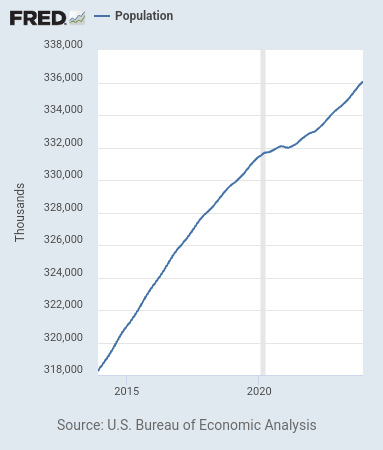

Population levels as well as the costs of living keep rising

Despite Deagel.com predictions of a 70% die off in the United States by 2025, it is becoming abundantly clear that none of this is happening. Moreover, population growth has reverted back to its longer trend post-covid. The absolute increases in population seem to be intact, although on a relative basis they are diminishing.

Over the past 10 years, the population of the United States has climbed by 18 million and stands at just over 336 million as of the end of December 2023. Where do you think all these sad sacks are going to live? They are all living in a van down by the river and so are the disenfranchised native populations.

With open borders, SFR landlords are raking in the dough. Cash flows keep climbing. Moreover, all of these soulless consumers keep consuming and build the balance sheets of the biggest and most influential publicly traded firms. The people can no longer control their spending and freely give their money to the shareholders of these companies.

Harvard University whitewashes homelessness causes

I provide the reader with a copy of the latest report from Harvard University.

AMERICA’S RENTAL HOUSING 2024

JOINT CENTER FOR HOUSING STUDIES OF HARVARD UNIVERSITY

Of course, Harvard’s findings will avoid the obvious contributing factors, such as open borders and prior government regulations, like rent and eviction moratoriums as well as unchecked fiscal deficit spending as being the root causes for housing unaffordability.

Rather, Harvard concludes that the lack of increased federal funding, institutionalized racism, climate change, and a rollback of eviction and rent moratoriums are major stumbling blocks. While the report accurately portrays the problem, it only provides solutions and suggestions that ultimately make the matter worse for renters (and better for landlords). As long as this report is taken seriously, rental supply will continue to lag demand.

Another alt-financial non sequitur

Why would the alt-financial media not recommend SFR investing if they are aware of the federal government’s desire of diluting the Caucasian race’s influence by overwhelming the borders with low-end demographics? These newcomers will never own a house, and are incapable of the responsibilities. All they do is jack up the costs of housing and rents for everyone else.

With open borders and spending schemes via COVID stimulus and the Inflation Reduction Act, which only raise inflation, any reasonable man could have predicted the outcome. This blog could have written the following article four years ago.

Record number of Americans are homeless amid nationwide surge in rent, report finds

Eviction moratoriums and government policy encourage homelessness

Recall how the government clamped down on tenant evictions during the manufactured covid crisis. While ostensibly helping tenants navigate the depths of the pandemic, It ultimately hurt them in the long run. Landlords are now loathe to rent out properties to applicants with less than stellar credit and backgrounds. This now leaves a whole swath of demographic unable to procure proper domiciles. Of course, none of the circumstances were from chance. One crisis begets another.

Unfortunately, I do not see any of these trends reversing for at least several more years. Unless there is a catastrophic loss of life, deagle.com will be proven wrong and many people will find it increasingly difficult to pay for their costs of living.

At this point, the only circumstance that cost burdened tenants can hope for would be for us to experience a deagle.com-type of die-off to ease housing demand.

2027, the year the prophecy of the popes will be fulfilled

Stay away from socialist blue areas if you want to invest in residential rental properties. Those areas are money losers for landlords as tenants don’t pay and the laws favor these deadbeat tenants.

https://nypost.com/2024/02/06/news/squatters-take-over-1200-homes-in-atlanta-terrorize-neighbors/

It’s always the blacks with a chip on their shoulder. They want to stick it to the man. Actually, their level of consciousness isn’t that high to get to that point.

I apologize for not posting much anymore. I don’t get much traction on the internet under this website and I feel it’s just not worth it right now. I don’t have people asking me questions nor posting comments. I had so many problems and had to close down the other site. Daily Google searches on my name and parsing of all of my writings to see how one could be offended or embarrassed. Everyone around me is fully injected and maybe all of these problems will eventually take care of themselves on their own. They all have growing health issues. At my age not looking to deal with big life changes.

Be careful about your life choices.

Take it to the Lord in prayer before making serious life choices. Many choices can have lasting effects that are difficult to shake off unless you make harsh changes. God has wisdom unlike humans to see the consequences ahead and guide you accordingly. I prayed to God about considering the Covid vaccines and I received a resounding message to avoid them at all costs. Now you and I see the consequences of these vaccines that come from the depths of hell.

I am so grateful that I heeded the Lord’s guidance.

My vaccinated and dying folks are grateful too because I have the health and energy to look after them. They still don’t acknowledge that the vaccine sparked my father’s cancer. My dad’s and my sister’s health started declining soon after their first Covid shots. I don’t feel as much of an obligation to care for my sister as she wanted to isolate me for not getting the Covid shot whereas my folks accepted my choice.

These days I am not taking any vaccinations period because they are probably adding a lot of garbage to the other vaccines even though they use more traditional methods. Studies have shown vaccines of any kind just don’t work.

You have to remember Christ was rejected before all of us. Being rejected by this world is a badge of honor. A martyr is an express ticket to be with Christ and the Saints. He who endures to the end will be saved. That does not mean a life of luxury and riches – for those are things of this world. Satan promised Christ all the nations if He only would bow down to him and of course Christ rejected that. All of us are weak when it comes to living a true Christian life.

Amen

Your not alone hang in there.

https://youtu.be/_SF9xrCtdgE?si=wzFRvIUkoKcS__j-

Blackstone also ponies up $3.5 billion for more SFR action….

Ex-Goldman Partner’s Pretium Nears $1 Billion for Bets on Single-Family Rentals

(Bloomberg) — Pretium, led by former Goldman Sachs Group Inc. partner Don Mullen, has raised nearly $1 billion for a new fund to acquire rental homes from builders.

The firm has been gathering capital and expects to exceed its target when the fund closes later this year, according to people familiar with the matter who asked not to be identified citing private information.

