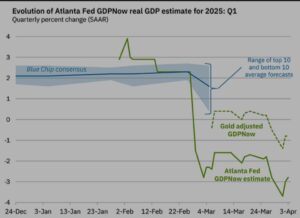

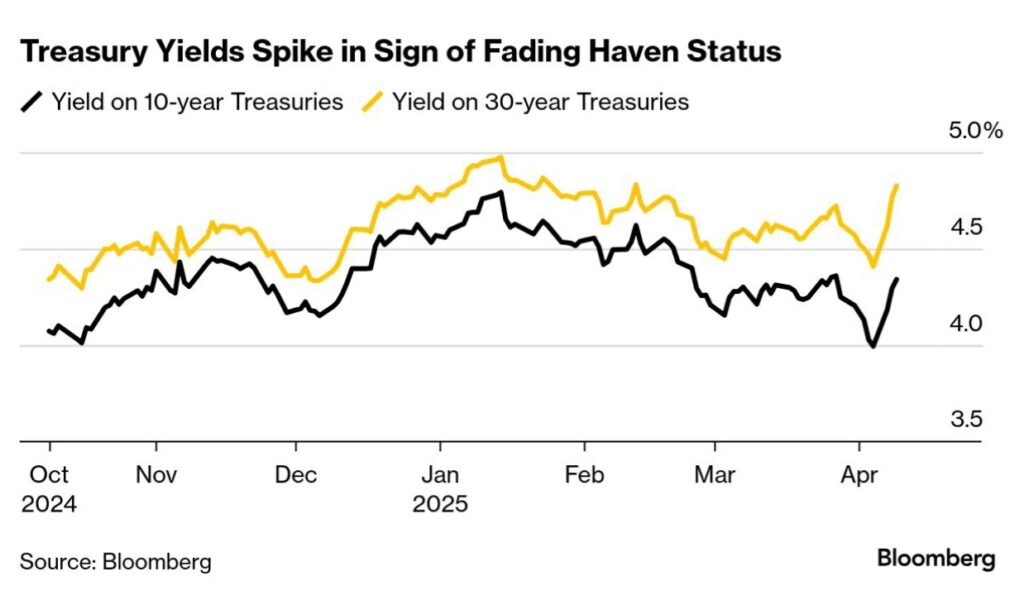

The role of Treasury securities as the usual safe-haven asset isn’t working this time. Why? Perhaps, there is more to this trade war than meets the eye.

Perhaps there’s more to it than just an overleveraged basis point trade that’s gone wrong. Although the Treasury is set to resume issuing Treasuries again, I don’t see this being an overriding catalyst either.

•Could foreigners be selling to make a point?

•If international trade is severely impacted, why should other nations even bother holding treasuries anymore?

•Could this truly begin to mark the end of the dollar’s role as the global currency?

•Is the entire Bretton Woods, post-1971, fiat currency system going down in flames?

I am also concerned that the Federal Reserve may decide to take an intentionally passive role this time around in the guise of fighting inflation. This certainly would mark a drastic change to its typical proactive and micromanaging stance, since the implementation of Quantitative Easing in late 2008.

I also sense that the Federal Reserve has become highly politicized and partisan towards liberal globalist policies. In other words, any government programs that buck the trend of the past 50 years will receive a cold shoulder by the FED bankers. While the Fed was extremely accommodative to anything the Biden regime offered, it has certainly turned its back on the current regime with its laissez-faire attitude.

This is why I am warning my readers to be prepared for Federal Reserve inaction until there are truly large cracks in the asset markets. Regardless, the singularly focused Federal Reserve must begin purchasing Treasury securities in large quantities again, regardless of the inflationary ramifications. There is no other alternative, other than to let the global asset markets crash and burn.

I suspect this is the outcome that the Trump regime wanted all along.

From Bloomberg this morning;

An unnerving development is starting to unfold as Donald Trump’s trade war hammers financial markets: US Treasuries, far from offering shelter from the turmoil, are suddenly losing their haven appeal.

The plunge in bond prices brings back memories of the onset of the pandemic, says James Athey of Marlborough Investment Management, when widespread deleveraging sparked blowups of a popular hedge fund strategy known as the basis trade.

While there’s little concrete evidence of dealers cutting off financing or hedge funds getting caught wrong-footed thus far, Athey said he can’t shake the feeling that recent moves are just a taste of the hidden risk lurking beneath the market’s surface.

