QE is dead, long live QE!

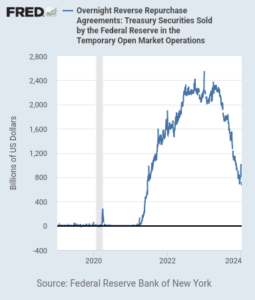

The RRP facility continues to show big drops in excess bank reserves at the FED, which is now down to $694 billion. Who will be around to buy up all that future UST stockpile? The Fed will have to stop its unwind, so the federal government can finance trillions in foolish multicolored largesse and wasteful tax credits on EVs and solar panels.

Does money grow on trees?

Don’t be fooled by the rantings in the alt-media. Money does indeed grow on trees… that is for the asset owners. The generated money all ends up in the balance sheets of the asset owners as the unilateral transfers from the Feds are spent by the multicolored rabble and the Federal agencies (DoD, GSA, NSA, USDA, FHA, etc.) and end up in the hands of those who can capture all that spending and money.

Wealth and power consolidation has never been more straightforward. Yet the alt-media and those who are unable to articulate the process, like Joel Skousen, quote Zerohedge and the Epoch Times and declare a collapse must follow as a result of all the craziness and greed.

What fools! Money does indeed grow on trees.

Here is a link to USTs Debt to the Penny site. Buy the assets to capture the money growing on the trees. The $34 trillion mark has been crossed…

$34,006,270,930,685.56

https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-penny

All of this fiscal deficit spending is spent and ends up on to the balance sheets of those who own the assets that can capture this spending. Socialism is the preferred method by the establishment as a means to consolidate their wealth and power over the unwashed masses. Socialism creates a populace of needy, dependent, and docile debt slaves.

As the banking liquidity mechanisms drain, the Fed will have to reassert itself

Below, I present you with a timely and unedited Bloomberg article concerning QT and how the Fed will need to cease its balance sheet unwind. After the RRP facility is drained, bank reserves will be considered to be too low, given the high public debt needs. In other words, who will be around to absorb all the additional debt if the Fed IOER and RRP facilities are drained and the Fed continues to unwind? There will not be enough savings available unless MM funds rates rise to attract buyers. The Fed must cease its unwinding within a few months by Springtime…

Forget Rates, Now Worry About the Fed Unwinding Its Balance Sheet

(Bloomberg) — The memory of a corner of the funding markets blowing up more than four years ago is still seared into the brains of many market participants. That episode will also be back of mind for the Federal Reserve as it attempts to halt its balance sheet runoff again.

This past week, the minutes from the latest Federal Open Market Committee meeting revealed that the Fed is already thinking about its balance sheet. But the last time the Fed attempted to slowly halt the process of unwinding its balance sheet — a process known as quantitative tightening, or QT, its efforts lasted only months before ructions in 2019 in the funding markets prompted a re-think.

During that episode, there was already evidence that bank reserves — a bellwether for how it conducts policy — were scarce. That is, financial institutions had just enough cash to satisfy regulatory and balance sheet needs. As a result, this exacerbated typical pressures when the combination of increased government borrowing and a corporate tax payment exacerbated a shortage of reserves. Overnight repo rates — widely relied upon by Wall Street to fund day-to-day operations — jumped five-fold to as high as 10% and order was only restored after the Fed restarted repo operations to stabilize the market.

While funding markets are nowhere near those extreme levels today, a number of recent events have caused some market participants to believe it’s time for the Fed to start thinking about ending QT. For starters, balances at the overnight reverse repurchase agreement (RRP) facility, which represent excess liquidity in the financial system, have fallen by nearly $1.5 trillion since June. Moreover, bouts of volatility at the end of November and December drove the Secured Overnight Financing Rate to new all-time highs.

As a result, in the minutes of the December Federal Open Market Committee Meeting released earlier this week, policymakers said it would be appropriate to begin discussing the factors that would guide the central bank’s decision to slow the pace of QT well before a decision has been reached.

“This is a very prudent step,” said Mark Cabana, head of US interest rate strategy at Bank of America Corp. “We very much worry that the lowest comfortable level of reserves is substantially higher than what the Fed had previously suggested it might be. It’s constructive that they’re starting these discussions now as opposed to waiting and needing to start them as money-market rates rise much more rapidly.”

