We have on this blog always contemplated how all the additional global sovereign debt would be absorbed as fiscal deficits continued to climb post 2020 COVID.

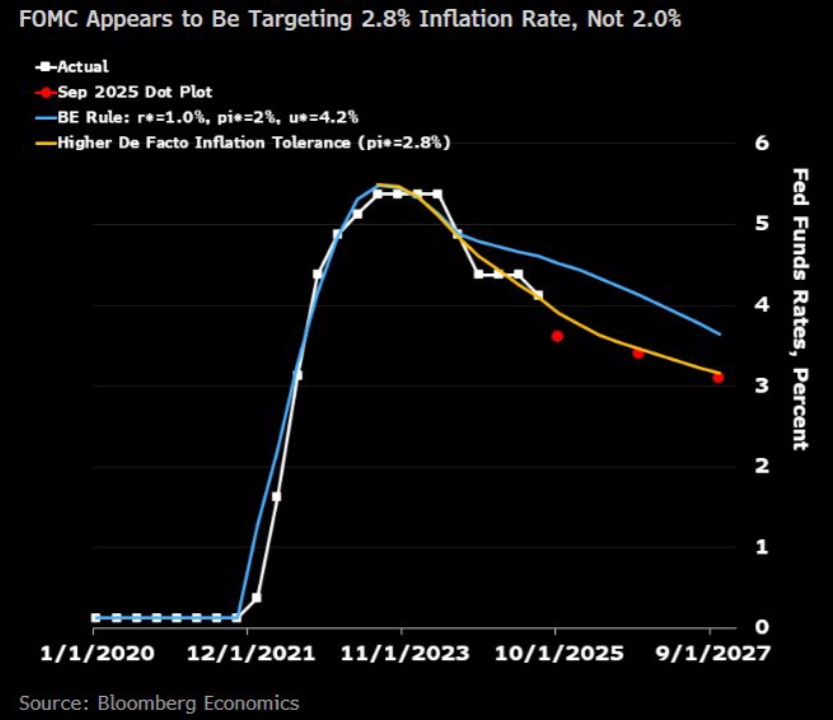

This blog’s overriding conclusion has been consistent for the past several years; in order to keep the United States government in business the Federal Reserve must accept a higher rate of inflation. In fact, we theorized that a 3% rate of inflation was the ultimate objective and that a 2% rate of inflation would no longer be in the cards.

Despite what the Federal Reserve had been stating all along, it was obvious to most observers that the achievement of a 2% target inflation rate was functionally impossible, unless economic growth was greatly curtailed.

It’s now impossible to rearrange fiscal finances to mirror that of pre-covid levels.

It’s now impossible to rearrange fiscal finances to mirror that of pre-covid levels.

First and foremost, the amount of interest outlays that are now being generated by the Federal government has exploded over the past few years.

The United States government is now essentially consuming too much of the world’s net savings and all of this interest income that is being received by investors is spilling over into assets across the globe. It’s safe to assume that fiscal 2026s interest outlays will be well over 1 trillion dollars.

Second, as the Federal government continued to consume more of the world’s net savings, the Federal Reserve would need to step in and pick up the difference. Hence, long-term balance sheet levels must continue to grow, despite talk of a balance sheet unwind.

There’s a trade-off here; the Federal Reserve can continue winding down its balance sheet of Treasury securities, but that comes at a very steep cost. If the Federal Reserve is not stepping in and absorbing treasury supply, the only other choice is to raise interest rates and bond yields to a level that would appeal to the typical investor.

This path has reached its end and even the partisan PhD hacks at the Federal Reserve know that the Federal government can no longer continue on its current path of accelerating interest outlays.

At this point, if the Fed truly wishes to keep the USG in business, the two primary paths that it could take would be;

•to allow the economy to move to recessionary conditions, so that the yield curve could fall back, making interest outlays more manageable,

•or to terminate its balance sheet unwinding and accept a higher rate of inflation, while providing relatively dovish monetary policy.

Given the constraints of political expediency, the Federal Reserve is clearly choosing the latter option. This was to be expected all along, but the FED can’t come out and publicly state that it desires to see a higher rate of equilibrium inflation. This could be seen as a catalyst for a self-fulfilling prophecy that overshoots, causing an even higher rate of equilibrium inflation, as well as a loss of confidence in the banking system.

However, most investors already know that inflation can never move back to pre-covid levels ever again. The fiscal deficits accruing around the world are just too extreme and restrictive monetary policies will only accelerate the demise of the nation-states and their spending.