“It looked like in March 2020 when we got these wild moves, possibly relating to the basis trade,” he said. “Last week we had not seen any signs of hedge funds getting stopped out of the bond futures basis, but suddenly you’re seeing yields spike.”

“It looked like in March 2020 when we got these wild moves, possibly relating to the basis trade,” he said. “Last week we had not seen any signs of hedge funds getting stopped out of the bond futures basis, but suddenly you’re seeing yields spike.”

The basis trade is a strategy hedge funds use to wager on the minuscule gaps between prices of cash Treasuries and futures. They typically borrow to multiply their bets, up to 50 or 100 times the capital invested. Recent estimates put the amount of existing wagers at about $1 trillion, roughly double what is was five years ago.

Problems can arise when market turmoil upends the economics of the trade and forces investors to rapidly unwind their positions to repay their loans. It can create a cascading effect that causes yields to surge, or even worse, the Treasury market to seize up, much like what occurred in 2020.

There are plenty of other reasons bonds might be selling off: The trade war will trigger stagflation that may prevent interest-rate cuts from the Federal Reserve. Foreign investors may be ditching US debt. Maybe fund managers are flocking to cash-like shorter-dated securities as risk assets swoon. And finally, portfolio managers may be selling to make room for a flood of new Treasury securities this week.

Excellent numbers and the Fed should take note….

Core PPI (MoM) (Mar)

Act: -0.1% Cons: 0.3% Prev: 0.1%

Core PPI (YoY) (Mar)

Act: 3.3% Cons: 3.6% Prev: 3.5%

PPI (MoM) (Mar)

Act: -0.4% Cons: 0.2% Prev: 0.1%

PPI (YoY) (Mar)

Act: 2.7% Cons: 3.3% Prev: 3.2%

PPI ex. Food/Energy/Transport (MoM) (Mar)

Act: 0.1% Cons: Prev: 0.4%

PPI ex. Food/Energy/Transport (YoY) (Mar)

Act: 3.4% Cons: Prev: 3.5%

I now get at least 80 to 90 spam comments a day. The people who post and try to spam my board with a dozen simultaneous spam messages at a time don’t realize that any comment that contains a link must be manually approved.

80% of these are from Chinese, Southeast Asia, and the Russian federation servers.

It looks like those who own rental real estate and gold will be the last ones standing.

Especially gold. I own my rentals for yield. I earn enough from my rentals to survive. It’s during these times that I would much rather own gold over anything else, including bitcoin.

For those waiting over a decade for the gold silver ratio to narrow, I present the current ratio of 103. That is an historic high.

For those waiting for the gold Platinum ratio to fall, I present the current all-time high ratio of 3.45.

Up until Quantitative Easing was announced in 2008, Platinum traditionally traded at a large premium to gold.

The rush to gold continues, the other precious metals be damned.

Yeah and if you have ever actually tried to trade that ratio with any physical pm dealers you will find how useless it truly is too in a practical sense.

Trump Threats Send Migrants Scrambling to Get Cash Out of the US

https://www.msn.com/en-us/weather/topstories/trump-threats-send-migrants-scrambling-to-get-cash-out-of-the-us/ar-AA1CGMhr

The USDX is currently at longer term support at 100.00. Bond yields rising and the.dollar falling. Gold futures trading once again at new ATHs overnight.

The post 1971 arrangement is ending.

This will result in WWIII, Jacob’s trouble, the Great tribulation, the end.

The race specific bioweapon injections are really helping out the adversary.

USDX is below 100. Currently @ 99.75.

Foreigners losing spending power. CCP China and PBIC are stimulating, while the Fed stands around. This will have to change. Something is broken in the Treasury markets and foreigners are dumping USTs.

Fed will have to get involved post haste.

You are right. Something is broken. Usually the Fed does get involved at this point in the markets. However, this time they probably will stand down and let the system break apart. This is all part of the plan. Gold is sky rocketing because investors are losing confidence in the USA. I think Powell hates Trump.

In all fairness to the Fed here, the FED governors are probably looking around and wondering if Trump may reverse his stances. They are probably trying to see if circumstances will reverse on themselves.

Honestly, if I were a Fed decision maker, I would probably be looking to see if the CCP and Trump regime figure something out. The FED may be waiting until something provides a more definitive reason to act.

