who would not and refuse to vote for this Evil Ilk. They will blame us when Harris becomes Inaugurated.

B3 prepared to be shut out

As brainwashed and mind controlled as the libtards are, and I know this first hand with the retardedness of my liberal friends in Northern Virginia, the Trump train supporters are just as mind controlled and stuck in the false dichotomy. Up until recently, many of these people should have known better. They took their injections and lost a big chunk of their free will.

Have you tried to tour a MLS listed property recently apparently I’m being told I need to sign a contract just to tour a house – seems like some crazy BS based on that NAR settlement. Digging through the FAQ now https://www.nar.realtor/the-facts/nar-settlement-faqs

Jeremiah, I have heard and read about that clause, that you as a buyer need to sign a contract with a buyer’s agent before you can tour a house. That has given me pause, as there is a property I want to look at right now. I have better experiences looking for and buying a property without a buyer’s agent, but now that is not an option I guess. Also, on the flip side, I just listed a property and there was variation on what different realtors wanted me to do on setting a commission rate up front that the potential buyer’s agent would get, as the commission structure for the seller agent and the buyer agent has been decoupled. The realtor I chose has a set rate for herself at 3% and a range for the potential buyer, which presumably is worked out later when the potential buyer comes along. The whole thing seems way more complicated and confusing now than when it was a a strait 6% to the seller agent, and the buyer agent commission was allowed to be advertised. I wonder if Stone or anyone else can share some different experiences they may have had in this area….but the law just came into effect on 8/17/24.

Yeah I was definitely thinking this seems like a demand suppression scheme more than anything else. If you read through the FAQ you will find that if the listing agent/broker or one with only the sellers interest at hand can still tour a property without any front end contract with a buyer but it seems to me that around here they do not want to bother with that I guess they have enough business. Certainly will be interesting to see how these changes play out over time. Right now I am going to see a property and using an agent that was the listing agent from the last property I purchased and she basically caved to accept the 2.5% the seller was offering to a buyers agent and I would be on the hook for a $495 broker fee. I suppose I could either self represent or retain an attorney to manage however if I price in my time it seems like the $495 is still the cheapest option for me. It will be interesting what paperwork she brings tomorrow looking for me to sign when I go look at this prospective property.

also, I had the option as a seller (now that the commission structure is decoupled) of not paying the buyer’s commission, but I didn’t think that was a good idea, given that it is less of a seller’s market and given that people have been used to the seller paying the commission, and I thought that not paying commission toward the seller would be a deterrent to the buyer. It will be interesting to see how all this plays out in the market over time.

It’s antitrust and monopolistic for a listing agent to demand a buyer have a buyer agent. You as a customer have every right to engage in a listed sale without a buyer agent. Moreover, you have every right to demand a rebate on your side since you are representing yourself as a customer. I do and offer at least 2.5% less on the offer with the understanding that the listing agent is forbidden to take both sides of the commission, unless there is dual agency.

I would negotiate down to no more than 5% for both sides (2.5% + 2.5%). If your proposed listing agent refuses then get another one.

Stone and Jeremiah, thought you would be interested in this article. BTW, I thought I was doing well going from a realtor who wanted 4% for her side to sell my property, to finding one who wanted 3% to sell. 🙂

Here’s the link to the article from the Wall Street Journal about this new law. https://www.wsj.com/real-estate/real-estate-commission-changes-homebuying-cf5d2448

I cut and pasted most of it below. However, here are some excerpts that seem contradictory. In one or more areas it says things like this: “The new rules require buyers to sign agreements with agents before touring homes. That agreement can be limited to just one home.” In another area it says, “Like home sellers, home buyers can choose to skip the agent and go at it alone, or use an attorney instead.” It also states (contradicting your comment, Stone), “Traditionally when a buyer didn’t have an agent, the seller’s representative often kept the commission offered to a buyer’s agent”…..I just see a confusing mess brought about by this new law and I wonder if a lot of people (both buyers and sellers) are going to get taken advantage of, because I think pretty much the same about this industry as you do, Stone.

WSJ 8/14/24 New Real-Estate Commissions Rules Are Here: What Home Buyers and Sellers Need to Know

The biggest changes in decades to the way real-estate agents get paid are being rolled out around the country. The National Association of Realtors, or NAR, reached a landmark legal settlement earlier this year over commissions, and by Aug. 17 most of its roughly 1.5 million members will be subject to the new rules.

Here is what home buyers and sellers need to know.

How does the system work right now and how is it changing?

For the past 30 years or so, the seller has typically paid the agents on both sides of a transaction and decided how much both agents get paid. Usually, sellers agree to pay their agents a certain amount—often 5% or 6% of the sale price—and the seller’s agent splits that amount with the buyer’s agent. When a home is listed for sale, the listing says how much the buyer’s agent can expect to be paid.