Pretium is already using the new fund to buy homes in its existing markets and can buy properties that aren’t immediately cash-flow positive, said one of the people.

A representative for Pretium, which has more than $50 billion in assets under management, declined to comment on its fundraising. Separately, the firm said in a statement Tuesday that it has invested more than $2.5 billion to buy and develop purpose-built rental homes.

Pretium’s fundraising effort is one of the latest signs that investors have developed other ways to buy homes, such as from builders, as a rapid increase in borrowing costs since 2022 has cooled purchases of existing properties. In January, Blackstone Inc. announced plans to buy Tricon Residential Inc., which owns some 38,000 US rental homes.

Read More: Blackstone Dives Deeper Into Housing Bet With $3.5 Billion Deal

A persistent housing shortage is driving demand, coupled with a demographic shift that is leading young families to trade downtown apartments for suburban homes, according to Josh Pristaw, Pretium’s head of real estate. That’s pushing Pretium to buy homes from large builders, focusing on three- and four-bedroom properties with backyards and two-car garages.

Pretium is also extending loans to smaller builders, filling a hole caused by a pullback from regional banks.

“When people form new households, they tend to want a single-family experience,” Pristaw said in an interview. “We see a tremendous opportunity to continue doing what we’re doing.”

Be on the loop for “unforseen” Fed rate cuts and/or QT halt. Banks still in a tenuous position. Come on, manufactured crisis….

Of course, the huge ongoing and growing spike in Alzheimer’s like symptoms are a direct result of the mRNA bioweapon injections and the resulting amyloidosis that these accelerated death injections cause. But the DoD, which organizes and controls the MSM news feed, needs to redirect the livestock. It works great.

___________

Nose picking likely ‘partially’ to blame for Alzheimer’s disease: scientists

https://nypost.com/2024/02/04/lifestyle/nose-picking-likely-partially-to-blame-for-alzheimers-disease-scientists/amp/

There was a time when we could berate employees and admonish sales staff for standing around picking their noses. Then we all got sensitivity training and jettisoned the Morris Massey school of motivation with his “Significant Emotional Event”™. Now everyone is getting alzheimers.

They are making cover excuses to cover up the fact that the mRNA vaccines are causing increasing brain fade and increased health issues. I see brain fade around me on a much higher extent than 4 years ago. The elephant in the room is so big and scary that nobody wants to acknowledge it.

MarketWatch

Powell tells ’60 Minutes’ the economy’s strength allows Fed to be careful about rate cuts

‘The time is coming’ for cuts, Fed chair says

Federal Reserve Chairman Jerome Powell on Sunday said that the strength of the economy allows the Fed to be “careful” in deciding when to cut interest rates.

“With the economy strong…we feel like we can approach the question of when to begin to reduce interest rates carefully,” Powell said, in an interview aired on CBS News’ “60 Minutes.”

The Fed chairman stressed the central bank is “actively considering” when to go forward cutting rates and wouldn’t wait until inflation got back down to the 2% target.

“My colleagues and I are trying to pick the right point at which to begin to dial back our restrictive policy stance,” Powell said. “That time is coming.”

The Fed is trying to balance the risks of cutting too soon, which might risk the progress made on inflation and cutting too late, which could lead to a recession.

“The prudent thing to do is to just give it some time and see that the data continue to confirm that inflation is moving down to 2% in a sustainable way,” Powell said.

Last week, the Fed policy statement said the central bank wanted to be more confident that inflation is moving down toward its 2% target.

Powell later told reporters that it was unlikely that the committee would reach that level of confidence by the time of the March meeting, which is in seven weeks.

The Fed chair repeated those comments in the interview.

A March rate cut “is not the most likely or base case,” he said.

Powell noted that only “a couple” of the 19 top Fed officials don’t want to cut interest rates at all this year. That means there is overwhelming support for cuts.

“And so, it is certainly to base case that we will do that,” Powell said. “We’re just trying to pick the right time, given the overall context.”

In December, the median forecast of Fed officials was for three rate cuts this year. Powell told “60 Minutes” that he didn’t think these forecasts had changed.

But Powell was interviewed before the strong January jobs data, which showed 353,000 new jobs were created, much higher than had been expected.

After the strong job report Friday, traders in derivate markets see over a 70% chance that the first rate cut is in early May. They foresee five quarter-point rate cuts this year.

The yield on the 10-year Treasury note BX:TMUBMUSD10Ymoved higher in trading on Sunday night.

Powell faced rapid-fire questions from “60 Minutes” correspondent Scott Pelley. Here are some key points he made.

“The economy is in a good place and there’s every reason to think it can get better,” Powell said.

Asked if the Fed has “pulled off” a soft landing, Powell said “I’m not prepared to say that yet. We have work left to do on this.”

“Geopolitical risks” are the greatest threat to the world economy today.

In hindsight, the Fed should have raised interest rates sooner to combat inflation. “I’m happy to say that.”

The U.S. is on an “unsustainable fiscal path” and it is now an “urgent problem” that needs attention sooner rather than later.

The decline in the value of commercial real estate “appears to be a manageable problem” on large banks’ balance sheets. Smaller banks may be challenged and there may be mergers, or bank closures.

The possibility of a recession “isn’t all that elevated right now,” Powell said.

FHFA Housing Price index data look sad for first time buyers. Properties that are mortgaged with Federal agency debt, and comprise most of the SFR segment, continue to climb higher than the Case Schiller.

https://www.terminaleconomics.com/wp-content/uploads/2024/02/FHFA-price.png

The controlled right, led by the CIA assets of Alex Jones, Elon Musk, Tucker Carlson, and Joe Rogan, have led the followers into poverty. They somehow fail to recognize what a depreciating dollar does to income generating assets. Moreover they blame partisan politics and Obama, specifically.

Must have been injected with the mRNA bioweapon….

A Kentucky groundhog died on Groundhog Day — just days after predicting an early spring.

Major, a nearly 10-year-old rodent meteorologist living at the Second Chances Wildlife Center, peacefully succumbed overnight to heart issues brought on by his age, the center’s staff said.

https://nypost.com/2024/02/03/news/major-the-kentucky-groundhog-dies-on-groundhog-day/amp/

I come across all these YouTube videos with tens and hundreds of thousands of views that claim to know about the satanic system and its reach.

