To all those who sold their income generating assets or who proclaimed the collapse of the housing market, I feel bad for you. There’s still a few years left until the end of this age.

•The Prophecy of the popes has come and gone,

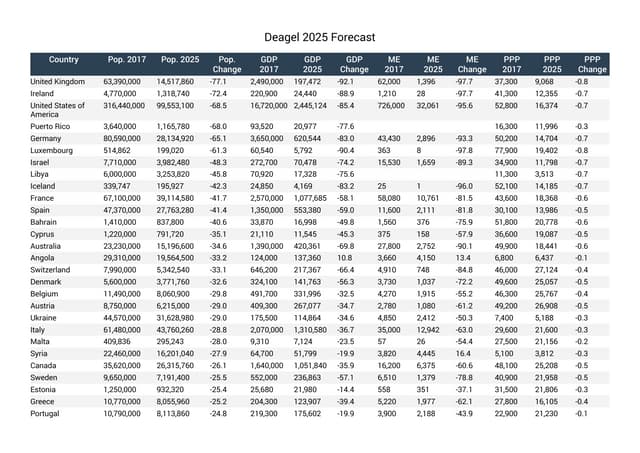

•Deagel.com was a fraud as the US population is up another 30 million people from 2017, and is currently 347 million, according to the US Census Bureau,

•The non-Adamic mongrels have taken over and government spending is still exploding,

•The new pope is a Marxist and he’s a perfect fit for the Communist Universal Church,

•The FED continues to get it wrong. It’s still overly restrictive, and will eventually relent with more dovish policy.

•The stock market still isn’t that far away from its highs,

•Rents that landlords are receiving still keep going up,

•Despite all of the Cassandra calls from the YouTube housing experts, house prices keep rising,

•The streets and highways are more packed than ever before,

•People are spending more money than ever before,

•Professional athletes are making more money than ever before,

•Sickness and disease helps the economy grow,

•The primitive looking black statues are meant to demoralize European Caucasian people, so they spend more money on YOLO endeavors,

•The white race has been bred into oblivion, which leaves a bunch of broke-ass and incontinent debt slaves. As much as 90% of the global population is now completely unable to stop their spending habits. they are essentially NPCs with no discernment.

•The least talented people are in control of the levers of influence, so deficit spending continues to explode. Fiscal deficit spending in any capacity is solely designed to consolidate the global wealth.

•Social spending continues to ramp up despite claims to the contrary,

•Younger folk have done away with most traditional endeavors. They make the perfect automaton spending slaves.

•Despite being on social media, most people are lonely, sad, and isolated. They are self-indulgent and will piss away every dollar they own. The large corporate shareholders benefit greatly.

The asset owners are winning

These sets of circumstances create the perfect setup for the asset owners. My instructions to the few readers I have left hasn’t wavered; own the income generating assets.

Never underestimate the ability of the least talented people to manage the country in a post-industrial AI-managed age. It’s a new reality in which the public blames others while they get fleeced.

The vast majority of the population are completely out of touch with reality and rely on experts for even the most basic necessities. Most people are hopelessly dependent on the government, their favorite politician, their Judeo-Christian tax deductible organization, the medical establishment, social media, etc. Don’t be like them.

While the world continues to crash and burn, I instruct my readers to continue investing and to stop listening to the crowd.

Good numbers overall. A huge data dump. The PPI was a huge drop and last month’s revised rose. Overall, good data and bonds are kind of muted in response. Philly Fed headline looks better as well.

Continuing Jobless Claims

Act: 1,881K Cons: 1,890K Prev: 1,872K

Core PPI (YoY) (Apr)

Act: 3.1% Cons: 3.1% Prev: 4.0%

Core PPI (MoM) (Apr)

Act: -0.4% Cons: 0.3% Prev: 0.4%

Core Retail Sales (MoM) (Apr)

Act: 0.1% Cons: 0.3% Prev: 0.8%

Initial Jobless Claims

Act: 229K Cons: 229K Prev: 229K

Jobless Claims 4-Week Avg.