In other words, I doubt that the FED has any malice aforethought. Rather, circumstances have devolved so quickly that FED decision makers are trying to digest the rapid change in events.

We are looking at the abomination of desolation.

The Venus Synodic cycle was completed March 29th. Jeremiah cursed those who worshiped the Queen of heaven in chapter 44, He mentions the queen of heaven 5 times which suggests he knew of the synodic cycle – part of the conspiracy he, Isaiah and Amos were aware of.

The children of disobedience are all complicit.

We should have meaningful discussion about the Mark, the time is running short.

Venus and Libertas. The pagan goddess! They go by many names but it’s all the same.

Ken, what are your thoughts on the Mark? A conversation like this would be good!

My understanding is that the mark is for all. If China and others are isolated, it gets difficult to coordinate and enforce – depending on what it actually is. If war comes in the form discussed on this blog (I am not disputing that), I had understood the mark would come prior. What would be the point after if everything is destroyed?

I recall all of us being refered to as a bunch of dolts for not understanding that AI would manage the mark, but no definition as to who was actually in authority.

Maybe it is simply premature to discuss such a thing, but I had thought the mark to be a turning point.

Like the injections, the mark is for everyone. Every nation. The technology is already here. It may just be a simple transponder and unique identifier that is set up to the entire financial grid.

It may not be the mark itself that does the damage as described in revelation, but it may be what the user has to do in order to get the mark that damns the soul. I suspect that the recipient will have to receive ongoing injections as well as having to renounce all religions and beliefs other than the official narrative.

White Christianity and Caucasians will get the blame for World War 3. It seems apparent that Trump will be the sitting president when the bombs start dropping. The world will blame the US.

Economically speaking, what the Trump regime is attempting here actually makes a lot of sense when it comes to looking out for the United States self-interest. The domestic trade and budget deficits can no longer continue and somebody has to rip off the Band-Aid. Trump has been chosen to do this and as a result, will be instrumental in unraveling the existing Global Order. Unfortunately for the United states, its citizens were the ones whose financial lives were sacrificed in order to build up the rest of the world. Even if it meant building up its own existential enemies like CCP China.

However, the only way these globalists will be able to convince the world to take this Mark and the series of injections and such will be through the use of fear. Without fear, the world will resist. With the proper fear as a catalyst, such as the results of a catastrophic War, the world will eagerly take the mark.

This upcoming war will serve two purposes. First, the outcome of the war will place the blame on the Caucasians. Second, this war will generate the necessary fear. Keep in mind that up to 80% of the world’s population took at least one covid injection. It was all done through fear, fear of getting sick and fear of missing out on life’s affairs.

Imagine the fear that will be generated and manufactured when the bombs start dropping and the people start dying by the tens of millions. Already, 1.5 million people have perished with the battle in Ukraine.

Every Nation already has the technology. And just like with the covid injection campaigns, every nation is already on board. This includes all Western Nations as well as the Oriental, etc. Russia, all of Africa, India, S.A. are all onboard.

Revelation 18 for thy merchants were the great men of the earth; for by thy sorceries were all nations deceived.”

Sorceries is pharmakia, All nations, as Stone indicated are involved and the merchants, and great men are in control. We have discussed many times who these money changers are and who their god is. Pharmekia sorcery, drugs. Why not an injection? The word mark translates to a few words like imprinted mark, carving or a palisade. A palisade is a pole that has a sharp point carved into one end. For poking or causing a prick. Perhaps like a needle! Once the dollar system is dead, the new technocrat system will emerge. Doing business and making purchases, etc will require this mark. What if our bodies can make the financial transaction? No need for a phone or credit card, just our upgraded DNA?

I suspect the blown up “basis point” trade is a cover for something else. I submit that CCP China is dumping all sorts of dollarized assets, especially liquid dollars as well as US Treasuries, as it’s forced to support its own asset markets. Raising money by selling off dollars would be the logical first choice.

Selling dollars would help to support yuan, while providing funds to buy up Chinese stocks and other Chinese assets.

To wit, we are observing Treasury yields rising, in spite of circumstances to the contrary, as well as the USDX continuing to face downward pressure.

Gold is the obvious winner, as it always should be.

The U.S. government posted a $161 billion budget deficit for March, down 32% or $76 billion from a year earlier, a decline due largely to a calendar shift for benefit payments as receipts continued to grow, the Treasury Department said on Thursday.

