Stone, the metals are confirming your position. We are getting real close to the top of the roller coaster now.

Steve

Most global inhabitants are properly conditioned

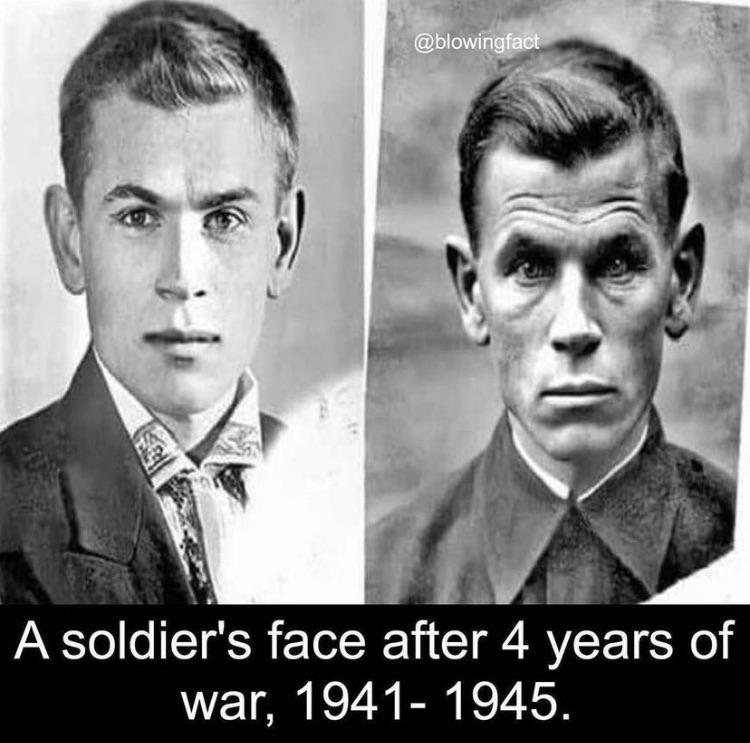

War brings change and, whether they are conscious of it or not, the vast majority of the global population actually desire the objectives of the New World Order.

This geopolitical trajectory needs to build for a couple more years. By the time war comes to the doorstep of the western nations, including the United States and Canada, most inhabitants of the earth will actually want it. Most inhabitants of the planet desire a new world order.

This geopolitical trajectory needs to build for a couple more years. By the time war comes to the doorstep of the western nations, including the United States and Canada, most inhabitants of the earth will actually want it. Most inhabitants of the planet desire a new world order.

I’m noticing that the S&P futures are currently trading at 6666 as I write this. Mineral and material stocks are showing excellent price support and resiliency, given the growing signs for this upcoming global war and the desire of the governing authorities to directly involve themselves in the ownership of these companies. The United States government is having a tremendous effect on the price action of some of these mining stocks, with LAC and UAMY shareholders being the latest beneficiaries.

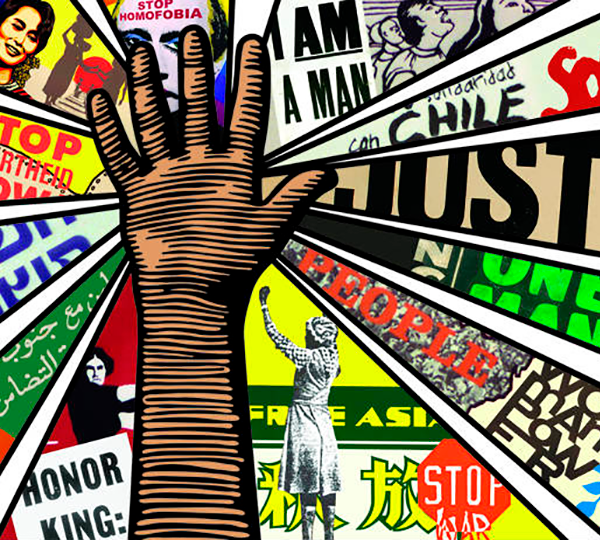

The world desires the Communist Utopia

Those who find communism in all its forms abhorrent only amount to a few percent of the global population.

The world’s population have been bred and engineered in the communist doctrine, whether in the organized religions throughout the world (e.g. Islamism, Buddhism, Catholicism, Protestantism, Sikhism, Hinduism, Oriental mysticism, etc.) or in their schooling and media, and are eagerly ready for the global government to emerge.

This global government will promise to spread the wealth evenly around to everybody. Indeed, the world prefers the ideals of the Communist man. This objective is shared unanimously throughout the Universal Judeo-Christian churches. It’s a concept in which everyone is identical and the same.

It will be a society in which women are men and men are women. Although all our freedoms will finally be stripped away, we will be free to indulge in any fleshly fantasy we desire.