Yet they never discuss the synagogue and still claim the OT was written for the Jews. Schofield scholars are wilfully ignorant of the elephant in the room, thus they can remain married while keeping their jobs and standing in this society.

To all my Caucasian readers; I warn you, please skip pursuing college and university degrees. Don’t send your children there either. There they will learn to hate their white skin. Instead, become an electrician or HVAC tech. Start buying SFRs in their 20s and learn to be the landlord and rule over the mixed breed multicultural rabble…

Colleges and universities will shame their Caucasian students while saddling them with insurmountable debt burdens. Let the darker skinned people be socially engineered and become student loan debt slaves….

These darker skinned people will be less talented, but will have huge chips on their shoulders, gratis the MSM, corporate advertising, and colleges.

I know of electricians in the DC area making about $150k a year, and it’s not back breaking.

__________

‘Shameful’: Mike Rowe trashes college degrees, says Harvard grads are taking their ‘degrees off the wall’ — is welding, pipe fitting or HVAC a better path to six figures?

Higher education has traditionally been hailed as a crucial stepping stone to success, but TV personality Mike Rowe argues this belief is now out of date.

The host of “Dirty Jobs” recently added to the backlash against Harvard University, an institution once renowned for academic prestige that has been rocked by allegations of antisemitism and plagiarism.

However, his skepticism of academia extends well beyond Harvard to a “collective delusion” about the worth of a college degree. Here’s what Rowe has to say about a shorter, cheaper, safer road to wealth.

College as commodity

Rowe clarified his use of the term “shameful” in a followup interview with Fox.

“I’m not saying that there’s anything inherently shameful about getting [a four-year college degree], but I do think from a PR standpoint, something really interesting has happened,” he explained.

Rowe argues the traditional perception of a college degree — once a testament to one’s intellect, wisdom and knowledge — has drastically deteriorated.

“That connection no longer exists in the minds of many millions of parents,” Rowe said.

Instead, he believes, many parents now view a college degree as a mere commodity, mirroring the transactional attitude many universities have adopted toward their student “consumers.”

Other paths to six figures

These days, the cost of a four-year college or university degree can be incredibly steep, making it unattainable for some. Rowe was particularly harsh on tuition hikes that continued even during the pandemic.

“New York University raised its tuition during Zoom classes. At some point, you’ve got to look at the people who are paying the bills,” he said. “It’s almost like they’re being dared, right? It’s like, how much further will it go?”

The average annual cost of college in the U.S. — inclusive of books, supplies and living expenses — stands at $36,436 per student, according to the Education Data Initiative. That number has more than doubled since the turn of the century.

Amid these soaring costs, Rowe advocates for an alternative: learning a trade. His mikeroweWORKS foundation awards scholarships to students pursuing a career in skilled trades.

“In my little tiny world, we offer work ethic scholarships for kids who want to learn a skill that’s in demand. The foundation’s never been more robust. We’re giving away another million dollars at the end of the month for these kinds of scholarships,” he shared.

Hitting pay dirt

Rowe emphasized that while the trades are not always perceived as glamorous, they are essential.

“Welders, steamfitters, pipe fitters, heating, air conditioning, electric — our country is built on those things,” he said. “Whether they’re sexy or not, the opportunities exist. There’s a path to six figures and it’s shorter than you think.”

Wage data adds a lot of credibility to Rowe’s argument. Consider this: The National Association of Colleges and Employers reported an average starting salary of $61,871 for the college class of 2022.

Meanwhile, ZipRecruiter indicates that the average annual pay for a journeyman electrician — a status that typically requires four to five years of paid apprenticeship — is $65,880. For steamfitters, the average annual pay is $78,926.

Having spent 10 seasons of “Dirty Jobs” exploring the importance of hands-on work, Rowe expects the rest of society will soon come around to his way of thinking.

“The collective delusion surrounding the primacy of a four-year degree is tipping. And when it falls, it’s going to go splat,” he concluded.

One of my nephews came to visit this week-end. He is in the University circuit and won’t come out until he is 29 if he completes what he is planning. I can’t imagine trying to start life at 29 with basically no work experience, a pile of student debt, and a set of degrees that will most likely have absolutely no value in 5 years. I wished him luck, there was no point in suggesting an alternative. Vaxxed, boosted, and no energy. I have my doubts he will make it.

Headline non-farm payrolls look like a slam dunk home run. Not good for the bond markets.

Nonfarm Payrolls (Jan)

Act: 353K Cons: 187K Prev: 333K

Unemployment Rate (Jan)

Act: 3.7% Cons: 3.8% Prev: 3.7%

Average Hourly Earnings (YoY) (YoY) (Jan)

Act: 4.5% Cons: 4.1% Prev: 4.3%

Average Hourly Earnings (MoM) (Jan)

Act: 0.6% Cons: 0.3% Prev: 0.4%

Average Weekly Hours (Jan)

Act: 34.1 Cons: 34.3 Prev: 34.3

Government Payrolls (Jan)

Act: 36.0K Cons: Prev: 55.0K

Manufacturing Payrolls (Jan)

Act: 23K Cons: 5K Prev: 8K

Participation Rate (Jan)

Act: 62.5% Cons: Prev: 62.5%

Private Nonfarm Payrolls (Jan)

Act: 317K Cons: 155K Prev: 278K

U6 Unemployment Rate (Jan)

Act: 7.2% Cons: Prev: 7.1%

As we can see below from the link I provide, The Establishment Survey continues to differ greatly from the Household Survey. If I were concentrating on Household Survey data, I wouldn’t be as sanguine on the job markets.

According to the household survey;

•the civilian labor force DROPPED by 175,000.

•the number of employed people DROPPED by 31,000.

•the number of unemployed dropped by 144,000.

•the number of people not in the labor force dropped by 285,000.

•the Household Survey, whose numbers determine the unemployment rate, remains the same at 3.7%.

https://www.bls.gov/news.release/empsit.a.htm

When people are sick the active labor force will drop as sick people cannot work. Those looking for work will drop off because sick people do not feel like working. People in the labor force will also decline as they die off.