The Treasury reported that net customs duties in March totaled $8.75 billion, about a $2 billion increase from a year earlier and the highest since September 2022. The increase is partly due to President Donald Trump’s tariff increases since February, a Treasury official said.

But the budget results indicate that Trump’s recent statement that the U.S. was now collecting $2 billion a day from his tariffs is an overstatement.

The Treasury reported a $1.307 trillion budget deficit for the first six months of fiscal 2025, which started Oct. 1, up 23% or $242 billion from a year earlier. It was the second highest deficit for the first six months of a fiscal year, after fiscal 2021’s record $1.706 trillion deficit, a gap that was inflated by COVID-19 induced spending increases and revenue reductions.

Its the convulsions of a dying Empire! All fiat based systems eventually come to and end and that’s what we are watching. 2027 is only a couple years away. We have a front row seat to the greatest show on Earth!

The dollar and bonds are getting pummeled as the post Brenton Woods agreement continues to unwind. Why would foreigners hold the US dollar if its status is in peril? Nobody wins, though China loses more.

Right. It seems, the damage has been done. The fiat dollar system is on its last legs! The change is coming. With a whimper or a bang.

Textbook action in gold. 3200 down to 3000 up to close to 3200 again in the front month futures.

And, stocks get pummeled again!

Quantitative tightening is going to end worldwide. Already, the BOE just stopped selling off their longer dated securities after a blow up in long dated gilts yields….

Bank of England Halts Sale of Long-Dated Debt After Market Ruptures

The Bank of England has temporarily halted the sale of long-dated bonds under its quantitative tightening program.

(Bloomberg) — The Bank of England temporarily halted the sale of long-dated bonds under its quantitative tightening program, bowing to market pressure after a surge in gilt yields ignited by Donald Trump’s tariffs.

The UK central bank said Thursday that it will now sell £750 million ($969 million) worth of short-dated debt on April 14 rather than the originally scheduled auction of £600 million longer maturity gilts in “light of recent market volatility.”

A BOE spokesperson said it had taken the decision as a “precautionary” measure. It plans to sell the long-term debt in the following quarter.

The sudden change to QT may signal a shift in the BOE’s appetite to push ahead with the bond sales in a turbulent global market environment. Analysts warned that it could mark a step toward it pausing the plan to unwind the balance sheet of bonds built up during over a decade of quantitative easing, intended to counteract the fallout from the global financial crisis in the first instance, and subsequently the Covid pandemic.

BOE Deputy Governor Sarah Breeden said in a question and answer session later on Thursday that the move was a “technical” decision and “nothing to with the monetary stance.”

“Given the kinds of volatility that we’ve been talking about and seeing in global markets, my colleagues in the markets area judged that it was wise as a precaution to switch the planned order of our sales,” she said.

Long-dated UK bonds were hammered in the volatility that ripped through markets following the US President’s announcements of reciprocal tariffs on April 2. The 30-year yield soared 60 basis points to 5.66% in a matter of days, the highest since 1998. Longer-term UK debt was particularly badly hit in the market volatility compared with other European government bonds.

The 30-year gilt posted sharp gains on Thursday, after Trump paused many of his tariffs for 90 days. The rise extended slightly after the BOE’s announcement and the yield was around 16 basis points lower on the day at 5.42% at 12.30 p.m. UK time. Still, yields and volatility remain high.

“It shows that the lifespan of QT could be very short if moves are as unhealthy as we have seen in last couple of sessions,” said Pooja Kumra, senior rates strategist at TD Securities. The decision “clearly suggests that we are heading closer to the period when we could see QT freeze, especially for long-end.”

The BOE plans to reduce its stock of gilts by £100 billion in the 12 months from October 2024, including £13 billion of active sales.

The central bank has previously insisted that QT has only a small impact on gilt yields. However, this week’s surge in long-dated debt evoked bad memories of a similar jump in the wake of former Prime Minister Liz Truss’s mini-Budget. Some analysts believe the impact of QT on gilt yields is much higher.

Sanjay Raja, chief UK economist at Deutsche Bank, said the BOE decision is a “clear reaction to the market moves we’ve seen – particularly in the long end of the curve.”

While he played down the prospect of the BOE ending its sales altogether, Raja said “this will certainly be a point of consideration when it looks at the next QT round.”