It’s clear to me that most inhabitants of my own country don’t even care about personal privacy anymore. All of their constitutional rights have been already stripped away through partisan politics. The transformation has been mind-blowing.

Unfortunately, for my few knowledgeable readers, the ultimate outcome will be much darker and grim.

The world’s people are eager for a change. They seek to embrace the change. Change is coming!

Day trading is about to get a lot easier for beginners. Things could get ugly.

MarketWatch

Finra voted to change its pattern day-trading rule, which would allow investors with smaller account sizes to trade actively

Published: Sept. 26, 2025 at 12:50 p.m. ET

Retail investors may soon be able to day trade regardless of how much they have invested.

It could get easier for anyone to start day trading soon — but should they?

This week, the Financial Industry Regulatory Authority announced that it had voted to change its pattern day-trading rule. Previously, Finra required investors to have an account worth at least $25,000 in order to day trade, which involves opening and closing a stock or option position within the same day. Doing this four or more times over a five-business-day period would get you marked as a pattern day trader, potentially resulting in your account getting restricted — unless you had enough money.

Now, that restriction may go away, which would allow investors of all account sizes to day trade.

“I think this is one of the most significant changes that Finra has made to equity-market structure in decades,” Adam Cohn, head of trading operations at TradeStation, told MarketWatch.

Cohn said that the pattern day-trading rule was put into effect around the time of the dot-com bubble as a way to put up some guardrails in response to an explosion in amateur day trading. The rule was not only meant to protect retail investors from trading too actively, but also to protect brokerages that had to monitor margin requirements and risk. However, since the technology around executing retail trades has gotten much better over the past few decades, those brokerage risks have come down quite a bit.

“The day-trading rules essentially became somewhat obsolete as the technology evolved,” Cohn said. “Firms were no longer allowing clients to overspend the available funds in their account because of the ability to validate buying-power values and margin requirements at the time of trade.”

But while technology has minimized the risk day trading poses to brokerage firms, risks remain for the individual trader.

“While I believe that these regulations are out of date and in need of updating, our markets have become casinos, and these changes will only benefit the house — [payment-for-order-flow] brokers and high-speed middlemen,” Dave Lauer, co-founder of Urvin Finance and investor-advocacy group We the Investors, told MarketWatch.

Market-making firms and brokerages that collect payment for order flow benefit when retail investors trade more, because they make money off of each trade.

“These firms are incentivized to encourage more active trading and are lobbying hard for changes like this. Unfortunately, as usual, it’ll be the average investor that is harmed,” Lauer said.

What the actual traders think

A handful of retail traders echo this sentiment that inexperienced traders could end up losing money because of the rule change.

Emre Arapkirli, a retail investor from New Jersey, said the change was a big deal, but it also gives him pause.

“From my understanding, most day traders lose money in the market. Also, most new traders lose money in the market as well,” Arapkirli told MarketWatch.

He said that he sees the pattern day-trading rule as a way to protect people from buying or selling in panic and falling victim to their emotions. Yet at the same time, he believes people should be allowed to do what they want with their money as long as they aren’t hurting others.

“So I am not against this change, but I think a lot of people are going to end up losing money that they can’t afford to lose,” Arapkirli told MarketWatch.

The rule change could open up the floodgates to more everyday people actively trading, and that influx could end up impacting overall market volatility.

“It’s going to have a pretty big impact in the retail market structure, and I can see there just being a huge volatility spike in the market,” Anmol Jena, an individual investor from Texas, told MarketWatch.

Jena said this could lead to more intraday churn in popular stocks and more people trading short-dated options. He said he may shift his strategy toward selling more options in order to adjust to this change.

But even traders who have run into the pattern day-trading rule in the past have some reservations about the $25,000 barrier going away. Aaron Cook, an active retail trader from Florida, once got his account flagged for 90 days for pattern day trading. He said the experience almost made him stop trading forever.

“I know that PDT rule kept me from blowing my account in a week or two,” Cook told MarketWatch.

He recalled working to get his trading account above the $25,000 mark, but the added pressure meant he would trade more conservatively. He would get out of trades and take losses out of fear of dipping below that level and losing the ability to day trade. He said he learned to trade with the pattern day-trader rule in the back of his mind.

“Most people with under $25,000 are new traders and struggle with emotions. This will allow them to have fear take over and the ability to sell when otherwise they wouldn’t be able to,” Cook said. “It’s both positive and negative.”

Cook said that the removal of this guardrail could be “very, very dangerous” for inexperienced traders.

“Trading has risk — it always has,” Cohn said. “So I believe that there’s always going to be accounts that don’t understand proper risk management and [will] overtrade.”

Without the pattern day-trading rule, retail investors would have greater individual responsibility to manage their risk effectively. But Cohn also said that the onus is on the brokerages to supply their clients with proper education, as those brokerages don’t want their customers blowing up their accounts and walking away from the market altogether.