Act: 230.50K Cons: Prev: 227.25K

NY Empire State Manufacturing Index (May)

Act: -9.20 Cons: -8.20 Prev: -8.10

Philadelphia Fed Manufacturing Index (May)

Act: -4.0 Cons: -11.3 Prev: -26.4

Philly Fed Business Conditions (May)

Act: 47.2 Cons: Prev: 6.9

Philly Fed CAPEX Index (May)

Act: 27.00 Cons: Prev: 2.00

Philly Fed Employment (May)

Act: 16.5 Cons: Prev: 0.2

Philly Fed New Orders (May) Act: 7.5 Cons: Prev: -34.2

Philly Fed Prices Paid (May)

Act: 59.80 Cons: Prev: 51.00

PPI (YoY) (Apr)

Act: 2.4% Cons: 2.5% Prev: 3.4%

PPI (MoM) (Apr)

Act: -0.5% Cons: 0.2% Prev: 0.0%

PPI ex. Food/Energy/Transport (YoY) (Apr)

Act: 2.9% Cons: Prev: 3.5%

PPI ex. Food/Energy/Transport (MoM) (Apr)

Act: -0.1% Cons: Prev: 0.2%

Retail Control (MoM) (Apr)

Act: -0.2% Cons: 0.3% Prev: 0.5%

Retail Sales (MoM) (Apr)

Act: 0.1% Cons: 0.0% Prev: 1.7%

Retail Sales Ex Gas/Autos (MoM) (Apr)

Act: 0.2% Cons: Prev: 1.1%

Walmart Warns It Can’t Hold on Price Forever With Tariff Hit Coming

(Bloomberg) — Supply Lines is a daily newsletter that tracks global trade.

Walmart Inc. delivered another quarter of solid sales and earnings growth, but cautioned that tariffs and increasing economic turbulence means even the world’s largest retailer expects to begin raising some prices this month.

Sales rose 4.5% at US Walmart stores open at least a year for the quarter ended April 30, while adjusted earnings were 61 cents a share. The results are better than what Wall Street analysts were expecting, suggesting a decision to lower prices to win market share is paying off for the retailer.

Still, President Donald Trump’s expansive, on-off tariffs haven’t spared the company. Transaction growth slowed from a year ago and sales were choppy, with grocery and pharmacy holding up while general merchandise slumped. And price increases fueled by the trade ware are soon expected to hit shelves.

“If you’ve not already seen it, it will happen in May and then it will become more pronounced,” Chief Financial Officer John David Rainey said of price hikes in an interview.

Walmart’s shares rose 2.2% in premarket trading. The stock had gained 7.2% this year through Wednesday, topping the S&P 500 Index, which had been little changed.

‘Lack of Clarity’

While the company plans to hold pat on its full-year sales and profit guidance, it opted not to give guidance on income for the ongoing quarter due to the inability to confidently predict “trade discussions taking place is changing by the week, and in some cases by the day,” the company said in a statement on Thursday. “The lack of clarity that exists in today’s dynamic operating environment makes the very near-term exceedingly difficult to forecast.”

The range of outcomes is “pretty extreme,” Rainey said, adding that the company is bracing for a bigger hit from the trade war and overall economic malaise in the coming months.

Trump’s trade war has upended operations for businesses across all industries. While temporary agreements – including the latest 90-day deal with China – are expected to alleviate short-term pressure on the supply chain, the whiplash has made it tough for companies to respond or plan.

Most consumer-facing companies have reported soft results in recent weeks, citing volatility in demand and economic disruption. Procter & Gamble Co. and Kraft Heinz Co. slashed their annual outlooks, while Southwest Airlines Co. and other airlines have voiced concerns about a looming recession. Just a handful of names — such as Tapestry Inc. — has posted upbeat reports.

Breaking Point

Walmart’s results now raise the pressure for competitors scheduled to report in the coming weeks, including Home Depot Inc. and Target Corp. The retailer’s performance also tends to serve as a barometer of the US economy, so the fact that Walmart performed well but is still warning investors of more tariff pain ahead is an ominous sign.