The 10s and 30s have gotten pummeled since the good news on CPI data this morning. The FED will have to step in and do something. It has been doing absolutely nothing. At least the boe did something, albeit small.

Bring on QE!

There is a deliberate reason why the Fed is sitting on the sidelines through the bond carnage. The Fed is getting orders from the SoS to stand down and let the crash happen so they can usher in a new system.

It sure seems like damned if you do, damned if you don’t at this point! That’s one way to tell it’s over.

I hope the timeline holds out to Q3 2027.

Ecclesiastes 1:18 “For in much wisdom is much grief”

This is a gift to only those that can bear it.

That is very true!

China will be increasingly shut out of most developed world trade over then next several years. Especially with the western hemispheric nations. The harsh light has finally been shown on its parasitic, unethical, and inequitable trade policies.

CCP China is responding exactly as predicted. It is all falling into place now very quickly. There’s no going back and the tableau is being established for global conflict later this decade.

CCP China’s contempt for its trading partners and its true colors are out in full view for the world to see.

This is what happens when people do business with those who worship the dragon.

That’s right. They want to prove to the world that the white man who goes against globalism is evil.

Excellent CPI data this morning. I’m sure the markets will love it. Let’s do QE….

Core CPI (MoM) (Mar)

Act: 0.1% Cons: 0.3% Prev: 0.2%

Core CPI (YoY) (Mar)

Act: 2.8% Cons: 3.0% Prev: 3.1%

Core CPI Index (Mar)

Act: 325.66 Cons: Prev: 325.48

CPI (YoY) (Mar)

Act: 2.4% Cons: 2.5% Prev: 2.8%

CPI (MoM) (Mar)

Act: -0.1% Cons: 0.1% Prev: 0.2%

CPI Index, n.s.a. (Mar)

Act: 319.80 Cons: 320.17 Prev: 319.08

CPI Index, s.a (Mar)

Act: 319.62 Cons: Prev: 319.78

CPI, n.s.a (MoM) (Mar)

Act: 0.22% Cons: Prev: 0.44%

Initial Jobless Claims

Act: 223K Cons: 223K Prev: 219K

Continuing Jobless Claims

Act: 1,850K Cons: 1,880K Prev: 1,893K

Jobless Claims 4-Week Avg.

Act: 223.00K Cons: Prev: 223.00K

Real Earnings (MoM) (Mar)

Act: 0.3% Cons: 0.3% Prev: 0.3%

And bam…another last minute changarooski. 90 pause on tariffs! Some stocks went up 5 bucks within half hour timeframe. There never were any tariffs, this has been all talk and no implementation. If you look what has to happen with all the cargo ships coming in and containers being offloaded it’s not an overnight thing or one week thing, it takes awhile for collections to begin.

125% still on China but we see the pattern now, last minute stand down. There wasn’t a Covid virus, There isn’t a Ukraine/Russian war, we didn’t land on the moon, and there are no tariffs….zero!

I understand the frustration. One minute it looks like the world is crashing down then the next minute everything is hunky dory. The key is not to get wrapped up in the big news of the moment. The truth is that the synagogue is playing us like a fiddle with news hype and then suddenly the tune changes about face. It is like going from easy listening classical music to hard metal industrial rock in a split second and back. Don’t get wrapped up in the current news. It is much easier said than done when one is close to retirement and that retirement plan looks like it is melting away in the stock market fall. Makes one realize their true priorities and rethink them.

Yes. NASA faked the moon landing. We still cannot leave Earth’s orbit.

Stone, that is correct! There is so much deception about our world, its hard to believe!

The full CCP China withdrawal from the Western hemisphere is in full swing….

Hegseth says Panama agreed to allow US warships to travel ‘first and free’ through canal

Defense Secretary Pete Hegseth announced Wednesday that U.S. and Panama officials would sign a “framework” agreement allowing U.S. warships to travel “first and free” through the Panama Canal.

Hegseth said the two countries had already signed a memorandum of understanding on security cooperation and that they would finalize a document guaranteeing U.S. warships and auxiliary vessels priority, toll-free passage through the canal.

When Secretary of State Marco Rubio visited Panama earlier this year, the State Department claimed it had secured a deal for the free passage of U.S. warships. But Panamanian President José Raúl Mulino denied any such agreement had been reached.

“I completely reject that statement,” Mulino said at the time. The Panama Canal Authority also said it had “not made any adjustments” to its fee structure.