However, most investors already know that inflation can never move back to pre-covid levels ever again. The fiscal deficits accruing around the world are just too extreme and restrictive monetary policies will only accelerate the demise of the nation-states and their spending.

For now, the spending must continue and the central banks must accommodate these new deficit levels with a wink and a nod. The Federal Reserve will once again commence quantitative easing, if only to say that it is to provide monetary reserves.

But for those wondering why asset prices continue to escalate, the reasons are simple. The nation states continue to spend above long-term trends, while the central banks seem more than willing to accommodate it.

Yes, investors already know the obvious and that’s why asset prices across the board continue to climb.

Don’t look for any collapses, but look for a further consolidation of the wealth and power across the board as the asset owners continue to benefit. The deficit spending will continue and the central banks will make certain the lights stay on.

In the New World Order, 3% is the new 2%. Asset owners should rejoice.

Putin’s not coming and neither is China….

US prepares attack on Venezuela as Maduro begs Putin for aid

By bnl intellinews

The Trump administration has drawn up a list of potential military targets within Venezuela as part of its intensifying pressure on President Nicolás Maduro, who has turned to Moscow seeking urgent military assistance, US officials have disclosed.

Pentagon planners are examining facilities including harbours, landing strips and naval installations that Washington alleges serve dual purposes – ostensibly military whilst facilitating cocaine shipments, according to officials who spoke to the Wall Street Journal. Whilst no final authorisation has been given for such operations, they would bring the conflict directly onto Venezuelan soil after a barrage of strikes against vessels the White House claims were carrying drugs.

Meanwhile, Maduro has appealed directly to Russian President Vladimir Putin for help strengthening Venezuela’s air defences, including delivery of 14 missile units and restoration of Russian-made Sukhoi Su-30MK2 fighter aircraft, the Washington Post reported on October 31, citing internal US government documents.

The embattled Venezuelan leader’s written plea was delivered by Transportation Minister Ramón Celestino Velásquez during a mid-October visit to Moscow, where he met with his Russian counterpart, according to the documents. The missive characterised the Su-30 jets as ‘the most important deterrent the Venezuelan National Government had when facing the threat of war,’ the Post reported….

However, Moscow – absorbed in its war in Ukraine and cultivating closer relationships with other regional partners such as Nicaragua – would have limited capacity or inclination to provide significant assistance should Washington launch a comprehensive operation inside Venezuela, analysts say. Additionally, Trump’s military focus on the Caribbean may paradoxically benefit Putin by diverting attention from Ukraine.

https://www.intellinews.com/us-prepares-attack-on-venezuela-as-maduro-begs-putin-for-aid-409173/

Think will see a bid put into oil before the fireworks start?

It’s difficult to tell, though I doubt any spike would last long and would be sold into (domestic producers would use any price increase to sell future production as a hedge).

The US is the largest oil as well as energy producer in the world. Though Venezuela supposedly has the world’s largest oil reserves, they produce only a little more than a million bpd. Venezuela’s corruption with Maduro is unbelievable.

Maduro definitely needs to go. Russia and China both know it, too. It’s terrible the state that Venezuela is in.

Yeah, I that’s kinda what I thought too. Up here there’s lots of Pump Jack’s on ideal or turned off completely many of them were recently drilled. There is alot of supply that can be turned on at a moments notice.

China’s trap for Putin: Russia forced to issue first-ever yuan bonds — Reuters

Russia is preparing to issue domestic bonds denominated in Chinese yuan for the first time — a move aimed at absorbing the vast yuan liquidity accumulated by exporters and banks from energy sales to China, Reuters reported on Oct. 31.

Three financial market sources told the agency that Russia’s Finance Ministry plans up to four bond issuances totaling the equivalent of 400 billion rubles (roughly $5 billion), with maturities ranging from three to ten years.

“The deal is scheduled for early December. They’re targeting the widest possible range of investors — from banks and asset managers to brokers working with retail clients,” one source said.

Another source told Reuters that the ministry has already held meetings with potential buyers, including banks and other institutional investors, presenting preliminary terms for the yuan bonds.

According to initial plans, the bonds will be listed on the Moscow Exchange — which remains under Western sanctions — making them unavailable to most foreign investors, including those from China and other Asian countries.

Analysts at Cbonds calculated that there are already 166 billion rubles (about $2 billion) worth of yuan-denominated corporate bonds circulating in Russia.