The cautiousness exhibited in the minutes is an about-face from Chair Jerome Powell’s comments at the December post-meeting press conference. At that time, Powell had signaled he was comfortable with the current level of reserves and said the central bank would slow or halt balance-sheet reductions as needed to make sure they remain “somewhat above” a level the Fed considered “ample.”

For over 18 months, the Fed has been letting as much as $60 billion in Treasuries and as much as $35 billion in agency debt holdings mature every month.

By contrast, the last time the central bank attempted to shrink the size of its balance sheet in 2018, it was only letting as much as $30 billion in Treasuries and as much as $20 billion in agency debt run off — nearly half the size of the current plan. In May of 2019, the Fed slashed the reinvestment cap for Treasuries to $15 billion before eliminating the limit entirely in August, while continuing to let its mortgage-backed securities holdings roll down. That first era of quantitative tightening lasted less than a year.

The problem now is that it’s unclear how many reserves would constitute an “ample” level. Recent market angst and the central bank’s latest survey suggests that a reserve balances at $3.46 trillion may not be as ample as policymakers think, especially given many institutions suggest they prefer to hold a buffer of reserves to ensure they have enough liquidity.

At the same time, Wall Street strategists are hopeful a plan is in place before the Fed’s RRP facility is nearly empty. Bank of America’s Cabana is skeptical the Fed will be able to continue QT for much more than a quarter after the facility is drained, with the risk that policymakers will have to slow or stop the Fed’s balance sheet reduction in the second quarter. That’s in line with Barclays Plc’s outlook, with the Fed ending QT in June or July. Deutsche Bank AG analysts expect the slowing of the balance sheet unwind to coincide with central bank rate cuts beginning in June.

“Rather than risking a spike in funding rates as happened in 2019, we expect the Fed to err on the side of caution,” Barclays strategist Joseph Abate wrote in a note to clients. “This argues for stopping QT sooner with bank reserves perhaps still above $3trn and some lingering balances (of a few hundred billion dollars) in the RRP.”

Link to original Bloomberg article (and not behind paywall):

https://finance.yahoo.com/news/forget-rates-now-worry-fed-181213522.html

With Alex Jones, who promotes the kosher mainstream version of the alt-media, it’s all about his false dichotomies supporting Trump and Musk. These are three of the most twisted bastards that currently walk this planet.

On behalf of my fellow investors, I find it quite lovely to see UST public debt continuing to escalate. My rent increases are in full swing this year. House prices will increase as well in 2024.; more than expected.

$34,058,513,894,474.08

https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-penny

Atlanta Fed’s latest GDP estimate: 2.2 percent — January 10, 2024

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2023 is 2.2 percent on January 10, unchanged from January 9 after rounding. After this morning’s wholesale trade release from the US Census Bureau, the nowcast of fourth-quarter real gross private domestic investment growth decreased from -0.6 percent to -0.7 percent.

https://www.atlantafed.org/cqer/research/gdpnow

The stocks of snack food companies are excellent long-term performers, because their customers are addicted to their snack food products. These foods create a vicious insulin cycle of feast and famine. I say own the new class of weight loss drugs. $LLY $NVO $ALT, etc..

It’s not a stock market bubble, it’s a humanity bubble. Profit off the addictive nature of the livestock goy and their unconscious misery.

_____

Barron’s

Snacks Are Pricey, but We Just Keep Eating

Carrefour and PepsiCo bicker over price increases but many food companies raised prices as inflation rose with limited damage to sales volume.

Last week, French grocery chain Carrefour said it would a range of PepsiCo products due to “unacceptable price increases.” The snack giant pushed back, telling The Wall Street Journal it was the one that stopped supplying the supermarket.

The public showdown is a testament of Europe’s food inflation that remains high even as price gains in the U.S. have slowed down. But companies like PepsiCo are raising prices for one simple reason: Consumers aren’t cutting back their purchases that much, yet.

PepsiCo’s earnings numbers are telling: It’s making plenty of money in Europe despite complaints from consumers, politicians, and grocers about high prices.

In the latest fiscal quarter ended on Sept. 9, the price mix of Pepsico’s products was 13% higher than a year ago in the European market, but sales volume remained the same, according to company filings. That means a 13% growth in organic net sales with no offset.

