Someone sent me a link to an article in which the subject was how China was quietly destroying the dollar. It illustrated how China was using the yuan to transact directly with other nations, such as third world nations in Africa, eliminating the USD as a third party currency.

Here is my response.

Is the dollar really collapsing around the world?

While this may seem counterintuitive,

•Expanding trade deficits work to enhance and reinforce the US dollar as the global transaction currency.

•Narrowing trade deficits undermine the dollar as the global transaction currency.

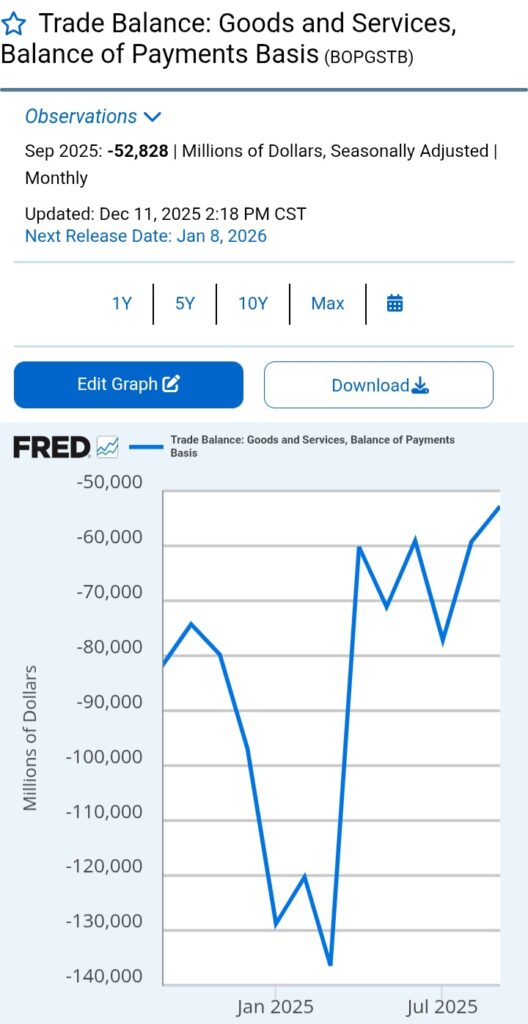

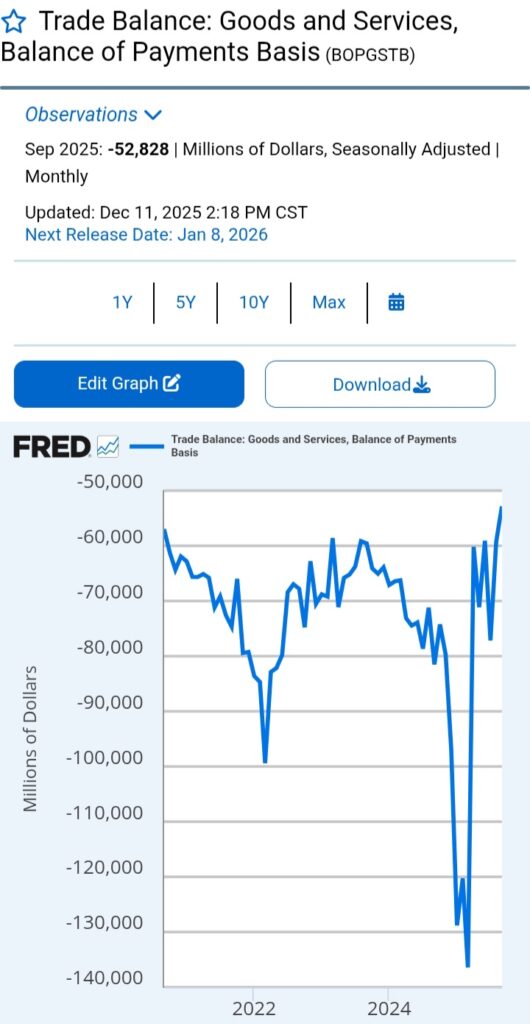

Since Trump has assumed office, the United States’ trade deficits have narrowed markedly. What was just economic theory is quickly becoming reality and the implementation of the tariffs are already having a profound effect. Furthermore, when we parse back the individual nation-state data, we observe a huge drop in the trade deficit with China.