“It’s a challenging environment to operate in retail right now, with prices going up like this. There really hasn’t been a historical precedent or prices going up this high, this fast,” Rainey said. “The magnitude of the tariff increases though are so large that retailers can’t absorb these by themselves.”

There hasn’t been major changes in prices across the industry so far, Rainey said, though tariff-related increases are hitting stores now and Walmart expects them to become more significant as the year progresses. The company said it will monitor such changes and how its competitors respond to them.

Walmart is better-positioned than other retailers to weather the range of challenges. The company’s global supply chain allows it to source products from a wide range of regions, while its scale means it can negotiate better deals with suppliers.

Known for low prices, the company typically performs well during times of economic hardships when people gravitate toward deals. Its digital operations are also giving Walmart a leg-up. The retailer is drawing more shoppers with its pickup and delivery services, and bringing in more higher-income shoppers into to buy groceries and things like cold medicine and baby products.

Advertising and newer units are generating higher profit margins than its core store operations, giving it cushion to invest in prices and other parts of the business.

Walmart said its online business posted a quarterly profit for the first time during the latest period.

Speaking during analyst day in April, Walmart executives had said they viewed the tariff environment as an opportunity to gain market share and signaled their intent to keep prices low.

Still, there’s been greater week-to-week sales volatility and pointed to factors putting near-term pressure on profits: It wants to be ready to invest in prices as tariffs are enacted, and consumers are buying more groceries that tend to have lower margins. Categories like electronics, home and sporting goods have taken a hit, while rising egg prices were also notable in the quarter.

Off tangent

https://www.instagram.com/reel/DGQ0lniuvRW/?igsh=MWI0NTAzMmxvbmh2dA== – this makes sense, I think. Having multiple wives. Thoughts? If it was not financial suicide in divorce court, definitely the way.

Great content thanks.

Interesting argument. It is true many biblical players like David and his son Solomon had multiple wives. If a man can handle all those women! The unfortunate thing for Solomon is that he married pagan women who did not worship the most high God and lead him astray.

If a man wants to keep life simple and trouble free he should stick with just one woman at a time or even better no relationships at all.

Solomon married FOREIGNERS.

What’s wrong with multiple no foreigner wives, though?

The Judeo-Christian and Universal Churches think it’s racist to not do so.

I really have a good feeling about what Trump is accomplishing on the World stage. The latest bromance deals with the Saudis and its neighbors is a great accomplishment in cementing ties with our old allies. This was long neglected and long overdue. I have hopes that this will bring peace. Trump tried talking with Iran and got nothing from them and left them high and dry as opposed to Biden/Obama insisting on friendship with Iran and Cuba where there was none. Iran hates us and Trump knows this. Meanwhile Biden/Obama neglected our old allies like the Saudis and instead kissed up to our mortal enemies like Iran who will always hate the USA.

I am curious where Israel stands in all this mideast bromance. Only time will tell.

The Saudi Royal family is Jewish. Iran has a large percentage of “caucasian” people. Iranian people do not hate American people, that’s propaganda. Trump or I should say the people in charge behind the scenes, have done nothing but changed his mind at the last minute on every important issue since he’s been in office. That should tell you where Israel and the script reader Trump stands. The new Pope is Jewish. Time has already told everyone who has been paying attention.

Yes, the Medes and some of the Persians were close relatives of the Israelites and looked very similar. The Middle East and Near East were much more heavily Caucasian 2,500 years ago. The populations there today are more mongrelized, but many of the Iranians and others like the Armenians today do look white European. The synagogue wants us warring with our cousins.

I agree that the Iranian people themselves are very pleasant and most actually love America. It is their government that is not good. There is a huge disconnect between the Iranian government and its people.

BTW, the CPI data this morning look good.