With well-managed costs, the food giant grew its profit even more. Excluding the impact from foreign exchange rates, Pepsico’s operating profit in Europe has increased 34% in the latest quarter from a year ago, and margins expanded 82 basis points, according to filings.

The trend is similar in other regions. Across all geographies, PepsiCo products’ prices were 11% higher from a year ago in the latest quarter, while volume declined just 2.5%. That translated to a 8.8% growth in organic revenue, while its organic operating profit increased by 12%.

Like PepsiCo, many food companies raised prices throughout rising inflation with limited damage to sales volume. Some have seen their profit margins shrink in 2022 amid high energy costs, but most were able to maintain or even expand margins in the past few years.

Notably, consumers haven’t been put off by price hikes in their favorite snacks. Mondelez International, the maker of Oreo and Ritz, raised prices by 12% in the latest quarter from a year ago. But sales volume didn’t drop. Instead, consumers are buying 3.8% more.

Chocolate maker Hershey has seen similar strength, with sales volume up 1% despite a nearly 10% price hike.

People are less tolerant with expensive food staples, though. Conagra Brands, known for its canned and packaged meals, recently reported a 3% drop in sales volume although its price mix slid a little from a year ago. Likewise, sales volume in Campbell Soup and General Mills products dropped 5% and 4%, respectively, from a year ago, even as prices are just 3% higher.

Make no mistake. These companies have been raising prices a lot over the past year. But consumers have been opting for more of their cheaper items, dragging down the price mix and sales value overall.

Among a group of 10 food companies Barron’s reviewed, Coca-Cola has the largest operating margin between 25% and 30%, followed by Hershey and Keurig Dr Pepper. Campbell Soup, Conagra, and Mondelez are on the lower end between 10% to 15%.

It’s yet to be seen whether Carrefour’s boycott could help it cut a better deal with PepsiCo. Affected Carrefour stores represent only 0.25% of PepsiCo’s global revenue, according to the WSJ report, so the move will likely have little impact on the food giant.

Still, the spat sets an example of how retailers—pressured by increasingly price-conscious consumers and concerned politicians—could make a more aggressive stance in their demand for lower prices.

Even if an agreement was reached, it would be hard to know whether prices actually went down since the negotiations usually take place behind the doors. Both PepsiCo and Carrefour didn’t respond to Barron’s request for comment.

In 2022, Kraft Heinz stopped supplying its baked beans, soups, and ketchup, among others, to the U.K.’s largest supermarket Tesco in a dispute over pricing. The two parties soon reached an agreement to put the products back on shelf, but didn’t disclose how prices were set.

Instead of boycotts from retailers, consumers’ actions would matter more to food companies when setting prices. Pepsi and Doritos aren’t something essential to life. If shoppers start buying less, PepsiCo will likely drop prices and cut its margins.

Many food companies are expected to report holiday season earnings in early February. Investors should closely watch for signs of softening demand. That will be the real price damper.

Most likely injected. I hope they all repented before their deaths. Hopefully the DNA wasn’t overwritten either….

Stars We’ve Lost: 7 Celebrities and Singers Who Have Died in the First Week of 2024

https://radaronline.com/p/celebrities-singers-who-have-died-in-the-first-week-of-2024/

Great price data at the producer level. This is a definite offset from yesterday’s CPI data dump. Bonds and such like it.

Core PPI (YoY) (Dec)

Act: 1.8% Cons: 1.9% Prev: 2.0%

Core PPI (MoM) (Dec)

Act: 0.0% Cons: 0.2% Prev: 0.0%

PPI ex. Food/Energy/Transport (MoM) (Dec)

Act: 0.2% Cons: Prev: 0.1%

PPI (MoM) (Dec)

Act: -0.1% Cons: 0.1% Prev: -0.1%

PPI ex. Food/Energy/Transport (YoY) (Dec)

Act: 2.5% Cons: Prev: 2.4%

PPI (YoY) (Dec)

Act: 1.0% Cons: 1.3% Prev: 0.8%

It is interesting how they come out with some economic figures that swing the markets in an extreme direction then the next day they come out with economic figures that go the opposite direction that reverse most of the prior market movement.

Anybody who believes these markets are free capitalist markets is living in another world. The whole economy including the stock market is controlled by a powerful invisible hand with an agenda.