I don’t get too caught up with the actual tariff rates coming from Trump. Rather, I observe a president who is attempting to create ostensible confusion, and it’s this uncertainty that is the catalyst for producers and suppliers to reshore or nearshore their factors of production.

In this regard, I see Trump as being successful in his endeavors to force supply chain participants to quit relying on China.

Why does a narrowing trade deficit undermine the dollar’s standing?

If the United States is no longer flooding the world with dollars, because of their narrowing trade deficits, other nation states will naturally try to find other currencies to replace the dollar for transactions. They have no choice, because there will be a supply deficit of dollars around the world.

Trump may say he wants a strong dollar, but by implementing a regime of protective tariffs, he is achieving conflicting results from his publicly stated goals. However, Trump’s handlers are not being foolish in this regard, but are being deliberate. I have to conclude that the ultimate geopolitical goals differ than what’s offered for public consumption.

Yes, it’s a matter of national security

In its aggregate, all of these actions only make sense if the Trump regime is attempting to enhance national security in anticipation of a wartime scenario.

Based on the actions of the Trump regime, I have to conclude that those in control here in the States want to emphasize the dollarization of the Western hemisphere, while effectively reducing the dollar’s role throughout Asia and elsewhere.

But, why?

If the Trump regime and the Department of War believe that a global conflict is imminent, the last thing they want to have hanging over them would be for the CCP to have too much leverage over the United States economy and by extension, the dollar.

By reducing the US bilateral trade deficit with China, as well as with Southeast Asia, US geopolitical strategists foresee less of an economic shock when the bombs start dropping.

We have to remember that if China’s trade surplus with the United States continues to shrink, they are receiving less dollars for payment. Naturally, the Chinese government is going to attempt to convince its other trading partners to begin accepting the yuan in lieu of the dollar.

This is not an easy process for China, as the CCP is loathe to run the necessary trade deficits that are required to flood the global trading system with the yuan needed to consummate international transactions.

Trump’s Western hemispheric actions make sense when viewed from this perspective

I suspect this is the true reason why Trump is insisting on removing current heads of state in Venezuela. This would go a long way in getting the entire Western hemisphere in line and using the US dollar exclusively. I also observe the recent shift to the right around Latin America as a very telling sign. These heads of state have all been told that war is coming and they best get in line.

Yes, it is now a matter of national security that the United States government begins to slash the trade deficit, while concomitantly eliminating the dollar for transactions in countries it deems as its existential enemy.

There is much more to this than meets the eye

The people who write these types of collapse talk articles are not seeing the bigger picture and are either panicking or are writing clickbait to scare the reader.

As global war gets closer, it’s in the best interest of the United States to remove the dollar as a transaction currency for nations like China, Russia, or SE Asia. The USD will serve its purpose for Oceania in a post-war environment.

I have to admit that whoever is handling Trump and working the circumstances behind the scenes are very intelligent. They are properly gearing up the United States for global conflict in an expedited fashion without setting off too many alarms.

World War III is coming soon. Let me explain.

In its gestalt, the recent actions of the United States government and its military make perfect sense if their geopolitical strategists are gearing for an upcoming global conflict.

Reduce reliance on existential enemies

First, as previously stated, it’s very important for the United States to reduce its reliance on foreign made goods, especially for those that affect its national security. Whether President Trump is acting unilaterally or according to a larger script is up for debate. However, if I were in charge and knew a war was coming, I would be promoting a very similar trade and economic policy.

Accelerate oil and gas production

Second, I also marvel at the ability of the United States to greatly accelerate its production of oil and gas at a critical time in the country’s history. The United States is by far the largest energy producer in the world.