Now that Finra has voted to change the pattern day-trading rule, it will go to the Securities and Exchange Commission for approval.

Traders breathing a sigh of relief this morning as the PCE price data come in largely as expected.

Core PCE Price Index (MoM) (Aug)

Act: 0.2% Cons: 0.2% Prev: 0.2%

Core PCE Price Index (YoY) (Aug)

Act: 2.9% Cons: 2.9% Prev: 2.9%

PCE Price index (YoY) (Aug)

Act: 2.7% Cons: 2.7% Prev: 2.6%

PCE price index (MoM) (Aug)

Act: 0.3% Cons: 0.3% Prev: 0.2%

Personal Income (MoM) (Aug)

Act: 0.4% Cons: 0.3% Prev: 0.4%

Personal Spending (MoM) (Aug)

Act: 0.6% Cons: 0.5% Prev: 0.5%

Real Personal Consumption (MoM) (Aug)

Act: 0.4% Prev: 0.4%

There has been a fair amount of chatter about a Mumbai terrorist attack in the states recently. Just passing this along. Vigilance is the key.

If a “terrorist attack” happens it will be done by the USA alphabet agencies.

A nice way to shut the country down and bring in the digital currency system would be to have an ATF agent set off a small lady bug firecracker in a Iowa cornfield and then have the national news media state that a nuclear bomb detonated. I’ve noticed the majorty of people believe what they see on television and the internet.

We aren’t there just yet. 2027 is almost a year and a half away. A few more mall and school shootings will happen, maybe another BLM/antifa event. The BRI project is moving into Germany then Holland, so we will see an increase in terrorist attacks in those areas.

2026 is going to be big…my brother is a paratrooper and goes to poland and romania to teach the art of killing…its full of nato…they are getting ready

Welll Freek you showed up outta nowhere and bombed the board with comments.

Miltary men take an oath to not discuss details of missions with family, after a certain timeframe, all communication is disabled.

We all have sources and experiences and know an event is going to happen. But to ease your worries, it will be staged. However the markets will briefly act as if it were real. There won’t be any “killing”, just media reports of it. If your brother is doing any training it’s how to hammer nails in wood and pour concrete. The BRI is a massive and expensive construction project. That all the fooled masses are paying for thru their taxes.

As T.S. Elliot wrote, we have become the hollow men. This does not refer to the very few that make up the remnant naturally. This is what happens when YHVH is rejected. We reap what we sow.

The data dump is definitely coming in hotter overall. The economy continues to show resiliency. Jobless claims are definitely lower and durable goods are higher. The price data coming in slightly hotter as well.

Revised GDP numbers also coming in much hotter. This was definitely not expected.

Look for a sharp upward revision in this current quarter’s GDP estimates as the trade deficit comes in much smaller than expected. Trump’s tariffs and pro-American trade policies are definitely having an effect on the United States trade balance.

Initial Jobless Claims

Act: 218K Cons: 233K Prev: 232K

Jobless Claims 4-Week Avg.

Act: 237.50K Cons: Prev: 240.25K

Continuing Jobless Claims

Act: 1,926K Cons: 1,930K Prev: 1,928K

Durable Goods Orders (MoM) (Aug)

Act: 2.9% Cons: -0.3% Prev: -2.7%

Durables Excluding Defense (MoM) (Aug)

Act: 1.9% Cons: 1.0% Prev: -2.3%

Core Durable Goods Orders (MoM) (Aug)

Act: 0.4% Cons: -0.1% Prev: 1.1%

Goods Orders Non Defense Ex Air (MoM) (Aug)

Act: 0.6% Cons: -0.1% Prev: 0.8%

Core PCE Prices (Q2)

Act: 2.60% Cons: 2.50% Prev: 3.50%

Corporate Profits (QoQ) (Q2)

Act: 0.2% Cons: 2.0% Prev: -3.3%

GDP (QoQ) (Q2)

Act: 3.8% Cons: 3.3% Prev: -0.5%

GDP Price Index (QoQ) (Q2)

Act: 2.1% Cons: 2.0% Prev: 3.8%

GDP Sales (Q2)

Act: 7.5% Cons: 6.8% Prev: -3.1%

Goods Trade Balance (Aug)

Act: -85.50B Cons: -95.70B Prev: -103.60B

PCE Prices (Q2)

Act: 2.1% Cons: 2.0% Prev: 3.7%

Real Consumer Spending (Q2)

Act: 2.5% Cons: 1.6% Prev: 0.5%

Retail Inventories Ex Auto (Aug)

Act: 0.3% Cons: Prev: 0.2%

Wholesale Inventories (MoM) (Aug)

Act: -0.2% Cons: 0.2% Prev: 0.1%

Average Weekly Earnings (YoY) (Jul)

Act: 3.31% Cons: Prev: 3.59%

SLI wants to fly.