The Ministry of Plenty has just announced that food rations will increase this year and that Big Brother has been very generous. Chocolate rations will be increased from 15 g a week to 20 g a week. It’s doubleplusgood, I tell you.

We have to support our troops on the Malabar front.

The Fed’s primary objective is to keep the federal government spending and in business. Everything else is there to help achieve this objective and there are various ways to accomplish this goal. By effectively sterilizing money in Bank reserves, which shows up in a falling M2 velocity, the powers can keep the government spending forever on whatever stupid set on whatever its owners dictate. Let’s just hope that the rising velocity over the past year or two is not the start of a new trend, but rather a continuation of the norm.

https://www.terminaleconomics.com/wp-content/uploads/2024/01/M2velres.png

But I heard Joel Skousen say this is only a bubble. He says to invest all your money in a survival house, but that’s what the Mormons have been saying for 150 years. 🤣🤣🤣

I can’t think of a better way for a Japanese investor to stay ahead of a depreciating yen and continued Central Bank accommodation than by owning Japanese stocks. The Nikkei 225 is currently trading at a 34-year high, well above 35,000, and is within shooting distance of its ATH. A couple years ago I would have thought that would have been nonsense, but after the yen has plummeted vis-a-vis the dollar, the results speak for themselves.

_______

Nikkei 225 Completes Biggest Weekly Rally in Almost Two Years

(Bloomberg) — Japanese equities extended their rally into the new year, with the Nikkei 225 Stock Average completing the biggest weekly gain since March 2022.

The blue-chip gauge rose 1.5% on Friday, buoyed by a weakening in the yen since the start of the year and upbeat expectations for the nation’s shares. It ended with a weekly advance of more than 6%.

The benchmark Topix, which has a wider variety of companies, climbed for a seventh trading session, during which all of its 33 sub-indexes have advanced. The strength in Japan has taken both key indexes to 34-year highs this week amid inflows from foreign investors, a favorable exchange rate and investor optimism that decades-long deflation is near an end.

Adding to the market’s momentum, Chinese investors are flocking to Japanese stock exchange-traded funds, with turnover in one ETF rising to a record on Wednesday. The introduction of tax-free accounts that got a revamp this year is also playing a major role in the rally for Japanese equities.

“Large-cap stocks, high-dividend stocks, and growth stocks with foreign demand are likely to continue to attract buying due to overseas investors buying and from tax-exempt savings accounts,” said Nobuhiko Kuramochi, a market strategist at Mizuho Securities Co.

A strong start to 2024 on the back of Japan’s outperformance of other major markets in 2023 points to a big shift in the investment environment for the world’s third-largest economy, according to Nikko Asset Management Co. Tension between the US and China should continue to increase attention on Japanese equities this year, Goldman Sachs Group Inc. said.

Both the Nikkei 225 and Topix completed an annual advance of more than 25% last year, their best performance in a decade.

While the all-country index is popular with tax-exempt retirement savings accounts known as NISA, Japanese companies that have high dividends are also attracting demand, according to Takeru Ogihara, a chief strategist at Asset Management One. “There is a possibility that investors will buy in the first half of the year before March, or move a little ahead of schedule,” he added.

On Friday, electric appliances and exporting companies were the largest contributors to the Topix as the yen headed for a second weekly loss on the receding view the Bank of Japan will end its negative interest rate this month.

Thank you, QE. Lots of money sitting around.

https://www.terminaleconomics.com/wp-content/uploads/2024/01/Fed-reserves.png

The numbers are coming in hotter than expected and the equity markets sold off in a knee-jerk reaction, but have since stabilized as I write this. The bond markets are obviously not doing nearly as well with the 10-year treasury yield spiking higher on the data dump. While the core comes in as expected, the headline comes in higher and so do prior month revisions. Unemployment claims come in lower once again as the people are puking and dying in the streets from the mRNA injections. Just ask Mary Lou Retton.