Pastor Lindsey Williams and his WWIII prediction

Going back to the early 2000s, I recall how pastor Lindsey Williams would often remark that when World War III got close, oil and gas production in the United States would accelerate greatly and the United States could actually become a net exporter of energy.

Pastor Williams has since passed on, but as recently as a few years ago, Williams’s critics dismissed him out of hand. Unfortunately, he was right all along. The United States is now an energy powerhouse and is properly equipped to be energy self-sufficient during a global conflict.

Conclusion

Both of these factors are working to help the United States in its pursuit to ride out whatever comes it’s way during World War III.

Mark my words here, there are no mistakes and the powers here in the United States know exactly what they are doing.

So, is China slowly destroying the dollar? Of course not. The United States isn’t destroying the dollar either. Both nations are getting ready for global conflict. China doesn’t want to use the dollar and the United States truly doesn’t want China using the dollar either, because that would mean running large trade deficits with its existential enemy.

A huge upside surprise for GDP. Otherwise, a mixed bag.

Core Durable Goods Orders (MoM) (Oct)

Act: 0.2% Cons: 0.3% Prev: 0.7%

Core PCE Prices (Q3)

Act: 2.90% Cons: 2.90% Prev: 2.60%

Corporate Profits (QoQ) (Q3)

Act: 4.4% Prev: 0.2%

Durable Goods Orders (MoM) (Oct)

Act: -2.2% Cons: -1.5% Prev: 0.7%

Durables Excluding Defense (MoM) (Oct)

Act: -1.5% Cons: Prev: 0.1%

GDP (QoQ) (Q3)

Act: 4.3% Cons: 3.3% Prev: 3.8%

GDP Price Index (QoQ) (Q3)

Act: 3.7% Cons: 2.7% Prev: 2.1%

GDP Sales (Q3)

Act: 4.6% Cons: Prev: 7.5%

Goods Orders Non Defense Ex Air (MoM) (Oct)

Act: 0.5% Cons: Prev: 1.1%

PCE Prices (Q3)

Act: 2.8% Cons: 2.9% Prev: 2.1%

Real Consumer Spending (Q3)

Act: 3.5% Prev: 2.5%

The big upside surprises to the trade balances have definitely helped. Consumer spending also surged. Insurance premiums and healthcare costs a huge chunk.

$100.00 for AG pretty soon!

Look at Platinum! Everything is on fire. I cannot believe what silver is doing.

We know war is getting close when the precious metals essentially lose the ask.

With the consumer spending and economy rocking stats, one would never know war is around the corner. I was thinking about getting an IRA, but in the back of my mind, I feel there is going to be a financial reset. Where we the commoners all have our savings and investment accounts deleted and have to start over from zero. I still have a ways to go before I can retire, so why bother saving up, the gloom is real. I should just start spending and enjoying my money, take myself to zero, then apply for all the welfare freebies.

It is interesting that you are suddenly gloomy when just a short time ago you implied that the reset was bunk. Why the sudden change of heart? Do you think the possible reset is suddenly not a hoax anymore. Before you were saying everything is a hoax. What a change of heart. Seems like Stone is seeing eye to eye with you as well.

Stone and the commenters on this blog have been very interesting and helpful. This blog should be more popular especially compared to all the politically correct stuff out there. I think when something happens with the issues discussed on here, many commenters on here come to the blog and want to know Stone’s and every ones opinion.

I never said “everything” was a hoax. I didn’t say a future reset was bunk. I mentioned that I don’t think guillotines will be used, and that mass death doesn’t have to happen for a financial reset. I do think the digital cashless system is going to happen, and wonder if we have to start over or will our savings be converted to the new digital apparatus. There doesn’t even need to be a big nasty event to make the changes. The new system could be professionally introduced. But the way the powers that be work they always have an event that sets it off. Yet even after the Covid event, 911/Iraq conflict, and the 2008 plunge, the wheel in the sky keeps turning. I’ll probably get that IRA, might not next year.