Increasing number of sick people also affect the productivity of healthy people as those healthy people have to take time off from work to tend their sick and dying relatives. I know this first hand as I am dealing with a sick and vaccinated father with turbo brain cancer. Sick people drain the energy of healthy people around them as the healthy relatives have to deal with extra chores and time in helping the sick family members.

That’s very sad to hear. I’m sorry. I went through a similar situation with my dad in 2007-2008. He had mesothelioma and I moved in to take care of him. He died in his living room chair.

Thank you for your consideration. I am sure I am one of many people these days who are dealing with sick family members. Very few of these people understand that the Covid vaccines brought on these health issues in addition to not protecting against Covid.

Fed’s Powell Will Discuss Interest Rates, Inflation on 60 Minutes Sunday

(Bloomberg) — Federal Reserve Chair Jerome Powell will appear on CBS News’s 60 Minutes this Sunday and will discuss inflation risks, expected rate cuts and the banking system, among other topics, the network said.

CBS announced his appearance on the social media platform X on Thursday, the same day that the interview was conducted. Powell last appeared on the program in April 2021.

The Fed, which left interest rates unchanged at a policy meeting earlier this week, is in the midst of a policy pivot. It’s moving away from the aggressive interest-rate increases of the past two years and turning to a period where it’s assessing when it can cut rates.

During a press conference following the Fed’s meeting Wednesday, Powell said that a cut is unlikely to come at the next gathering in March, which some market participants had been betting on.

The Fed chief expressed optimism at recent cooling inflation data, but said he’s concerned that prices fail to fully return to the central bank’s 2% target.

While Powell holds press conferences eight times a year after each Federal Open Market Committee meeting, the chair has often tried to reach Americans beyond financial markets to explain the central bank’s view of monetary policy and its goals. He discussed the economic recovery from the recession sparked by the Covid-19 pandemic in his 2021 appearance on 60 Minutes.

Here’s the current total public debt outstanding, according to the US Treasury’s Debt to the Penny.

$34,191,150,402,393.64

I read about Alex Jones saying that Obama and his cohorts wanted to destroy the international status of the US dollar and that overburdening it with debt would accomplish the task. He conveniently overlooks how the deficit spending trajectory escalated under Donald Trump and his pack of swamp action figures. The left and the right are just two sides of the same coin, a coin minted and flipped by the synagogue of Satan. Regardless whoever gets in, asset owners will claim a glorious victory, which will climb a wall of worry.

Tucker Carlson and Elon Musk as well as Alex Jones all have ties back to the CIA. Their families are knee deep in it and Jones boasted of his family’s Masonic roots. I don’t know who’s more of a sucker, the Libtards or the Trumpites.

“Unforeseen” drivers pushing inflation down the road

https://www.wsj.com/business/energy-oil/the-u-s-is-spoiled-by-cheap-canadian-oil-thats-about-to-change-bafe831a?st=oax1zttp1sgk761&reflink=article_copyURL_share

Current developmemt projects running into problems… there won’t be a mad rush for developers to initiate new projects in the short term

https://stocks.apple.com/ASIiRVz9oQXWBtp-KSlZhIQ

Treasuries Surge as Bank Stock Rout Rekindles Fed Rate-Cut Hopes

(Bloomberg) — Treasury yields tumbled Thursday as a second day of declines for US financial stocks led traders to price in a more rapid pace of Federal Reserve interest-rate cuts.

The US five-year yield fell as much as 9 basis points to 3.75%, the lowest since June. At the same time, traders priced in a larger total amount of Fed interest-rate cuts this year. Swap contracts indicated a slightly increased possibility of a March start, a day after that wager suffered a setback when Fed Chair Jerome Powell said it was unlikely.

Bank shares extended a decline that was sparked Wednesday by a small New York bank reporting a surprise loss and cutting its dividend — fallout from US commercial property losses that are expected to deepen. For investors, it evokes the rout in US regional bank shares last March that also drove haven demand for Treasuries.

While the scope of the problem is uncertain, “it negatively impacts banking lending, the lifeblood of our economy,” said Jack McIntyre, portfolio manager at Brandywine Global Investment Management. “Investors are buying Treasuries first, ask questions later.”

Banks that had predicted cuts would begin in March were abandoned that call after Wednesday’s Fed policy meeting.

Still, swap contracts that predict the outcome of future Fed meetings are priced for about 150 basis points of easing this year, with the first move fully priced in for May.

Some investors are concerned that the longer the Fed delays the rate cuts, the more risks the economy will slow and inflation may undershoot the Fed’s 2% target.

“If the ultimate outcome is that the Fed is resisting a rate cut the economy needs, we will see stress on market conditions and long yields fall,” Tim Duy, chief U.S. economist at SGH Macro Advisors, wrote in a note.

New York Community Bancorp tumbled as much as 15% on Thursday, extending its record 38% plunge Wednesday when it announced losses. The firm’s results sparked broader concerns about other small lenders’ exposure to the commercial real estate market. The KBW Regional Banking Index extended its two-day drop to as much as 11%, the most since March.

The renewed banking concern came just one month before the Fed is scheduled to wind down an emergency funding program for lenders. Launched during the banking crisis in March, the Bank Term Funding Program, allows banks and credit unions to borrow funds for up to one year, pledging US Treasuries and agency debt as collateral valued at par. The facility is set to close on March 11.

Despite the banking woes, the broad equity market is holding up with the S&P 500 Index gaining 0.4% for the day.

Earlier Thursday, data showed that US labor productivity advanced at a rapid pace in the fourth quarter, while the unit labor costs increased less than economists forecast. Meanwhile, a measure of US factory activity climbed to a 15-month high at the start of the year.

The moderate labor costs solidified the market’s expectation that rate “cuts are coming, even if growth remains strong,” said Gennadiy Goldberg, head of US interest-rates strategy at TD Securities.