Core CPI (MoM) (Dec)

Act: 0.3% Cons: 0.3% Prev: 0.3%

Core CPI (YoY) (Dec)

Act: 3.9% Cons: 3.8% Prev: 4.0%

Core CPI Index (Dec)

Act: 313.22 Cons: 313.00 Prev: 312.25

CPI (YoY) (Dec)

Act: 3.4% Cons: 3.2% Prev: 3.1%

CPI (MoM) (Dec)

Act: 0.3% Cons: 0.2% Prev: 0.1%

CPI Index, n.s.a. (Dec)

Act: 306.75 Cons: 306.61 Prev: 307.05

CPI Index, s.a (Dec)

Act: 308.85 Cons: Prev: 307.92

CPI, n.s.a (MoM) (Dec)

Act: -0.10% Cons: Prev: -0.20%

Continuing Jobless Claims

Act: 1,834K Cons: 1,871K Prev: 1,868K

Initial Jobless Claims

Act: 202K Cons: 210K Prev: 203K

Jobless Claims 4-Week Avg.

Act: 207.75K Cons: Prev: 208.00K

Real Earnings (MoM) (Dec)

Act: -0.2% Cons: Prev: 0.5%

Inflation will never go away as long as most people are self entitled and demand free handouts.

And the federal government continues to heavily subsidize fruitless industries like green energy and all of the other things that go along with it.

The Inflation Reduction Act is all about raising inflation and spending the government into bankruptcy. Just like with the Patriot Act, that’s all about clamping down on the personal liberties and freedoms of the average citizen, while concomitantly overturning the Declaration of Independence and Bill of Rights. Rothschild and the synagogue bankers are the primary beneficiaries of these types of legislative packages.

These acts of legislation are named in the memory of George Orwell.

Always remember, the government hates you and those in office want us to hate ourselves. It does an effective job.

A lot of people getting sick lately for prolonged periods of time. What is unusual compared to the past is that these sicknesses last much longer. These are signs of weakened immune systems.This could affect employment numbers and labor participation rates pretty soon. Check out this blog:

https://www.reddit.com/r/conspiracy/comments/191wt3f/not_sure_what_sickness_has_been_going_around/?rdt=42357

Nobody in the mainstream media is talking about the elephant in the room causing the weakened immune systems resulting in the prolonged sicknesses (the Covid Clot shots).

The biotech and pharmaceutical firms are on fire 🔥🔥🔥.

All the emerging diseases, cancers, and debilitating chronic illnesses from the mRNA injections are wonderful new pastures for these drug companies. Lots of money to be made off the backs of the multibreed populations.

There’s no resistance in a heterogenous population lab setting, so there’s tons of money to be made from the misery of the human livestock culling.

The pale horse of Revelation can be very profitable. For the injected animals, they struggle with the black horse that will bleed them dry. For the savvy uninjected, let’s get out there and make some money before we are shut out from the economy, since we won’t take the mark.

Amen. Those who are vaccinated and sick will be poor and broke due to all the medical bills. They will have a stark choice of take the mark to get medical care or forego medical care without the mark. The vaccinated will most likely take the mark.

I feel it more in 2024 that we are starting the tribulation as foretold in the Bible.

It is becoming more and more obvious every day. To even contemplate that the alt media is as compromised as the MSM. It doesn’t sound like a collapsed economy to me. John was even left speechless, while admiring the end time economy and society.

Revelation 17:4-7 KJV – 4 And the woman was arrayed in purple and scarlet colour, and decked with gold and precious stones and pearls, having a golden cup in her hand full of abominations and filthiness of her fornication:

5 And upon her forehead was a name written, MYSTERY, BABYLON THE GREAT, THE MOTHER OF HARLOTS AND ABOMINATIONS OF THE EARTH.

6 And I saw the woman drunken with the blood of the saints, and with the blood of the martyrs of Jesus: and when I saw her, I wondered with great admiration. 7 And the angel said unto me, Wherefore didst thou marvel? I will tell thee the mystery of the woman, and of the beast that carrieth her, which hath the seven heads and ten horns.

The Bible does predict disasters and war, however, the economic system still will function very well for the top 1% . It is obvious when it is stated that the wine and oil( luxury items) will be preserved and in abundance while things that the masses use will be in very short supply.

There will be an excellent economy for the top 1% while the bottom 90% will experience economic depression.

Proverbs 22:3 KJV – 3 A prudent man foreseeth the evil, and hideth himself: but the simple pass on, and are punished.