Core CPI (MoM) (Apr)

Act: 0.2% Cons: 0.3% Prev: 0.1%

Core CPI (YoY) (Apr)

Act: 2.8% Cons: 2.8% Prev: 2.8%

Core CPI Index (Apr)

Act: 326.43 Cons: Prev: 325.66

CPI (MoM) (Apr)

Act: 0.2% Cons: 0.3% Prev: -0.1%

CPI (YoY) (Apr)

Act: 2.3% Cons: 2.4% Prev: 2.4%

CPI Index, n.s.a. (Apr)

Act: 320.80 Cons: 320.86 Prev: 319.80

CPI Index, s.a (Apr)

Act: 320.32 Cons: Prev: 319.62

CPI, n.s.a (MoM) (Apr)

Act: 0.31% Cons: Prev: 0.22%

Real Earnings (MoM) (Apr)

Act: -0.1% Cons: Prev: 0.6%

Regardless of how it’s getting done, I have to tip my hat to the Trump economic team. The libtards must be hating life.

Business conditions are generally better, both on Canadian side and American side. We have turned optimistic over the past couple of weeks, it’s amazing what happens to your perspective when the boot gets lifted off your throat just a little bit. We are never going back to 2019 and prior type of conditions, but we can manage this.

I am waiting to see the new encyclical from Leo. I think they want to tweak Rerum Novarum – it loses its relevance when nobody really works anymore. Maybe they jettison the rule of St. Benedict as well, how do you get sanctity from your work when you no longer work?

Good point. The encyclical you mentioned goes back to the 19th century. Back then, people worked hard. Obviously, that’s no longer the case.

By the way, I’ve been reading up on Pope Leo and he seems more conservative than what the establishment press indicate. His brother sounds like a MAGA fan. You know the apple doesn’t fall far from the tree. The mainstream even declare that this Pope is the first black pope. It just continues to get richer and richer.

I have to admit, the business climate has gotten better. I don’t feel the pressure from the government about being a landlord like before Trump’s second term. All of that social policy seems to have died on the vine. In Maryland, however, they passed a bunch of stuff regarding tenant rights and all that does is hinder capital formation for residential real estate and apartment construction.

And you’re right, it’s as if the collective vice was unscrewed a couple turns to let the blood flow again. It is a nice reprieve and I do not take it for granted. I am still carrying out my financial strategies as if the Communists will get back into power.

It’s funny, I suddenly feel better about the business environment in the last week. Trump is really getting things done. Trump got more done in the last three months than Biden has ever done in 3 lifetimes.

Just another day in a black-controlled country….

South Africa’s Eskom Plans Rolling Power Blackouts to Thursday

(Bloomberg) — South Africa’s state-owned power utility plans rolling blackouts through Thursday evening to manage limited generation capacity.

Eskom Holdings SOC Ltd. will start so-called stage 2 loadshedding at 4 p.m. Tuesday, it said in a statement. Its decision follows the delayed return of units that generate 3,120 megawatts, as well as an additional loss of capacity in the past day due to unplanned breakdowns.

The utility throttled supply on some days in April and March and in February, it took 6,000 megawatts offline — the most stringent cuts in a year — after multiple generating units at Eskom plants failed, raising questions about the turnaround in the company’s performance.

Loadshedding had until early 2024 taken a significant toll on the economy — as much as 899 million rand ($49 million) per day, according to central bank estimates — and was among the reasons why the ruling African National Congress lost its majority in last year’s elections. Eskom halted the almost-daily outages, which lasted as many as 12 hours per day, in the weeks before the May national vote.

Blacks run a crap show.

I’m executing my sixth 1031 exchange over the past 27 months out of PG County Maryland as I write this. Proceeds are going into a red area of Virginia. It’s a great place to do business and all my tenants are European Caucasian. Doubleplusgood, I tell you!

I’ve deferred about $250,000 in capital gains tax and depreciation recapture. The black loving state of Maryland won’t see a penny. Their socialist policies angered me and as a result, they missed out on about $50,000 in tax revenue. All done legally! F Maryland and their schvartze loving communist ways. I use the 1031 exchange to give PG County and Maryland the big European Caucasian middle finger.

HTZ is really struggling and I don’t know how they’re going to turn their business around. I’m running the numbers in my head and I don’t see what Bill Ackman sees.