Every data point is higher than consensus, even the ISM prices paid. That’s definitely moving in the wrong direction…

Manufacturing PMI (Jan)

Act: 50.7 Cons: 50.3 Prev: 47.9

Construction Spending (MoM) (Dec)

Act: 0.9% Cons: 0.5% Prev: 0.9%

ISM Manufacturing Employment (Jan)

Act: 47.1 Cons: 47.0 Prev: 47.5

ISM Manufacturing New Orders Index (Jan)

Act: 52.5 Cons: 48.2 Prev: 47.0

ISM Manufacturing PMI (Jan)

Act: 49.1 Cons: 47.2 Prev: 47.1

ISM Manufacturing Prices (Jan)

Act: 52.9 Cons: 46.0 Prev: 45.2

NRBO has great news. I picked up a thousand shares for some kicks. Already up. Could run, but I look to buy some more on weakness.

Excellent data dump this morning. Unit labor costs less than half of expected. Productivity higher and so is initial jobless claims. Bonds like them initially. Good data for the dovish camp.

Continuing Jobless Claims

Act: 1,898K Cons: 1,840K Prev: 1,828K

Initial Jobless Claims

Act: 224K Cons: 213K Prev: 215K

Jobless Claims 4-Week Avg.

Act: 207.75K Cons: Prev: 202.50K

Nonfarm Productivity (QoQ) (Q4)

Act: 3.2% Cons: 2.4% Prev: 4.9%

Unit Labor Costs (QoQ) (Q4)

Act: 0.5% Cons: 1.3% Prev: -1.1%

Bank of England says rates ‘under review’ as inflation to dip below 2%

Reuters

February 1, 2024 7:02 AM EST Updated 9 min ago

LONDON, Feb 1 (Reuters) – The Bank of England kept interest rates unchanged on Thursday, after officials split three ways on the right course for policy and Governor Andrew Bailey wanted more evidence inflation would return permanently to target.

Six out of nine members of the Monetary Policy Committee voted to keep rates at a 15-year high of 5.25%. Jonathan Haskel and Catherine Mann opted voted for a 0.25 percentage-point hike, while Swati Dhingra voted for a cut of the same size.

It marked the first time since August 2008 – early in the global financial crisis – that different policymakers have voted to move interest rates up and down at the same meeting.

“We need to see more evidence that inflation is set to fall all the way to the 2% target, and stay there, before we can lower interest rates,” BoE Governor Andrew Bailey said.

Economists polled by Reuters had expected one policymaker to vote for a rate rise, and for the remainder to vote to keep rates on hold.

In a softening of its language on the outlook for interest rates, the BoE dropped its warning that “further tightening” would be required if more persistent inflation pressure emerged.

Instead, the BoE said it would “keep under review for how long Bank Rate should be maintained at its current level”.

Officials at the U.S. Federal Reserve and European Central Bank have been more explicit that rate cuts are on the agenda.

Late on Wednesday the Fed said its rates had peaked and would move lower later this year.

The BoE reiterated that policy would need to stay “restrictive for sufficiently long” – even as it slashed its inflation forecast for the coming months.

However, considerably higher wage growth set Britain apart from its peers in driving inflation pressure over the longer term, the BoE said.

Annual consumer price inflation now looks likely to return to 2% in the second quarter of this year, albeit briefly, in a sharp downgrade of the BoE’s near-term outlook for price growth compared with November’s projections.

But the medium-term forecast – based on a much lower market path for interest rates than in November – showed inflation would rise back above 2% in the third quarter of 2024 and not return to target until late 2026, a year later than the BoE had forecast in November.

The BoE stuck to its view that Britain’s economy will struggle to generate much economic growth in the quarters ahead, despite a modest upgrade to the annual growth projections.

In a small boost for finance minister Jeremy Hunt, the BoE judged that his tax cuts announced in November would boost British economic output slightly in the years ahead.

But the central bank largely maintained its forecast for weak household income growth after tax and inflation – with the cost of living a key issue ahead of a likely national election this year.

Advertisement · Scroll to continue

Households’ living standards have fallen over the past two years due to high inflation, contributing to the electoral challenge facing Prime Minister Rishi Sunak.

Hunt is preparing a budget to be delivered on March 6 that is likely to include tax cuts in a pre-election bid to woo voters back to the Conservative Party, which is lagging badly behind the opposition Labour Party in opinion polls.

Earlier this week the International Monetary Fund warned Hunt not to cut taxes, due to high levels of public debt and growing demands on services, and trimmed its outlook for British economic growth in 2025.

10,000 illegals PER DAY pouring into the USA to REPLACE the American people.

https://www.brighteon.com/d5dc140b-9621-4a0a-a773-d76dce9eac6a

Do these illegals also have to take the COVID jab to get a Job?

Nope. They replace the natives already living (dying from extended release covid injections death) here. Pope Francis calls it replacement theology and is a necessary means to an end to replace the wicked white Westerners with dumb and docile lovers of social largesse and command control.

Own the assets and be the landlord to the low IQ multibreed populations. Own properties in LLC s and don’t tell anyone you’re Caucasian. Being white is evil. Being black and mulatto is a blessing, according to the synagogue of Satan.

The Italian late-night talk show Che Tempo Che Fa had a special guest on its Jan. 14, 2024 episode: the apostate Argentinian Jesuit Jorge Mario Bergoglio, marketed under his stage name ‘Pope Francis’.

Approximately 45 minutes into the show, Francis was asked about hell, that pesky dogma of eternal damnation for the wicked. The host, to all appearances quite sincerely, expressed his struggle to reconcile an eternal hell with an all-loving God:

Fabio Fazio: It is hard to imagine Hell, a Father that condemns eternally…. It is hard to imagine.

Francis: Yes, it is hard to imagine. This is not a dogma of Faith, what I am going to tell you, it is a personal thing of mine, which pleases me: it pleases me to think that Hell is empty. It is a pleasure. I hope it is a reality. But it pleases me.

It should slowly become clear to every Catholic that this monster is an antipope and that no obedience is owed to this man.

Illnesses and diseases of all types are escalating in the wake of the mRNA bioweapon injection campaign in which almost 80% of American adults received their injections.

It just so happens that PFE has the drug that the immunocompromised syphilitic people need.

__________

US Syphilis Cases Rise to Highest Level in More Than 70 Years

(Bloomberg) — Cases of syphilis, a debilitating sexually transmitted disease, are surging in the US and have returned to levels not seen in more than 70 years.