The stupid people there have nobody to blame but themselves. Don’t look to me for blame, I warned you all and continue to warn you. The simple and stupid deserve to go where they’re going. The stupid lack faith and so do the fearful. The simple and stupid make our lives more difficult.

We Christians must isolate ourselves from humanity as the masses become more like asses.

Just watch today’s tv shows and listen to today’s music to see that the average person is getting stupider by the second. I have been distancing myself from a lot of people recently as they have more toxic group think.

Question: If inflation is going to stay stubbornly high, as some economists suggest, how can the Fed reduce rates more than the anticipated 75 basis points, starting in June? Further, the US is under pressure to keep rates higher to make Treasury notes appealing to foreign buyers , like Japan. The Chinese are still dumping US Treasuries and rates have to be appealing for other countries to buy the Treasury notes, as suggested by some analysts.

Finally, after the US election in November, some are predicting, like Martin Armstrong, chaos in the US and interest rates rising into 2025. Hmmmm?…..

Thank you.

You are correct in your assessment of inflation. I suspect inflation is going to remain elevated for quite some time, but at a reduced run rate from the past couple years.

Since QE was implemented, the Federal Reserve has gradually been increasing its share of Treasury ownership, at the expense of foreign Nations. CCP ownership of treasuries is becoming an asterisk at the bottom of the page. Its ownership has been stuck at about $1 trillion for at least 15 years. China can dump all its treasuries and it wouldn’t matter anymore. Japan can dump its treasuries and it really wouldn’t matter as the FED would step in to buy anything that was needed.

In the QE world, what foreigners do with treasuries mean less and less every year. I’m careful not to get caught up in the hyperbole of what foreigners think of the treasury market, because every year that goes by their influence over it slowly dwindles.

Perhaps the Federal Reserve will eventually own all the treasuries. However, since the US dollar is the global Reserve currency and the global transaction currency, the nation states need to hold a pool of these dollars and what better way to do this than by holding treasuries? US Treasuries still hold a real yield advantage over other developed Nations, whose domestic inflation rates are still higher than those in the United States.

https://www.bloomberg.com/markets/rates-bonds

During covid, the UST and Fed helped to build bank reserves and they overshot what was needed by at least $2 to 3 trillion. As relative reserves decline vis-à-vis the debt markets and economy, the Federal Reserve will eventually step in. And when it does, look for a knee-jerk reaction with bond yields moving to the downside.

As for Martin Armstrong, I couldn’t care less what he thinks and what his computers determine. He’s a one-string banjo and I have discussed his name in the past in great detail. His whole big bang was a big scam and I wasted $3,000 and a weekend of my time to figure that out attending one of his conferences.

Okay, the Federal Reserve will eventually have to begin buying treasuries again or at least cease QT. I suspect bond yields will fall initially, but my concern is that they may not fall as much as many hope for and confidence could be lost in the QE concept.

But that is a big if, and that’s because investors like QE. If all I cared about was myself, I’d be chomping at the bit for more QE.

I know prices are still elevated and the cost of living has been greatly elevated since covid, but the rate at which it’s growing has fallen tremendously over the past year and now the FED funds rate is fully 150 basis points above the prevailing core price measures, and 200 basis points higher than headline measures. One fly in the ointment in my opinion is wage growth which seems to be stuck at around 4% per annum.

Analyzing bond yields in a world of QE is almost fruitless now as the bond markets are centrally managed by the Fed. They truly determine bond yields and what quicker way for bond yields to fall than by reversing course like the FED did in late 2019?

https://www.bloomberg.com/markets/rates-bonds

Excellent! Thanks for putting it all in perspective. I enjoy the blog very much. Keep up the excellent work.

Gary

Worth a read IMO. Written last year. I started to read into the Uniform Commercial Code and what he says crosschecks when one has drilled down far enough. The only thing missing from this would be how it would be enforced. Would US judges and thus the police acquiesce to having people’s “securities” stolen by preferred creditors if a collapse comes to pass? https://thegreattaking.com/

I also went looking for who the actual owners/shareholder of the US Federal Reserve are but found little other than chartered US banks. Can anyone point to a source listing who the actual owners are?

The guy who checks our mouse traps every month was telling me about this book. Everyone is sending me links about it and telling me that I should read it. I will pass, thanks.

Check Eustace Mullins for Fed. Res. ownership, or if you must G. Edward Griffin.