US, PANAMA ‘TAKING BACK’ CANAL FROM ‘CHINA’S INFLUENCE,’ SAYS HEGSETH

Earlier Wednesday, Hegseth warned that China’s military presence in the Western Hemisphere is “too large” as he visited Panama to meet with the nation’s officials, visit U.S. troops and tour the canal ports.

READ ON THE FOX NEWS APP

“Make no mistake, Beijing is investing and operating in this region for military advantage and unfair economic gain,” Hegseth said in brief remarks to the press. “China’s military has too large of a presence in the Western Hemisphere. They operate military facilities and ground stations that extend their reach into space. They exploit natural resources and land to fuel China’s global military ambitions. China’s factory fishing fleets are stealing food from our nations and from our people.”

He added that war with China is “not inevitable,” and the U.S. does not seek war in any form. “Together, we must prevent war by robustly and vigorously deterring China’s threats in this hemisphere.”

To strengthen military ties with Panama and reassert influence over the canal, the U.S. will deploy the USNS Comfort, a Navy hospital ship, to the region.

Hegseth vowed Tuesday that the U.S. will “take back” the Panama Canal from Chinese influence, pointing to port operations controlled by Hong Kong-based CK Hutchison.

The secretary later said Wednesday that he and Panamanian officials would be signing an agreement that U.S. warships would travel “first and free” through the Panama Canal.

TRUMP, HEGSETH REVEAL WHOPPING FIGURE THEY WANT FOR THE NEXT PENTAGON BUDGET

Last month the conglomerate agreed to a $19 billion deal to sell a group of 43 ports, including two in Panama, to U.S.-based BlackRock,

Trump hailed the agreement, seen as a solution to his complaints that the canal was owned by China, but now that deal may fall apart.

China has criticized the deal, opening up antitrust probes, and a Panamanian official has accused CK Hutchison of failing to properly renew its contract in 2021 and owing the country $300 million.

After meeting with Mulino, Hegseth said Tuesday the U.S. will not allow China to threaten the canal’s operation.

“To this end, the United States and Panama have done more in recent weeks to strengthen our defense and security cooperation than we have in decades,” he said.

US, PANAMA ‘TAKING BACK’ CANAL FROM ‘CHINA’S INFLUENCE,’ SAYS HEGSETH

Hegseth alluded to the ports owned by CK Hutchison. “China-based companies continue to control critical infrastructure in the canal area,” he said. “That gives China the potential to conduct surveillance activities across Panama. This makes Panama and the United States less secure, less prosperous and less sovereign. And as President Donald Trump has pointed out, that situation is not acceptable.”

The Chinese embassy in Panama hit back: “The U.S. has carried out a sensationalistic campaign about the ‘theoretical Chinese threat’ in an attempt to sabotage Chinese-Panamanian cooperation, which is all just rooted in the United States’ own geopolitical interests.”

The war of words in Panama comes as China and the U.S. are now locked in a trade war, where Trump slapped Chinese goods with a total 104% tariff. China retaliated with 84% tariffs on U.S. goods.

With both Russia and China continuing to be isolated in the world scene, it seems that Gog and Magog are gearing up for war. China is shipping arms all over Central Asia. The CCP Chinese don’t even mind pissing off Russia by stepping on their traditional turf…..

China Expands Arms Sales in Central Asia

By Eurasianet – Apr 09, 2025, 2:00 PM CDT

•China is actively expanding its role as an arms supplier in Central Asia, providing drones and anti-aircraft systems to countries like Kazakhstan and Uzbekistan.

•Russia’s traditional dominance in the Central Asian arms market has decreased due to its military involvement in Ukraine, creating opportunities for other nations, including China, to increase sales.

•Uzbekistan is considering a significant purchase of Chinese-made JF-17 fighter jets, potentially marking a major shift in the region’s military procurement and reinforcing China’s growing influence.

https://oilprice.com/Geopolitics/International/China-Expands-Arms-Sales-in-Central-Asia.html

The polarization continues! All lining up for the final conflict!

Excellent 10-year note auction. Nice high bid to cover ratio.

10-Yr Note Auction

Released On 4/9/2025 1:00:00 PM For 4/9/2025 5:00:00 PM

Auction Results

Total Amount $ 39.000 B

Coupon Rate 4.625%

Bid/Cover 2.67

Yield Awarded 4.435%

CUSIP Number 91282CMM0

Ah yeah. That’s why TLT got spanked.