Hey Stone, I was just checking out a FRED chart on (Net Domestic investment: Private: Domestic business (W790RC1Q027SBEA)

Looks like a good recession indicator and investment looks posted to plung. What you think?

It’s something worth looking at. I think it may be something more akin of a coincident economic indicator, rather than a leading one. However, if the GDP is still holding up nicely and this indicator does happen to take a sharp downward turn, I would expect there would be a greater chance of an economic contraction.

Take a look at this indicator.

We can see that over the decades of offshoring manufacturing capacity, this ratio has steadily declined. It shows how much of the nation’s GDP as being devoted to private investment and productive capacity. We can see that during the depths of the covid recession, net investment actually fell below zero as depreciation turned out to be greater than investment.

I would expect to see this ratio begin to climb if more factories are being built.

Interesting. Each leg down is generally greater than the previous one and the highs are not as high as previous. So if the pattern holds, the next down could go past -0.01 which as you said is a big contraction. More reason for the Fed to accelerate buying government debt and lower rates right?

Perhaps. I am hoping to see net investment and this ratio rise as the trade balance improves.

Where and how does the synagogue of Satan, the international banking cartel fall into these scenario?

All of it gets the kosher seal of approval. All of these stressors will culminate in war. The great unraveling of the global order and shift towards nationalism will be the blame for the war.

War is reset!

There does seem to be a slowly growing white nationalist movement coming. It seems many younger whites are waking to their extinction.

Well Steve, this is why I have my blog. There is no other reason for me to have this site, but to try to educate those of my people who are trying to find the truth out there.

I just so happen to have a background in economics, but I have been studying the written word for a long time now. I know the truth behind the written word and it has to do with my people.

I’m just trying to provide another outlet for my people to stop by and learn while we live in a sea of darkness and my people are under a direct existential threat.

The prophets all talked about this reality that this blog describes, and once a person who is seeking the truth stumbles upon this site and the few others that are out there, the entire Bible and the other books associated with the written word all makes sense. It will make perfect sense.

That’s all I care about. I don’t think I have many years left. I have nothing to gain, but I get a sense of comfort by maintaining this site. I have not one person in my life who cares to hear anything I have to say. They actually hate what I have to say. This is why I reach out to those special few through the Internet.

Yes indeed! A noble undertaking in this end time!

Jeremiah 32:30 For the children of Israel and the children of Judah have only done evil before me from their youth: for the children of Israel have only provoked me to anger with the work of their hands, saith the YHVH.

Very clearly, the house of Israel is distinct from Judah. That should make people think.

Moreover, Jeremiah prophesied decades after the northern kingdom was taken into captivity. They were the Israelites, since Ephraim and Manasseh were both called the house of Joseph. They were given the name Israel. Not the southern tribes. In this instance, Jeremiah’s prophesy about the last days as well as the coming punishments of Judah and Benjamin, the southern kingdom.

Jeremiah is a latter days or a last days prophet. The same goes with most of the others in what we call the old testament.

Precisely!

Too humorous.

https://www.zerohedge.com/political/dna-evidence-proves-first-black-briton-was-actually-white-girl

I know it’s supposed to come off as being funny, but I find it very sad. The demoralization campaign against us is terrible and truly, we like kind people are the only ones who can really solve the mess.

The ones being persecuted are actually the ones who have the ability to destroy the enemy. No Orientals in any Nation, no Indians, no Schvartzes anywhere, no Hispanics of any kind, etc. can solve the mess the globe is in.

The only people who understand the enemy and have the answers are the actual ones being persecuted. I find nothing humerous anymore. I actually find it tragic that there are people of our own race who worked to destroy us. These articles just work to desensitize, humiliate, and acclimate us to the inevitable.

This is just another reason why I know the Bible is the true source for everything, along with its accompanying books. The true enemy parades itself as the God’s chosen, the Jews, while the true Israelites, who built the world, are being destroyed.

The Cain Esau Jew synagogue Constantine clan are the real enemies. They created religious communism and are spreading political communism around the world and is being embraced by almost everybody.