What Changes to Real-Estate Commissions Mean for Buyers and Sellers

Two main changes are happening now. First, listings in local databases called multiple-listing services will no longer show whether a seller is offering to pay a buyer’s agent, or how much. Second, buyers will be required to sign agreements specifying how much their agents will be paid. Buyers will do this before they start touring homes with agents.

This means that buyers should negotiate directly with their agents, instead of letting the seller decide how much the buyer’s representative earns.

These changes are happening across most of the U.S. but not everywhere. Here is a list of multiple-listing services that are adopting the rule changes.

Is this going to bring home prices down?

The rule changes don’t automatically mean that real-estate agents’ commissions will go down. That will be up to buyers and what fees they negotiate with their agents.

If commissions do fall, buyers could benefit by paying lower home prices or sellers could benefit by keeping more profit, depending on how competitive and fast-moving the market is.

Am I eligible to receive money as part of this settlement?

If you sold a home in the U.S. in the past decade or so, you might be one of some 50 million sellers who are eligible for a modest payout. Check out this page for details on who is eligible.

I’m planning to buy a home soon. Do I need to use a real-estate agent?

Nope. Like home sellers, home buyers can choose to skip the agent and go at it alone, or use an attorney instead. Almost 90% of buyers used an agent in the year ended in June 2023, according to NAR. It depends on how much time you want to spend overseeing the home search and your confidence as a negotiator.

If I do want to use an agent, how much will that cost?

You and your agent will agree on compensation upfront. Buyers’ agents today are usually paid a percentage of the sale price, often 2.5% or 3%.

Stephen Brobeck, a senior fellow at the Consumer Federation of America, suggests as a rule of thumb that buyers agree to pay no more than 2%. You can also look for an agent who offers a flat price, an hourly rate or specific fees for a menu of services.

You can sign a nonexclusive agreement, so you can work with other agents, too.

What if I want to just tour a home or go to an open house without committing to an agent?

The new rules require buyers to sign agreements with agents before touring homes. That agreement can be limited to just one home. But if you aren’t ready for that commitment, you can go to an open house without an agent. Open houses are hosted by the seller’s agent.

You can also ask sellers’ agents to give you tours. In that case, the seller’s agent isn’t working for you, unless you both agree otherwise.

Do I have to pay my agent myself?

No. As a buyer, you will be responsible for coming to an agreement with your agent about how much the agent will get paid. But you can always ask the seller to cover that cost so you don’t have to.

If the seller says no, you can sweeten your offer by raising the price. You can also walk away.

What if the seller is offering a different amount than what I have agreed to with my agent?

You have a few options to consider. Let’s say you have agreed to pay your agent $10,000, but then you find a home to buy and the seller has offered to pay a buyer’s agent $20,000. In that case, it is up to the seller what to do with the extra money. You can ask the seller to give that extra money back to you, either by lowering the purchase price or by giving you a concession.

With Real Estate Commission Rules Changing, Should I Wait to Buy a House?

Today’s 15- and 30-year mortgage rates are holding steady at lowest level in over a year

Now let’s say you have agreed to pay your agent $10,000, but the seller is offering $5,000. You can still ask the seller to pay the full $10,000 when you make a bid to buy the home. You could also go back to your agent and try to renegotiate the fee.

I’m planning to sell my home soon. Should I offer to pay the buyer’s agent?

Sellers now have more flexibility to decide whether to offer a commission to a buyer’s agent. It is unethical for your agent to tell you that you must pay a commission or that if you don’t, agents won’t bring buyers to see your home.

Here are a few options:

You can tell buyers’ agents upfront what you are planning to pay them. You can do this by offering to pay the buyer’s agent directly or by agreeing to pay both commissions to your agent to split with the buyer’s agent.

You can offer a concession that buyers can use to compensate their agents or for other expenses, such as repairs and closing costs.

You can offer nothing upfront. When buyers submit offers, they might ask you to compensate their agents.

What happens if a buyer’s agent already agreed to get paid less?

Your contract with your agent should specify whether you want to hold on to any surplus, or have it go to the buyer or to your agent.

What happens if the buyer for my home doesn’t have an agent?

Traditionally when a buyer didn’t have an agent, the seller’s representative often kept the commission offered to a buyer’s agent. But you should negotiate upfront with your agent what would happen in this scenario. Your agent might want additional compensation because it could be more work to close the deal. You should also discuss whether your agent can agree to represent both sides, though that isn’t allowed in some states.

What do I do if I think my agent is breaking the rules?

If you think your agent is breaking any of the rules we have explained above, you have a few options. You can find another agent. You can report the agent to your state’s real-estate commission, to a local Realtor association or to a multiple-listing service, which sets the rules for home listings.

You can also speak to plaintiff attorneys involved in the settlements or consumer advocates.