Thank goodness I sold my last bit at $8.50. I took my couple grand and left town.

Yeah timing is always key – I can’t ever seem to get it right – I often see the macro and micro trends and even identify the right assets or tickers but I never seem to get the timing right. I think he is betting on his ability to influence some deals/partnerships to unlock some as of yet priced in value but it seems like a long shot to me.

Yes. Ackman is hoping to use his influence and sway to rally the stock. It’s only a $2 billion company, so it’s relatively illiquid, and he’ll be out there pumping it. Ackman is hoping to make it into a $5 billion company.

In terms of the timing, I jumped on board as soon as he claimed to own 19.8% of the stock. Originally, the 13f filing said about 4%. That wasn’t a big enough deal for me, but I did day traded for a couple hundred bucks. When he came out and said that he had effective control of almost 20% of the shares, I jumped on board for that big pop.

I was looking at the technicals at the time I was trading it and it seemed to be wavering around the 9+ area. I figured I rode it up enough. I looked at the intraday trading, for example, and the cycle high of 9 and change was not taken out the second day, which was slightly below the previous day’s high. That was the first red flag for me.

Then Bloomberg put out that article indicating that they needed to tap into the capital markets again and perhaps use their relatively higher stock price to consummate an ATM equity offering, I suspected the top was in for that short-term cycle. I immediately sold after reading that article, which came out after close, and took it off my screen. It’s been straight down ever since.

Unless there is another big event, like Hertz ganging up with Uber to use excess capacity for delivery services, I just don’t see the catalyst that will push it higher.

In its earnings conference call, Hertz management put the best spin on their circumstances, but it just doesn’t look good. At least for now.

If you’re white it is best to stay out of black controlled areas as they will harass whites because they hate whites. Stick with your like kind people. Humanity is fracturing into ethnic groups and racial groups that hate each other. This is planned by the synagogue of satan. Stay with your own kind. Whites should not live in places that are governed by other races.

One of my ancestors:

https://en.m.wikipedia.org/wiki/Willem_Schouten

Some of my family is still in the countryside around Hoorn. It is the only other place on earth that instantly felt like home to me but it is also turning brown.

US budget surplus surges to $258 billion in April, year-to-date deficit tops $1 trillion

(Reuters) -The U.S. government posted a $258 billion budget surplus for April, up 23%, or about $49 billion, from a year earlier, reflecting strong tax receipts in the final month of the tax season and record collections of import duties, the Treasury Department said on Monday.

Treasury reported that customs duties in April totaled $16 billion, about a $9 billion increase from the year-earlier period and far eclipsing the previous record of $9.6 billion two years earlier. The jump occurred during a month in which President Donald Trump boosted tariffs on Chinese goods to as much as 145% while slapping at least 10% levies on imports of goods from other countries.

The budget results indicate the U.S. collected just over $500 million a day from tariffs in April. Trump last month said the collections were about $2 billion a day.

For the first seven months of the fiscal year, net customs duties totaled $63 billion, compared with $48 billion in the same period a year earlier.

That new revenue, however, is likely to drop off. The U.S. and China over the weekend reached a deal to temporarily ease their steep tariffs on each other, with the U.S. cutting its 145% duties to 30% for the next 90 days, while Chinese levies on U.S. imports will fall to 10% from 125%.

Receipts last month were driven by a 16% increase in individual non-withheld tax payments, which totaled $460 billion. Individual refunds also rose 16% to $86 billion, detracting from net total budget receipts of $850 billion for the month.

Treasury reported a $1.049 trillion budget deficit for the first seven months of fiscal 2025, which started Oct. 1, up 23%, or $194 billion, from a year earlier. Fiscal year-to-date receipts of $3.110 trillion and outlays of $4.159 trillion were both records for the year through April, though the deficit itself was not, a Treasury official said.

After accounting for calendar differences that exaggerated outlays recorded in 2024 and $85 billion in deferred tax receipts from California that had boosted fiscal-year 2024 receipts, the deficit would have been 4% higher, according to the official.