It’s tragic. It’s truly tragic.

Hoses 4:6 My people are destroyed for lack of knowledge: because thou hast rejected knowledge, I will also reject thee, that thou shalt be no priest to me: seeing thou hast forgotten the law of thy God, I will also forget thy children.

This directly ties rejecting YHVH to our current calamity. This is “the” reason for our tragic dilemma!

So Marco Rubio gets it! Secretary of State Marco Rubio has fired a direct shot at Europe’s globalist trajectory, warning that unchecked mass migration and erosion of core values could shatter the “shared culture” binding the West together—and weaken ties with America.

Maybe he’s a Nationalist

dallasexpress.com/business-markets/fedex-wins-2-2b-federal-contract-then-hires-hundreds-of-h-1b-workers-while-laying-off-americans/

Unacceptable!

Declaration of Independence We hold these truths to be self-evident, that all men are created equal.

All men meaning the white colonists were equal to king George. It has nothing to do with other races.

Just look at the nation of Liberia for a glimpse into what other people’s have tried to do when they attempted to duplicate the form of government of the United States. The schvartzes are hopelessly cursed.

The formation of the United States was solely designed for European Caucasian Israelites, because they understood. There is no other race of people on the planet that can form a country like the United States. The other races only know how to destroy it, which they are in the process of doing. All of the other forms of humanity eventually will form dictatorships.

https://x.com/i/status/2001880217376395452

Look at the way Trump is handled physically.

That’s o.k. Mr. Levin is a fellow believer, if you know what I mean!

Excellent price data this morning. Even Philly Fed prices paid dropped more than expected. Unemployment data coming in largely as expected.

Core CPI (MoM) (Nov)

Act: 0.2% Cons: 0.3% Prev: 0.2%

Core CPI (YoY) (Nov)

Act: 2.6% Cons: 3.0% Prev: 3.0%

CPI (MoM) (Nov)

Act: 0.2% Cons: 0.3% Prev: 0.3%

CPI (YoY) (Nov)

Act: 2.7% Cons: 3.1% Prev: 3.0%

Core CPI Index (Nov)

Act: 331.07 Prev: 330.54

CPI Index, n.s.a. (Nov)

Act: 324.12 Cons: 325.13 Prev: 324.80

Initial Jobless Claims

Act: 224K Cons: 224K Prev: 237K

Jobless Claims 4-Week Avg.

Act: 217.50K Prev: 217.00K

Continuing Jobless Claims

Act: 1,897K Cons: 1,930K Prev: 1,830K

Philadelphia Fed Manufacturing Index (Dec)

Act: -10.2 Cons: 2.5 Prev: -1.7

Philly Fed Business Conditions (Dec)

Act: 41.6 Prev: 49.6

Philly Fed CAPEX Index (Dec)

Act: 30.30 Prev: 26.70

Philly Fed Employment (Dec)

Act: 12.9 Prev: 6.0

Philly Fed New Orders (Dec)

Act: 5.0 Prev: -8.6

Philly Fed Prices Paid (Dec)

Act: 43.60 Prev: 56.10

Russia Will Be Paying for Its War on Ukraine Long After It Ends

Bloomberg News

(Bloomberg) — Russia will be paying for its invasion of Ukraine for years to come even if the fighting ended tomorrow, as the government plugs a widening gap in the military budget with increasingly costly borrowing.

As US President Donald Trump pushes for a deal to end the war, the future bill for Moscow keeps growing. In one of the final bond auctions of the year, the government on Wednesday issued 108.9 billion rubles ($1.36 billion) in debt known as OFZ, taking the total for 2025 so far to 7.9 trillion rubles, sharply surpassing the previous record set in 2020 during the Covid-19 pandemic.

Back then, the central bank’s key rate was as low as 4.25%, while it reached a record 21% a year ago. Even after the Bank of Russia began cutting borrowing costs in June, to 16.5% now, money has remained extremely expensive for households, businesses and the state.