Infections rose 17% to 207,000 cases in the US in 2022, the Centers for Disease Control and Prevention said on Tuesday in a release of the latest data available. Annual cases hovered just above 30,000 two decades ago.

Rates of syphilis have been rising for years amid funding cuts to local public health agencies and transmission increases associated with more drug use and unprotected sex. In response, the Department of Health and Human Services, which oversees the CDC, initiated a syphilis task force last year that has focused on increasing testing and treatment.

“We need a whole country response,” said Jonathan Mermin, director of the National Center for HIV, Viral Hepatitis, STD and TB Prevention at the CDC. “There are no shortcuts.”

Syphilis can lay dormant in people for years and then cause medical problems, including blindness and even death. It’s particularly troubling if a pregnant woman gets infected because the disease can be passed to fetuses and babies with deadly effects. In 2022, congenital syphilis caused 231 stillbirths and 51 infant deaths, according to CDC data.

As part of its strategy to combat the disease, the CDC has also supported the development of a rapid syphilis test that could identify cases anywhere, an improvement over current tests in the US that require laboratories, Mermin said.

But even when patients are identified, they currently face a hurdle to treatment. The best medicine for syphilis is penicillin G benzathine, which is sold by Pfizer Inc. in the US under the brand Bicillin L-A, and it’s been in short supply since April because of high demand.

Pfizer has increased production and expects supply to normalize by June. The Food and Drug Administration also greenlit the importation of a version of penicillin G benzathine that’s approved in Europe but not the US.

About 50,000 doses are available, said Pavel Svintozelskiy, medical affairs manager for Provepharm, a company involved in the importation.

Only Drug

Penicillin G benzathine is the only drug that can prevent someone from passing the disease to a fetus, resulting in congenital syphilis.

To preserve Bicillin L-A for pregnant people, the CDC recommended that health-care providers treat others with a different drug, doxycycline. But that medicine is significantly less convenient. While Bicillin L-A can cure syphilis with as little as one shot, doxycycline requires weeks of taking a pill twice a day. Many people with syphilis are homeless or struggle with substance abuse, making it difficult to consistently take medication.

“We worry about compliance,” said Admiral Rachel Levine, HHS’s assistant secretary for health, who heads the national syphilis task force.

If someone doesn’t take the whole course of doxycycline, they might remain contagious and infect a pregnant person, endangering the fetus — a situation that wouldn’t have occurred with a ready supply of penicillin G benzathine. That happened at least once in Arizona, said Rebecca Scranton, a deputy bureau chief at the Arizona Department of Health Services.

“It is really concerning,” Scranton said of the penicillin G benzanthine shortage. “We’re still very much closely monitoring the situation.”

House prices data a mixed bag… FHFA data (SF prices with federal backed loans) still looking great. These are also the meat of the SFR market.

FHFA House Price Index (YoY) (Nov)

Act: 6.6% Cons: Prev: 6.3%

FHFA House Price Index (MoM) (Nov)

Act: 0.3% Cons: 0.2% Prev: 0.3%

House Price Index (Nov)

Act: 417.4 Cons: Prev: 416.1

S&P/CS HPI Composite – 20 s.a. (MoM) (Nov)

Act: 0.1% Cons: Prev: 0.6%

S&P/CS HPI Composite – 20 n.s.a. (MoM) (Nov)

Act: -0.2% Cons: Prev: 0.1%

S&P/CS HPI Composite – 20 n.s.a. (YoY) (Nov)

Act: 5.4% Cons: 5.8% Prev: 4.9%

Alex Jones says Elon Musk is our ally and is helping those who love our country and freedoms. Yet, all I see is a man who says he doesn’t mind going to hell, is working with the synagogue to electrify our transportation, sending up track and trace military hardware into space, and implanting subdermal brain chips… AJ is not our friend; neither is Musk nor Trump. All three are charlatans.

________

Barron’s

Musk’s Neuralink Implants First Brain Chip in Human

Elon Musk said late Monday that the first person has received an implant from his brain-chip start-up Neuralink and is “recovering well.”

Welcome to the future, it’s pretty terrifying.

Elon Musk said late Monday that the first human has received an implant from his brain-chip start-up Neuralink and is “recovering well.” Initial results showed promising neuron spike detection, in a post on X.

It’s a potentially significant breakthrough in the field of brain-computer interface technology and the development will also have implications for the tech sector.

Musk’s aim is for people to control smartphones and computers. Big Tech names such as the likes of Apple, Microsoft and others will undoubtedly be monitoring Neuralink’s progress even if they don’t plan to get involved in brain-computer interface technology for now.

In a separate post the Tesla CEO confirmed that Neuralink’s first product will be called ‘Telepathy,’ enabling users to control their phone or computer, and by extension any other device, “just by thinking.”

Musk referenced theoretical physicist Stephen Hawking, who died in 2018 after living for more than 50 years with a type of motor neurone disease, as an example of someone who could have benefited from the technology.

“Initial users will be those who have lost the use of their limbs. Imagine if Stephen Hawking could communicate faster than a speed typist or auctioneer. That is the goal,” he said.

The human trial, launched in September, sought —limited function in all four limbs. From its initial aims, the healthcare implications are clear and it’s easy to imagine that demand would be strong. The trial was only launched four months ago, so the company has reached this . It’s all still very futuristic, though, as the study will take around six years to complete.

There are also the obvious safety and ethical concerns. Recent artificial intelligence developments have sparked a debate around safety, and Neuralink’s breakthrough will undoubtedly do the same in the weeks and months ahead.

IMF Lifts World GDP Outlook on US Strength, China Fiscal Support

23 mins ago

(Bloomberg) — The International Monetary Fund raised its forecast for global growth this year on better-than-expected expansion in the US and fiscal stimulus in China, while warning of risks from wars and inflation.

The world economy will grow 3.1% this year, up from 2.9% seen in October, the Washington-based institution said in its quarterly World Economic Outlook on Tuesday. The fund kept its 2025 forecast unchanged at 3.2%.

Tighter central-bank policy to fight inflation and public-spending cuts in some countries are among the reasons why growth is expected to be slower than in the two decades before the pandemic, when it averaged 3.8%. Still, given the scale of the Covid-19 price shocks and the interest-rate hikes that followed, the IMF suggested things could have gone much worse.