The 5% increase in unadjusted fiscal year-to-date receipts was driven by a 6% increase in individual paycheck tax withholdings to $2.145 trillion, accounting for the lion’s share of the total budget receipts.

The 9% increase in unadjusted fiscal-year-to-date outlays was driven by higher spending on the Medicare health program for seniors and the disabled, which was up 16% to $658 billion, and on the Medicaid program for lower-income Americans, which was up 6% to $378 billion. Both programs saw enrollment climb and service costs rise.

Spending on the Social Security retirement program rose 9% to $945 billion on a fiscal-year basis, while payments to cover Treasury debt interest climbed 10% from a year earlier to $684 billion.

The Treasury official said the weighted average interest rate for the month was 3.29%, up 6 basis points from a year earlier, but close to where it has been for the past five months.

Dozens of white South Africans land in US under Trump refugee plan

President Donald Trump has said the refugee applications for the country’s Afrikaner minority had been expedited as they were victims of “racial discrimination”.

The South African government said the group were not suffering any such persecution that would merit refugee status.

The Trump administration has halted all other refugee admissions, including for applicants from warzones. Human Rights Watch described the move as a cruel racial twist, saying that thousands of people – many black and Afghan refugees – had been denied refuge in the US.

The group of white South Africans, who landed at Dulles airport near Washington DC on Monday, received a warm welcome from US authorities.

Article continues….

https://www.bbc.com/news/articles/crljn5046epo.amp?xtor=AL-%5B72%5D-%5B

That is awesome news. Now let’s ban Islam.

https://www.youtube.com/live/c2Gd1bHY29Q?si=ah6PxoAUUt_h2JOc here is a video of your article. I look at the physical features of these people, the right people, indeed.

Wonderful and beautiful. I immediately notice their spark of life in their expressions. And NO TATTOOS.

They are certainly Adamic Man and not Genesis One man. This is why the synagogue media keeps criticizing them. The Genesis One people (e.g. blacks, Asians, and Hispanics) hate these folk. They hate us.

We have to help our fellow white peoples.

From Bloomberg:

Xi Jinping’s decision to stand his ground against Donald Trump paid dividends to the Chinese leader Monday. After two days of high-stakes talks in Switzerland, trade negotiators from the world’s biggest economies announced a massive if temporary de-escalation of tariffs, with the US slashing duties on Chinese products to 30% from 145% and Beijing dropping its levy on most goods to 10%.

The US administration began to retreat on promised levies and make public entreaties to Beijing shortly after markets nosedived in response to Trump’s “reciprocal” tariff rollout on April 2. The retaliation that followed the announcement had taken duties to levels that for many companies effectively blocked trade, causing widespread uncertainty and fueling warnings of a self-induced US recession.

The dramatic reduction in tariffs exceeded expectations in China and sent the dollar and stocks soaring—providing some much-needed market relief for the US president, who is facing pressure as inflation looks set to speed up at home. China equities also surged as the deal—though only a 90-day delay—ended up meeting nearly all of the Chinese president’s core demands. The “reciprocal” tariff for China, which Trump set at 34%, has been suspended—leaving America’s top rival with the same 10% rate that applies to US allies like the UK.

“This is arguably the best outcome that China could have hoped for—the US backed down,” said Trey McArver, co-founder of research firm Trivium China. “Going forward, this will make the Chinese side confident that they have leverage over the US in any negotiations.” —Natasha Solo-Lyons and David E. Rovella

The new Pope Leo is the Vatican’s Obama. He pretends to play centrist while he is a flaming anti Christ leftist. He is very stealth and bear in mind that He had close ties to Pope Francis.

This article is very timely. Stocks are roaring up as the USA and China are talking reconciliation on trade. Those who thought the stock market is going to crash and the world will end are once again wrong. I see no evidence so far that the Deagel.com prediction is coming true and very unlikely to do so before the end of the year.

Life and the world goes on and the masses who are asses will keep on spending beyond their last penny. The world is looking great again as of Monday. Those who are waiting for the world to end are missing the boat.