I have already commented on this book in a prior post. I have had at least three or four others who have emailed me on it. Let me mention a couple quick points.

There’s no need to execute some sort of “great taking,” as the Talmudic synagogue and its banking cartel have been engineering a great taking for decades. Just as Esau sold his birthright for a bowl of soup, multicolored Americans have been handing over their assets and birthrights to the synagogue syndicate through UCC and contract law. Non-Caucasians blame white people, but the non-Caucasians have no one to blame but themselves as they piss away their money like it’s burning a hole in their pockets. As a property manager for 25 years, I see this phenomenon first hand.

I have been coming across variations of the topics in the book you mention since the late 90s, and many of those Cassandras in the past have admonished the fearful of a similar outcome. All I see are the wealthy getting wealthier and the bottom 80% of the population getting poorer. The bottom 80% are susceptible to this type of propaganda, and this keeps them from taking risks to acquire assets. It keeps most of the readers flat-footed and unable to think clearly.

All I see is a great taking that has been going on since I was a child. I wouldn’t wait for some proverbial shoe to drop, the great taking has been going on for a long time.

As Ken says, this book is making the rounds everywhere. Whenever I see a book like this free for download I have to suspect that the adversary is advancing its scare tactics on the fearful populations.

I ask myself, how would the synagogue take someone’s house if it has a mortgage on it? How can they extract title at the County courthouse? How can they just take control of someone’s house? If the governing officials attempted to take someone’s personal property, there’d be bonfires from coast to coast as houses in every jurisdiction would be burning to the ground.

How are they going to take someone’s pension? How can they take someone’s bank account? This is a very naive way of thinking as these adversaries do not want social and civil unrest. The quickest way to unravel the Great Reset and the objectives of the New World order is to forcibly take people’s property. The synagogue and the banking cartel do a wonderful job with the current plan already in place.

It looks like there will be no drama surrounding the debt ceiling/funding issue. It’s early too.

I suppose the FED ending QT is timely, it seems there does not even need to be a new crisis to move things along, they can just glide back into some form of QE. The public doesn’t care.

Vaccines just don’t work:

https://www.zerohedge.com/political/did-vaccine-eradicate-smallpox

Why take something that carries side effects and doesn’t work as promised?

However, many people still faithfully take the flu and Covid shots each year.

I think at some point soon the Fed will have to turn on the spigots again to fund the government’s expenditures. Hold on to stocks and RE which ever way the prices go. History has proven that they only go up when there is rising government expenditures. Government expenditures will never go down due to political pressure from the sheeple. Every politician that put a damper on expenditures got voted out.

BTW for those who listened to my stock pick last Friday morning, Zack’s just downgraded it to a #3 from a #1. Unless it really falls far this morning, I’m not going to concentrate on it anymore.

Read up on Elon Musk’s drug use. It just shows he’s not running the show.

Moon shot tomorrow if all goes well. This time they are trying a new unmanned lunar lander (not like the jiffy-pop Apollo lander) and will apparently be depositing the remains of Gene Roddenberry in the “Sea of Stickiness”. Also being deposited is one BTC with the address on a physical coin – it should land 23Feb. Something like 40 days.

The Apollo mission was reportedly 8 days total – there, back and a little time to land, mess around, and take off from the moon. Why so slow this time? Maybe this time it’s an eco-friendly rocket booster, kind of like a Prius.

Maybe we never went in the first place. Man cannot survive the absolute vacuum and radiation levels of outer space. Man has yet to develop the technology.

The modern day Kubrick, Daniel Langlois, was killed in Dominica late last year.

https://globalnews.ca/news/10169825/daniel-langlois-murder-timeline-dominique-marchand/

He is the pioneer of CGI.

Is space real? Is the moon real? Could Nasa’s pictures be just fake? Maybe the medieval Catholics are correct that all the planets and sun revolve around the earth just like they are correct about creationism as described in Genesis. Like Darwinism, which is a load of crap, this whole moon landing thing and outer space thing is just recent and may be a load of baloney as well. I am just throwing this out there for discussion.

Take all this to the Lord in prayer.

Look at the description of the Earth in the Bible. Their is your answer!

Elon Musk lit up a marijuana bong while as a guest on a video talk show. He obviously has drug addiction issues.