I haven’t bought a property since June. Just represent yourself. Buyer agents suck. The whole real estate broker industry sucks! The contracts are designed to shield them from any liabilities and allows them to be the scumbags they truly are.

Certainly agree but the problem I’m having is that the listing agent and broker wouldn’t return my calls to see the specific property I’m interested in and to get anyone else to turn a key they want to be identified as buyers agent and have you agree to terms in order to tour.

Each broker seems to be interpreting these new regulations as they see fit. Once again, this proves that RE brokers suck and are turf protecting scumbags. The entire industry is built by charlatans. Every contract they craft is designed to protect their interests before the client’s.

Go and knock on the door in the evening. Tell the inhabitants (I am assuming that they are the owners) that you are interested in buying but that their agent will not return calls. For bonus points, try to convince them to fire their agent and tell them that they will automatically save that cost. Yes real estate agents are scum. Their job is mainly to unlock the door. They do not do much else either in Canada or it seems in the USA.

This was the house in question https://www.redfin.com/PA/Harrisburg/5925-Longview-Rd-17112/home/122775630 wasn’t occupied being sold via POA. Had 15 offers so I guess in these circumstances they can do whatever they want. Deed had an interesting restriction included: The t r a c t of land herein conveyed shall not be sold to, leased to or occupied by, any persons other than those of the Caucasian race.

That’s an ambitious project to fix up that house. The entire thing needs to be updated. Anyway, how did you hear about the deed restriction?

By the way, it now says there’s a pending offer.

Yeah and they didn’t even show everything in the pictures. Both bathrooms needed redone had carpet and one bedroom even had carpet on the walls. I received a copy of that deed as I put an unsuccessful offer in on the house. But even with all the updating needed I think it would have been a solid rental with the comps as the location was good and there was room to unlock equity for sure and I think it had nice character and floor plan was adaptable with a mostly unfinished walk out basement the potential for more rooms was also there.

Ultimately someone else always has more money and resources out there. I really want to figure out how to find houses without the MLS and agents though.

Housing prices data a mixed bag.

FHFA House Price Index (YoY) (Jun)

Act: 5.1% Cons: Prev: 5.9%

FHFA House Price Index (MoM) (Jun)

Act: -0.1% Cons: 0.1% Prev: 0.0%

FHFA House Price Index (Jun)

Act: 424.5 Cons: Prev: 424.8

S&P/CS HPI Composite – 20 s.a. (MoM) (Jun)

Act: 0.4% Cons: 0.3% Prev: 0.4%

S&P/CS HPI Composite – 20 n.s.a. (MoM) (Jun)

Act: 0.6% Cons: Prev: 1.0%

S&P/CS HPI Composite – 20 n.s.a. (YoY) (Jun)

Act: 6.5% Cons: 6.2% Prev: 6.9%

This last weekend my friend and I went to a drag race meet in Eureka. The difference this time is my buddy’s wife booked an Air B&B rather than a stinky hotel in “tweakerville.”

Since being tuned into this blog that beats us over the head about income generating assets, I had to wonder if owning this shack darn close to being ocean front property is a good investment. I didn’t ask what the rates were but I bet it wasn’t $100 / night. Here is the link to the property that says it last sold for $159K in 2018. I bet the owner knew this would be a good investment when he bought it and had every intention to rent it out. https://www.realtor.com/realestateandhomes-detail/1473-Buhne-Dr_Eureka_CA_95503_M15135-67369

Clearly prices are not what they were in 2018. And this place does not look like it does in the photo. It’s purple now, doesn’t stink and far better than a cheap hotel / whore house ran by East Indians. But it’s no Pitti Palace either. I can’t help wonder if getting in on this Air B&B thing is a good idea, even pooling some cash with a couple of trusted friends.

The real estate trends going back a few years suggest the more odd the place, the more attractive it was to investors as a unique rental. For 13 years I rented a building for my classic car hobby / machine shop at a former NIKE missile base. Not that I can afford to buy the 26 acre property, but imagine the potential to Air B&B a NIKE base situated in a gorgeous hillside setting? Thoughts?

For the price the buyer paid and even for the Realtor estimate currently, I am certain this ABNB owner is cleaning up.

However, owning and running an ABNB is not the same as running a long term rental. Running a short term rental is like owning a hospitality business. I could convert some of my properties to ABNBs, but I do not want to do that work. This stuff takes work.

Regardless, where this property is located makes it a wonderful ABNB choice property.

Thanks for your thoughts. On one hand the ABNB can make sense assuming there are protections that favor the property owner. I never looked into it. And those that stay in ABNBs are generally people with some discretionary income. I agree that it’s work basically running a hotel, or you pay a local to look after it, which eats at the bottom line. In the long term rental business it seems the protections favor the tenant from the greedy slumlord property owner, especially in my neck of the woods.