It’s all about China.

Trump temporarily drops tariffs to 10% for most countries, hits China harder with 125%

Published Wed, Apr 9 20251:55 PM

President Donald Trump announced a 90-day pause on the full effect of his new tariffs for at least some countries.

Trump also said that he was raising the tariffs imposed on imports from China to 125% “effective immediately” due to the “lack of respect that China has shown to the World’s Markets.”

President Donald Trump on Wednesday dropped tariffs under his new trade plan to 10% on imports from most countries, as he announced a 90-day pause for stiffer, so-called reciprocal tariffs that took effect this week.

Trump also said in a social media post that he was raising the tariffs imposed on imports from China to 125% “effective immediately” due to the “lack of respect that China has shown to the World’s Markets.”

Stock market indices rocketed sharply higher on Trump’s announcement. The benchmark S&P 500 index leapt by 7%, which puts it on track for its largest single-day gain in five years.

Trump’s Truth Social post credited his decision to pause the full effect of tariffs on the fact that “more than 75 Countries” have contacted U.S. officials “to negotiate a solution” to trade concerns that he raised in imposing the new duties.

Commerce Secretary Howard Lutnick, in a tweet, said that he and Treasury Secretary Scott Bessent sat with Trump while he wrote out the announcement on Truth Social, “one of the most extraordinary Truth posts of his Presidency.”

“The world is ready to work with President Trump to fix global trade, and China has chosen the opposite direction,” Lutnick wrote.

Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately. At some point, hopefully in the near future, China will realize that the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable.

Conversely, and based on the fact that more than 75 Countries have called Representatives of the United States, including the Departments of Commerce, Treasury, and the USTR, to negotiate a solution to the subjects being discussed relative to Trade, Trade Barriers, Tariffs, Currency Manipulation, and Non Monetary Tariffs, and that these Countries have not, at my strong suggestion, retaliated in any way, shape, or form against the United States, I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately. Thank you for your attention to this matter!

This is breaking news. Please refresh for updates.

I think China and the CCP is where Trump should direct his tariff wrath instead of Canada. However, Canada is heavily influenced by the Chinese.

That’s been his real objective all along. That’s what I’ve been saying. Everything else is a smoke screen for the real objective, getting rid of China.

So far Stone, that is how it looks! You nailed it! We will see what the unintended consequences are!

Gold is awesome! Up $120

The stock market is a total sham. Get out of all stocks.

70% of household net is now in rentals for a reason. I personally don’t have any paper retirement money. I’m a hard asset guy. Rental properties and gold mostly. My wife has her DC money tied up in stocks. She was freaking out, but I told her to sit tight. Lutnick and Bessent make a killing while they help out writing up Trump’s social media texts.

This is interesting indeed! Lets get the world to gang up on China!

Silver also. Not your favorite I know.

Trump has been hired to bring down the Fiat monetary system. At least, that’s the result of his labors.

That is Correct! Now China has 84% tariff for USA.

The dollar system is coming to a close. It won’t be long before the man of sin emerges to save the day!

Once tariffs rise above 40%, all trade is off. Whether it’s 45% or 145%, the results are the same. Chinese manufacturers are estimated to have a profit margin between 30 and 40% after shipping to the United states. Once a tariff rises above 40 to 50%, it doesn’t matter after that.

Headline from E.U.

European Union approves first set of retaliatory tariffs on U.S. imports. April 15.

No trade, no market. Liquidity seizes up like a rusty dry pump.

I hope we can hold out to Q3 2027. Jesus will have to intervene, as promised.

Stone if the fed resumes Q.E. would that not cause hyper inflation? Too much money chasing very few goods. Revelation 6.

Inflation regardless of what happens, but, yes. At least in theory.

Tuesdays are Soylent Green days.

90 day tariff pause! This is a test. It is only a test!

A 90-day pause on non retaliating countries. It’s all about shafting China. hahaha

A weak system eventually comes crashing down. The fiat dollar system has been eroding for a long time. With a US government that served outside interests instead of American interests how can it permanently last?

Gold is looking good this morning. It truly is the one safe Haven asset out there. It seems to be holding up better than US Treasuries.

Looks like a good time to stock up at Wal-Mart!

Costco was selling gold bars too. Time to stock up on gold.