“The global economy continues to display remarkable resilience, and we are now in the final descent toward a soft landing with inflation declining steadily and growth holding up,” IMF Chief Economist Pierre-Olivier Gourinchas said in a briefing. “But the pace of expansion remains on the slow side, and there might be turbulence ahead.”

Among the downside risks cited by the IMF are new commodity-price spikes caused by geopolitical shocks and global supply disruptions — such as attacks by Houthis in the Red Sea or a widening conflict in the Middle East — or more tenacious inflation that might force central banks to keep interest rates higher for longer.

The IMF’s forecasts assume commodities prices, including fuel, will drop this year and next, and that interest rates will ease in major economies. The fund’s economists factored in, for instance, that the Federal Reserve, European Central Bank and Bank of England will hold interest rates in the first half of this year before gradually reducing them as inflation slows.

The IMF said that inflation in the fourth quarter cooled more than projected as energy prices eased, and that it expects the deceleration to continue through 2025, bringing global inflation down to 4.4% from 6.8%. Advanced economies are estimated to see faster disinflation than emerging markets.

The fund repeated its warning about possible fragmentation of global trade into rival blocs, forecasting world trade growth of 3.3% in 2024 and 3.6% in 2025, below the historical average rate of 4.9%. Nations imposed about 3,000 new trade restrictions last year, almost three times the number in 2019, the IMF said.

For central banks, the IMF said that the challenge is to normalize monetary policy and “deliver a smooth landing, neither lowering rates prematurely nor delaying such lowering too much.”

The IMF is watching the possibility of an escalation of conflict in the Middle East and “we remain vigilant,” Gourinchas said. “At this point, the implications in terms of supply disruptions and what this might imply for overall inflation remains relatively limited.”

For the US, the IMF raised its growth expectation to 2.1% from a previous forecast of 1.5%, based on higher-than-estimated consumer spending at the end of last year. That still a slowdown from 2.5% growth in 2023 due to the delayed impact from the highest Fed rates in two decades, gradual fiscal tightening and a weakening labor market holding back demand.

The euro area’s growth forecast was cut to 0.9% from 1.2% previous, reflecting a weaker-than-expected outcome in 2023, which was due largely to the impact of the Ukraine war. The IMF expects European consumers to boost spending as the effect of higher energy prices subsides.

China’s growth projection for this year was revised up to 4.6%, from 4.2%, reflecting stronger growth last year and higher government spending to guard against natural disasters. India’s economy is expected to be among the fastest-growing in the world at 6.5%, up from a prior 6.3% forecast.

Russia is expected to expand 2.6% this year, up from an earlier 1.1% estimate, in part reflecting high military spending and private consumption.

Argentina was slashed to a 2.8% contraction this year, from the previous estimate of a 2.8% expansion made in October, before the election of President Javier Milei. The IMF cited a “significant policy adjustment” under his new government, which so far has included eliminating subsidies and price controls, devaluing the currency by more than half and proposing plans to shore up government finances.

Treasury Cuts Quarterly Borrowing Estimate to $760 Billion

1 hour ago

(Bloomberg) — The US Treasury reduced its estimate for federal borrowing for the current quarter, a move unexpected by many dealers, helping stoke rallies in bonds and stocks Monday.

The Treasury Department said that it now estimates $760 billion in net borrowing for January-through-March, down from a previous prediction of $816 billion released in late October. US debt managers kept their estimate for the Treasury’s cash balance for the end of March at $750 billion.

Treasuries hit their highs of the day after the release, with benchmark 10-year yields down about 7 basis points as of 3:30 p.m. in New York, at about 4.07%. The S&P 500 hit its high of the session, up 0.7% on the day.

“Because of the enormous debts and deficits being accumulated,” the Treasury’s announcements on borrowing plans are now market-moving events, Peter Boockvar, author of the Boock Report, wrote in a note Monday. The new borrowing estimate “has the Treasury market rallying and stocks following.”

The smaller borrowing need was driven by higher projected net fiscal flows, and having more cash on hand at the start of the quarter than expected, the department said in a statement. Treasury officials speaking with reporters declined to offer a breakdown on the improvement in fiscal flows relative to previous expectations.

Market Expectations

Many Wall Street strategists had anticipated a slight boost to the borrowing estimate, in part due to the fiscal deficit widening in recent months. Jay Barry, co-head of US rates strategy at JPMorgan Chase & Co., had predicted an $855 billion net borrowing figure for this quarter, assuming a $750 billion cash balance at the end of the period.

That wasn’t a universal view, however. Ira Jersey, chief US interest-rate strategist at Bloomberg Intelligence, was among those seeing a decline, and had forecast a net borrowing figure of about $700 billion.

While the Treasury is still facing rising costs to refinance its existing debt in wake of the Federal Reserve lifting its policy rate from near zero in 2022 to over 5%, yields tumbled over the past quarter as traders bet on a pivot to easing in 2024. A potential tapering, or end, of the Fed’s bond-portfolio runoff has also boosted sentiment — a shift that would also ease borrowing pressure on the Treasury.

The backdrop has most dealers expecting the Treasury on Wednesday to announce a final round of increases to note and bond sales, at its so-called quarterly refunding.

The Treasury’s cash balance was about $830 billion as of Jan. 25, down slightly from about $838 billion on Oct. 30, when the department released its initial financing projections for the quarter.

For the April-to-June quarter, the Treasury on Monday said it expects to borrow a net $202 billion, with a cash balance of $750 billion seen for the end of the period.

Dealers warn that there’s much more uncertainty regarding financing estimates for the second quarter. Along with the Fed’s plans for its quantitative tightening program, another unknown is prospects for Congress enacting a $78 billion tax bill — which would worsen the deficit.

“The outlook for the Wyden-Smith tax bill is a major swing factor,” and at present we “flipped a coin and decided to assume that the legislation would not be approved,” Lou Crandall at Wrightson ICAP LLC said in a note before the Treasury’s Monday release. He penciled in $410 billion for net borrowing for the three months through June, ending with a $750 billion cash balance.

I thought Deagel.com was extreme with predicting a 70% population reduction for the USA.

I only see two possibilities for that to happen by 2025:

1) A force majeure happens that causes massive destruction such as WWIII with nuclear weapons and/or a huge asteroid hitting earth.