Whatever the case may be, I assume that Airbnb owner is making money, despite communist government. My one observation over the past 20 to 25 years is that the more communist a local jurisdiction may happen to be, the higher their rents will be. It’s six or a half dozen and it’s all a wash. I wouldn’t complain too much about it, I take lemons and make lemonade.

It makes sense that local governments with tighter regulations against landlords effectively increase rents. Communist oriented local governments that impose strict regulations on landlords discourage landlords from renting out therefore reducing supply. Reduced supply drives up rents. When they subsidize tenants that increases demand and raises rents.

Rent control really kills supply and promotes slums as less landlords will rent out at below market regulated rates. Those landlords that do rent out will not care to spend money to keep the properties up. Also tenants will end up paying higher rents under the table to get a place that they really need.

Those landlords that can negotiate the regulations in those localities can possibly really make out with higher rents. However who wants to rent out to tenants that most likely hate you and want to stick it to you.

For Jeremiah who was wondering how to find properties without a realtor:

A friend uses this technique. He door knocks. He ( and the banksters) own about 8 properties in a certain neighbourhood in Victoria BC. He lives locally so he really knows the area well. The city loves him since when he buys a property to subdivide and create more rental units, he makes sure to keep any older heritage exterior intact. If he is in the market for a new property, he goes out and door knocks. He introduces himself and asks if they are considering selling. If so, he can easily access assessed value online, he knows his local market as well or better than any realtor, and he offers them a fair price. Then he subdivides, renovates and rents. He is only still working now and then and mainly to keep his crew of renovators employed.

Alternatively, post in various media, Facebook,print etc that you are looking to buy SFR without any realtors adding to the price with their commission – or however you wish to word it. You may get some hits that way as well. I don’t know your circumstance and if you are looking to buy locally to your domicile or if you are looking across the US. By the way, that listing seems really cheap. I know PA is part of the so called rust belt, but that seems really low. Mind you, I am comparing that to coastal BC where I live and where a 20-25 year influx of Chinese money looking to move their capital out of Communist China has so distorted our housing market that someone starting out cannot afford to buy.

You are right. Despite the cost to rehab (though it could probably be used as a rental with as little as 20k plus lots of sweat equity), it is a great deal. This was a low-ball listing and probably part of an estate. The listing agent made it look very attractive to get it sold. I am sure it sold for as-is cash well above list.

There was a 2004 townhouse with an unfinished basement in Strasburg VA that was listed for 250k a couple months back. It had great potential as a rental. It sold three weeks later for 275k cash. Comps are about 300k. I knew it was cheap and told a fellow investor about it. He was screwing around with a heloc and I knew he wouldn’t get it.

House prices in the states still have a basis in reality. There are isolated areas in Canada like Edmonton and Calgary that come close, but the US still has tremendous opportunities for long term buy and hold landlords. The cash flow is there.

Thanks for sharing your techniques. They are something that would set Jeremiah above other investors. I get 6-7 pieces of investor junk mail pieces a week and that’s very expensive and a waste of resources, but it’s less work.

When Harris gets elected , and that is the most likely outcome, the money printing presses will be cranked up and deficit spending will shoot to the moon. Be prepared for a communist regime similar to the Soviet Union. Seems like that is what Americans want today. She will sucker the swing voters to vote for her with her sweet talk of patriotism and compassion and freedom.

Now it sounds like djt is him hawing about the scheduled debate. Will he back out? That’s what controlled opposition does

What is your opinion on owning silver coins? You have mentioned gold in the past and right now silver is very under valued. I heard that Samsung has developed a silver based battery which could replace lithium. With the E.V. push accelerating, would you consider silver a hard asset worth owning?

It’s not that I don’t like silver, but gold is truly a monetary metal and as such, I prefer gold over any other metal.

Silver’s use is approximately 80 to 90% industrial off take and is more prone to economic cycles.

My One true contention with owning silver in small denominated coins (i.e. 1 oz or less) is that the markups and bid ask spreads can be substantial. While silver eagles are quite beautiful to look at, if I were to purchase silver in bulk as an investment, I would buy 10 or 100 oz bars and make certain that they are genuine.

It’s okay to own small denominated silver coins for some trade, but fewer and fewer people every year recognize the value of silver. The physical gold and silver markets have changed a lot in the past 20 to 25 years that I’ve been following it. The problem is that less and less people wish to deal with cash, let alone gold and silver coins.

Of course, these are just my opinions and are the reasons why I don’t generally recommend owning them for trade. My favorite form of precious metal investment is the US Gold eagle for American citizens. A 1 oz Gold eagle is easily recognizable and much more difficult to counterfeit. At least that used to be the case.

Thanks for your reply! I agree that the general public would not have a clue about precious metals, or their value. They will be so used to using their phones, and eventually biometrics that coins will seem useless.I suspect only preppers, etc. would see the value for trade and barter.