Moscow had little choice but to ramp up bond sales after more than half of its rainy-day reserves were depleted and the budget deficit widened amid a 30%-60% surge in military spending and slumping commodity revenues including from oil and gas.

Russia’s military spending climbed to 7.3% of gross domestic product this year, with 2.2 percentage points of the outlay unrelated to the war in Ukraine, Defense Minister Andrey Belousov said Wednesday at a meeting with President Vladimir Putin. Based on the Economy Ministry’s GDP estimate for this year, total defense outlays exceed the original budget target, reaching about 15.8 trillion rubles including roughly 11 trillion rubles spent on the invasion.

While budget outlays on defense over the next three years are forecast to remain nearly flat, debt-servicing costs will keep climbing and outpace the cumulative increase in the military budget since the start of the war in 2022, Bloomberg calculations show.

Debt-servicing costs now account for twice the share of total spending they did before the war and, in nominal terms, already exceed budget allocations for healthcare and education. Starting next year, they’ll surpass combined government spending on health and education, climbing to the fourth-largest item in the budget alongside national security.

If debt costs rise ahead of the budget plan, the government will have to cut back elsewhere to avoid widening the deficit, said Natalya Milchakova, lead analyst at Freedom Finance Global. Social spending will have to be protected “in any weather,” but funding for national projects and economic-support programs may be at risk, she said.

Debt-servicing expenditures are set to increase by almost 40% this year and more than 20% next year, according to the budget law.

That’s being driven both by rising debt levels and the increasing share of floating-rate bonds and new high-yield bond issues in the debt structure, said Andrei Melaschenko, an analyst at Renaissance Capital. The government was “too optimistic” about expected economic growth and revenue this year, he said, and shortfalls in both oil-and-gas and non-energy income now have to be covered with borrowing.

Russia was forced to more than double its bond sales target for the last quarter to 3.8 trillion rubles from 1.5 trillion, primarily in long-dated bonds with maturities over 10 years. At some auctions, fixed-rate OFZs were sold with a yield premium of up to 20 basis points over the secondary market, according to the Bank of Russia.

In early November, the ministry returned to issuing floating-rate bonds to meet large borrowing volumes and, for the first time in history, placed sovereign bonds denominated in Chinese yuan.

The list of risks facing the budget in coming years is long. It includes weaker-than-expected revenue due to lower oil prices, a stronger ruble and growth falling short of forecasts as the economy slows, as well as higher spending linked to military operations.

A slowdown or pause in the Bank of Russia’s easing cycle is also possible, as policymakers remain uncertain whether inflation will move sustainably toward the 4% target next year. That would add further pressure, given that most of Russia’s debt is domestic, with roughly half tied to floating-rate bonds.

The budget assumes a ruble rate of 92 per dollar and Urals oil at $59 in 2026 — levels that now appear highly optimistic, according to Sergey Konygin, chief economist at Sinara Bank. Revenue shortfalls could push the deficit to 5.2 trillion rubles, versus the Finance Ministry’s forecast of 3.6 trillion, he said.

If the central bank keeps its key interest rate elevated for longer and oil and gas revenues decline, Russia faces a stark choice: raise taxes, cut other spending, or increase borrowing, Konygin added.

While Russia’s debt burden may rise faster than the government plans, it’s still one of the lowest in the world, International Monetary Fund data shows. Debt-to-GDP ratio is expected to remain below 20% in the coming three years, while servicing costs of 9% of the budget and less than 2% of national income are regarded as comfortable thresholds by many economists.

“There is still a lot of room to increase public debt,” said Alexander Dzhioev, strategist at Alfa-Capital.

Still, “debt financing is a temporary but not a systemic solution,” he said. It doesn’t solve the long-term problem of filling the budget and leads to rising interest payments and reduced fiscal flexibility over time.

A government order approved this week adopted a different tack, though. It endorsed a forecast showing debt-to-GDP exceeding 20% starting in 2027 and climbing to nearly 70% by 2042, while Russia’s reserve fund is projected to shrink to just 1% of GDP from the current 6%.