2) The Covid Vaccine kill shot delayed side effects start going into overdrive to kill people off.

While the mortality rates have gone up, I still have yet to see the Deagel.com predictions start to happen. Most places I go are as crowded as ever to my disappointment. While most of humanity sucks, it looks like we will still have to deal with the hoards of masses who are asses for the time being. For now the earth will continue to be an overcrowded hell hole.

Fed’s Inflation Battle Hinges on Convincing Americans Price Hikes Are Done

(Bloomberg) — The way inflation has fallen toward the Federal Reserve’s goal with little cost to jobs has many convinced the central bank has won the battle. Victory, however, requires persuading people like Steve DelGiorno that price increases are a thing of the past.

DelGiorno’s restaurant group — Crema Concepts LLC in Danville, Virginia — has tried to hold menu prices stable over the past two years despite the higher cost of everything from paper cups to eggs. But he doesn’t think he can hold out much longer.

“Turkey, meats, roast beef, ham — it’s crazy. We have eaten as much margin as we can,” DelGiorno says. “What they are reporting is not what we are experiencing,” he says of the government’s inflation statistics.

Fed officials are expected to hold interest rates steady when they meet this week, but dramatic inflation progress in recent months has some predicting officials will start cutting borrowing costs at their subsequent gathering in March.

The inflation metric the Fed targets rose 2.6% in December from a year ago, much improved from the four-decade high of 7.1% seen in 2022. Policymakers’ preferred gauge of underlying inflation has slipped to its slowest annual pace in nearly three years, and widely watched measures of inflation expectations have fallen as a result.

But price shocks can have long echoes in the memories of consumers and businesses.

While inflation has eased, prices have not. Efforts by Americans to catch up to inflation — real or perceived — risk keeping the kind of price stability the US enjoyed for decades out of reach. That’s one reason why Fed officials have indicated they’re in no hurry to cut the benchmark lending rate.

Former Fed Chair Alan Greenspan described price stability as a world in which inflation is so low that neither businesses nor households factor price changes into their daily decisions. But it’s clear the more than 19% surge in consumer prices over the past four years continues to seep into Americans’ views about inflation.

Each week, polling firm Morning Consult asks households how much their incomes would have to rise to purchase the same goods and services they are buying today a year from now. While that measure peaked just above 8% in November 2022, consumers still say they’d need their incomes to rise 5.8% over the coming year to cover those same expenses.

“Consumer attitudes on inflation have improved as inflation has improved,” says Kayla Bruun, a senior economist at Morning Consult. “But overall, there is still a lot of price consciousness.”

“The consumer mindset around prices and inflation is not back to normal,” she says.

Michael Weber, an associate professor at the University of Chicago’s Booth School of Business, calls it “price nostalgia.” Consumers remember what they used to pay for eggs or an oil change. When they go to purchase that same good or service today, the higher price reignites the perception that inflation is high.

It doesn’t help that many prices continue to climb.

Though there are indications businesses are seeing more consumer pushback from price hikes, a net 25% of small businesses reported recently raising prices in a December survey from the National Federation of Independent Business. A third of owners expect to increase prices further in the next three months.

“People are still out there trying to increase prices at rates higher than pre-Covid levels,” says Richmond Fed President Thomas Barkin, who votes on monetary policy this year. He told reporters earlier this month that he will be watching business and consumer behavior carefully in the first quarter to see how they react to price hikes.

Cost Pressures

Alfonso Wright, the co-founder of Brooklyn Tea, says he would rather not raise prices on his customers. But his costs for items such as some Chinese teas have doubled while agave syrup is up about 30% over two years.

“In February we are going to raise some prices for the first time in five years,” says Wright.

In his view, inflation is far from over. Wright sees few barriers to the cost of rent or equipment repairs moving higher.

Wage growth, however, is one area that firms are beginning to see some reprieve. John Waldmann, founder and chief executive officer of the small business scheduling and payroll software company Homebase, says wage rates held steady in its database of more than 100,000 firms in December after rising 17% in the two years ending in 2023.

That’s just a brick on the road to price stability, but it’s an essential one that Fed officials have been looking for. “Things are starting to settle down,” Waldmann says. “The labor market is returning to normal.”

Judging when to cut rates as the economy slowly returns to stable prices is tricky, says Julia Coronado, founder of MacroPolicy Perspectives LLC. Fed officials may have to cut before that condition is in hand, or risk damaging the economy.

Rates may have to stay higher as officials wait for price nostalgia to fade, she says, “but they don’t need to be where they are.”

Communist tactic;

Create the crisis… child care costs skyrocket for day care from profligate fiscal deficit spending

React… People increasingly complain about the ever rising costs (purposely caused by the owners of the federal government)

Solution… Propose “free” government child care and day care to the people as an answer. Of course, it eventually will be modeled after Aldous Huxley’s Brave New World scenario. Its defenders will reason that it will be less expensive when measured against existing economic outcomes.

The MSM will position it, saying if a person doesn’t support this he or she will be like John the Savage in Brave New World

__________

The threat that high childcare costs pose to the US economy

https://finance.yahoo.com/news/the-threat-that-high-childcare-costs-pose-to-the-us-economy-124248273.html?guccounter=1

The irony is a household that has 1 parent work and 1 parent stay at home will have more children. More children means more economic output in the long run. If governments truly cared about growing their economies, they would be encouraging one parent to stay at home.

Here’s an example from Minnesota: https://www.startribune.com/dfl-early-learning-scholarships-child-care-middle-income/600330379/

If you walk around the Minnesota Twin Cities you’ll notice there’s a lot of families with just 1 child. And its rare you see a family with more than 2 children. The policies Minnesota implements to encourage family formation ends up hurting it.

I agree that more children create more economic output on a short term basis as there is more demand for baby items, clothes, toys, school, and etc. More people create more producers and spenders in the short run. However, resources and space are limited on this imperfect planet earth. More people create more demand for dwindling resources which drive up costs and ultimately curtail productivity as there is less to go around per person. When there is less resources per person then productivity ultimately drops off as less resources can be used.

I am amazed that earth as a whole has made it this far with 8 billion people. However most of those 8 billion are just getting by.