Analysts expect strong demand from Russian exporters, including major energy firms that currently hold profits in yuan on local bank deposits. This oversupply of Chinese currency has pushed domestic yuan interest rates in Russia to record lows.

Renaissance Capital analysts noted that the bond issuance could also help reduce currency risk in Russia’s banking system, which has become saturated with yuan liquidity from energy exports to China. The move would also assist banks in meeting regulatory requirements.

Russia’s Finance Ministry and the Moscow Exchange did not respond to Reuters’ requests for comment.

Reuters pointed out that preparations for the bond sale come as sanctioned oil giants Rosneft and Lukoil are repatriating their yuan earnings ahead of Nov. 21, when new U.S. sanctions are set to take effect.

Nigeria says U.S. help against Islamist insurgents must respect its sovereignty

ABUJA (Reuters) -Nigeria said on Sunday it would welcome U.S. help in fighting Islamist insurgents as long as its territorial integrity is respected, responding to threats of military action by President Donald Trump over what he said was the ill-treatment of Christians in the West African country.

Trump said on Saturday he had asked the Defense Department to prepare for possible “fast” military action in Nigeria if Africa’s most populous country fails to crack down on the killing of Christians.

“We welcome U.S. assistance as long as it recognises our territorial integrity,” Daniel Bwala, an adviser to Nigerian President Bola Tinubu, told Reuters….

https://www.reuters.com/?tag:reuters.com,2025:newsml_KBN3M809L

Again, interesting and enlightening observances Thomas. However, some other Ph.d Economist’s and commentators have suggested that interest rates WILL and MUST rise to contain escalating inflation.

The Fed and the economy can not cope with the coming rise in the inflation rate of 4% and even a 5% inflation in 2026. What do you think? Will rates rise in late 2026?

The Fed will make certain that the government financing costs remain below the true costs of inflation.

I read how trained economists keep referring to the linear relationship between price inflation and interest rates, but they fail to disclose the real problem; escalating Federal government interest outlays.

And this is because the Federal Reserve keeps playing this one factor down. The Federal Reserve and these economists seem to be willfully whistling past the graveyard, so to speak. Jerome Powell even said so in a recent press conference. He stated that this isn’t a concern for him and his decision making process. Of course, nothing could be further from the truth, but he can’t publicly say so.

As of right now, monetary policy is slightly restrictive. CPI-U is 3.0% and overnight rates are about 3.8%. However, the balance sheet unwind is ceasing on 12/01.

QE will begin again in 2026, under some excuse, because it has to.

Why? The Federal government’s fiscal deficits are too massive. Someone has to buy all these securities and the pool of investors, even with their bloated asset balance sheets, aren’t interested at prevailing interest rates and bond yields. That’s because the FED is essentially subsidizing the yield curve already. The reverse repo window has dwindled to nothing and banking reserves will soon prove to be too small.

The FED will step in, because it has to. The fact that the Federal Reserve is already acting the way it is shows that it already knows that a 2% inflation rate is impossible to achieve.

The FED has already announced that its balance sheet unwind is ending. It has intimated that it may increase its balance sheet next year. Despite all its public consternation and hand wringing, the Fed will continue to drop interest rates, because it has to.

Moreover, the Fed in its operation twist has stated that it will emphasize short-term treasury bills, thus facilitating this process.

The problem with today’s economists is that they are now too partisan. I can’t trust the economists anymore, because of their love or hatred of whoever is in the white house.

A heterogeneous and socially Marxist society lies all the time.

The tableau has been set. “Liquidity concerns” will eventually force a more proactive approach….

Fed’s T-bill pivot expected to ease supply, but rate futures flag tight funding

October 31, 2025

NEW YORK (Reuters) -The Federal Reserve’s decision on Wednesday to begin winding down its long-running balance sheet runoff has done little to ease concerns about near-term liquidity strains in the roughly $4 trillion U.S. overnight repurchase market.

U.S. repo futures continue to reflect expectations of elevated overnight funding rates over the next two months, despite the U.S. central bank’s announcement that it will reinvest all proceeds from its maturing mortgage-backed securities (MBS) into Treasury bills. Analysts estimate the reinvestment will amount to $15 billion in T-bill purchases per month.

In halting the drawdown of its still-sizable balance sheet, the Fed cited signs of tightening liquidity that have driven repo rates higher over the past few months.