While economists in Russia are divided on whether such a trajectory is financially sustainable, the more immediate challenge for the government is the rising cost of servicing its debt.

However the war ultimately is brought to an end, high interest payments are already locked into future budgets and, unlike military outlays, they can’t be cut.

North of the Boarder Carney is planning to quadruple the number of military personnel. This is another data point for you. This will just be the first traunch. Over the years I’ve see massive warehouse facilities being built on the northern prairies in industrial section of cities with no business or marginal type business being built and thought these aren’t being built for great north hottub and Uncle Weiners Chineseim emporium this are going to be used for armaments manufacturing. Just my intuition. These started being built 12-15 years ago. They make no sense for the commercial purposes they are currently being utilized for. This infrastructure always comes first cannon fauter is easy to organize and mobilize in a relatively short time. Makes me think alot of the AI build out is not as it appears. How could it be. Deepseek showed us that.

https://www.cbc.ca/news/politics/army-mobilization-canada-troops-9.7009323

Thanks for sharing. Very interesting.

Canada has to fire that woman. She says they are planning to plan. Sounds like an episode of Get Smart. Trump has been firing the women DEI hires.

Carney is an expert in monetary policy. He should deport the DEI dregs that bottom feed the resources and push the BoC to start up QE and devote the funds to the military.

The Trump regime says NATO members better start last year. Trump’s not stupid like most think. The fundamental attribution error isn’t working anymore.

Perhaps Canada will be lucky and the bombs coming from the north will miss it entirely. There’s a lot of empty land up north for Canadians to secure and I doubt the DEI Canadians will be mocking Trump when they need help.

The only thing really holding back a full scale invasion of NA is the 2A..This is why we are.seeing the Cain Esau Jew clan engineering these staged mass shootings. They all go on in gun free zones. They want the citizens broke, demoralized, and defenseless.

Correct! The 2 A is not about hunting. What country can preserve its liberties if their rulers are not warned from time to time that their people preserve the spirit of resistance. Let them take arms.”

– Thomas Jefferson, letter to James Madison, December 20, 1787

This was just announced, Carney involved and it will be run by the Peerage (His wifes family). He can let that broad twist in the wind planning to plan while the families steal the money.

https://www.cbc.ca/news/canada/toronto/toronto-bids-dsrb-military-bank-9.7019994

Oy… vey….

And the march towards war continues!

Looks like the CTFC has scheduled an emergency meeting today at 9 am to discus silver.. Time to rescue the likes of JP Morgan. Silver is on a tear and they can’t control it!

While they’re at it, they better figure out what to do with Platinum futures as well.

Speaking of bankers, There are two ways to conquer and enslave a country. One is by the sword. The other is by debt.

The modern futurists discussed how people would learn to love their servitude. It’s not conquest through the barrel of a gun, but rather, through eager acceptance. And this is for the most part, a universal concept on both sides of the dialectic.

EXCELLENT!

Excellent analysis! My question is how do lower fed interest rates play into this scenario? Perhaps lower interest rates primarily benefit the U.S.

If we think deductively here, lower rates help the domestic economy, while adversely impacting the US dollar in the international markets.

The logic is simple. Lower domestic rates obviously will help the economy and investors.

Lower interest rates makes the US dollar less attractive vis-à-vis alternatives. While the US dollar still has a decent yield advantage versus its major competitors, every time the FED drops rates the dollar is affected.

In order for the FED to continue allowing the federal government to finance its ballooning deficits, it must lower overnight rates and in order to do that, it must start buying treasuries in large quantities. This is why the FED decided to buy at least $40 billion dollars a month in short-term treasuries.

As I’ve commented in the past, the US Treasury will announce an emphasis on financing over the shorter term instead of financing through notes and bonds. The US Treasury hopes to lessen the supply of 10s and 30s, which should translate into a flattening yield curve.

Ipso facto lower interest outlays, while the DoW gears up.