Since launching quantitative tightening, or QT, in June 2022 to unwind emergency stimulus measures introduced during the COVID-19 pandemic, the Fed has slashed the size of its balance sheet from a peak of roughly $9 trillion to about $6.6 trillion.

The Fed’s increased demand for Treasury bills is expected to significantly shrink their net supply to private investors in 2026, likely driving prices higher and yields lower. This dynamic could help alleviate supply pressures and stabilize overnight funding rates.

Still, the initial reaction in the futures market pointed to expectations of a higher Secured Overnight Financing Rate (SOFR) – an overnight repo rate – in November and December, relative to the effective federal funds rate, the central bank’s key policy rate. The fed funds rate reflects the cost of unsecured overnight loans between banks used to meet reserve requirements.

“The key takeaway here is that the Fed is not alarmed by recent front-end developments, and does not see a need for any dramatic adjustments in its operations,” said Lou Crandall, chief economist at money market research firm Wrightson ICAP.

SOFR stood at 4.27% on Thursday, while the effective fed funds rate, reported with a one-day lag, was 4.12% late on Wednesday.

The one-month SOFR-fed funds futures spread is a key liquidity stress indicator: the more negative it is, the tighter repo funding conditions are perceived to be.

Following the Fed’s policy decision this week, that spread hit minus 11.5 basis points (bps) for the November contract, a record gap. For December, the spread dropped to minus 12.5 bps, also an all-time low.

The numbers suggested that investors in the futures market expect SOFR to trade 11.5 bps and 12.5 bps higher, respectively, than the fed funds rate by the end of November and December.

FED COULD HAVE DONE MORE

“The market was largely priced in for an announcement on the end of QT, and we got that, but we didn’t get anything that was out of left field for dovish risks,” said Jan Nevruzi, U.S. rates strategist at TD Securities in New York.

“The Fed ended QT with a month delay, so that doesn’t really help for November. We also didn’t get anything that was a surprise on the upside: they could have said … that they’re also thinking about reserve management purchases, which could have meant another $20, $30 billion a month in reinvestments.”

Repo rates are also currently elevated due to the end of the month on Friday, which also happens to be the end of the year for Canadian banks, making funding tight for a non-quarter reporting period like October. Analysts said Canadian banks are lenders in the U.S. repo market.

Overnight rates tend to spike at the end of the month, quarter or year, as primary dealers, mostly large banks, withdraw from acting as middlemen in repo transactions due to higher balance sheet costs that make them look bloated during those reporting dates.

Pressures in repo markets are also largely due to aggressive bill issuance by the Treasury to build its cash balance after the U.S. debt ceiling was lifted over the summer. The increased bill issuance has raised the need for repo financing to absorb all those Treasuries in the market.

“I don’t think QT would have had much of an immediate effect on repo rates whether you ended it or not,” said Joseph Abate, head of rates strategy at SMBC Nikko Securities in New York.

Yet the Fed’s planned reinvestment of MBS proceeds into T-bills was not a surprise.

Dallas Fed President Lorie Logan, who previously ran the New York Fed’s open market operation, had suggested in a speech in February this year that the central bank’s portfolio of Treasuries was significantly overweight longer-term securities and underweight short-dated bills. She noted that moving toward a more neutral mix would mean holding relatively more bills.

T-bills are currently just less than 5% of the Fed’s Treasury holdings.

“A bill-heavier portfolio can do more maturity transformation trades where you replace the bills as they run off with longer-dated securities which bring down term rates,” SMBC’s Abate said.

An increase in bill holdings enhances the Fed’s operational flexibility and helps minimize the portfolio’s unintended influence on market rates beyond its QT objectives, he added.

Trump says Christians face “existential threat” in Nigeria, adds country to watch list

WASHINGTON (Reuters) -U.S. President Donald Trump said on Friday that Christianity faces a threat in Nigeria and he was adding the West African nation to a State Department watch list.

“Christianity is facing an existential threat in Nigeria. Thousands of Christians are being killed. Radical Islamists are responsible for this mass slaughter,” Trump wrote in a post on Truth Social.

He said he was putting Nigeria, Africa’s top oil producer and most populous country, on a “Countries of Particular Concern” list of nations the U.S. finds have engaged in religious freedom violations. The list includes China, Myanmar, North Korea, Russia and Pakistan among others, according to the State Department website.

Trump said he was asking U.S. Representatives Riley Moore and Tom Cole, as well as the House of Representatives Appropriations Committee, to look into the matter and report back to him.